Property investors know and respect the mantra; location, location, location. In bond and fixed income markets, the equivalent of location is capital structure, which determines who gets paid out first in the event of a company wind-up.

Property investors know and respect the mantra; location, location, location. In bond and fixed income markets, the equivalent of location is capital structure, which determines who gets paid out first in the event of a company wind-up.

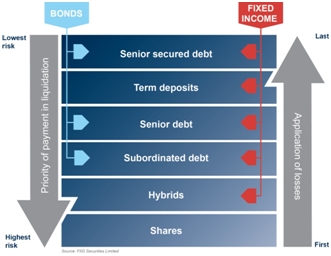

The seniority, or rank in the company’s capital structure, is crucial in determining whether the return offered adequately compensates the investor for the risk involved. Every bank and company has its own capital structure and it is legally binding.

In the event of wind-up or liquidation, funds are paid to the most senior investor in the capital structure (senior secured debt) first and these investors must be repaid in full before any funds are paid to investors on the next level. In turn, each level must be repaid in full before funds are apportioned to the next level. The higher your investment sits in the capital structure, the lower the risk.

Investments at the top of the structure have known interest and maturity dates. Companies that miss paying interest or principal face serious consequences.

Moving down through the rungs, terms and conditions change and there is less certainty. Interest can be deferred or not paid at all, while maturity dates can be extended or become perpetual where there is no obligation to return principal to the investor.

Investments lower in the structure do not offer the same certainty and are thus higher risk, and should offer higher returns to investors. For example, there is no obligation for companies to pay dividends to shareholders, they can be cut without any consequences for the company and there is no repayment date. Shareholders must sell shares to recoup capital. This uncertainty needs to be adequately rewarded with higher returns.

In liquidation, losses are applied from the lowest level up, making shares the “first loss” and highest risk investment in the capital structure. Each rung from the lowest up must be “wiped out” before the next rung up on the ladder takes any loss.

However, new Basel III regulations mean bank hybrids can convert to shares on breach of a capital trigger and bank subordinated debt and hybrids can be deemed “non-viable” by APRA and also converted to shares. These conditions increase the risk of the new style investments and need to be compensated through higher returns. In essence the regulations are to ensure the bank maintains sufficient capital for its operations and they protect investors sitting higher in the capital structure.

Source: FIIG Securities

Bonds are issued at three different levels in the capital structure: senior secured, senior unsecured and subordinated debt, whereas the fixed income asset class also includes deposits and hybrids.

Risk has a direct relationship with reward. The higher the risk of a security the greater the expected reward. Investing a high proportion of your funds in the highest risk category, shares can expose your portfolio to loss in a cyclical downturn. Investors need to diversify investments to protect income and capital. Bonds generally lower the risk of your overall portfolio and help to preserve capital.