In our previous paper entitled “Which superannuation funds may be affected by the ALP franking credit proposal” we found that members of many superannuation funds, not just SMSFs, may be impacted by the ALP proposal to no longer refund franking credits.

In this new paper, we consider which individuals, investing in their own names, may be impacted by the ALP proposal.1

The ALP proposal

On 13 March 2018 the ALP announced a proposal to abolish the net refunding of franking credits to Australian investors, other than for charities and endowments which would be exempted from the proposal. The initial proposal was expected to impact 1.17 million individuals and superannuation funds and generate $59 billion in government savings over 10 years.

On 26 March 2018, the ALP revised their proposal in the light of significant public criticism of the initial proposal. Direct investments by pensioners (part and full on aged, disability and other Centrelink pensions) were excluded from the no franking credit refund regime. This exclusion means that 306,000 individuals on pensions will continue to receive franking credits on investments in Australian shares and partly offsets the criticism that this proposal impacts many battlers.

Which individuals will likely be impacted?

The proposal looks to abolish the net refunding of franking credits, but franking credits themselves are not abolished. Australian investors can continue to use franking credits to offset income tax payable, they simply won’t be able to receive a net refund of franking credits under the proposal. Individuals currently receive a refund of franking credits if the franking credits they receive on dividends exceed their total tax payable.

Franking credit refunds will depend upon the circumstances of each individual, such as other income earned, PAYG tax, deductions etc. Given it would be impossible for us to model each type of recipient of a franking credit refund, so we primarily focus here on those who arguably are most impacted – fully self-funded retirees living off the income of their investments.

Self-funded retiree individuals

Fully self-funded retirees receive no pension entitlements, and therefore will lose the ability to receive a net refund of franking credits under the ALP proposal.

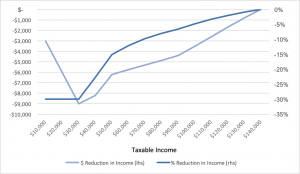

In Figure 1 we model the estimated franking credit refunds for a single fully self-funded retiree whose only income is fully franked dividends, taking into account Australia’s marginal tax rates, the Medicare Levy, and tax offsets including the Seniors and pensioners tax offset where applicable. We also assume the individual has no income tax deductions.

Figure 1. Estimated impact of losing franking credit refunds on net income for self-funded retirees receiving fully franked income only.

Source: Plato

A single self-funded retiree should currently receive $9000 in franking credit refunds at a taxable income level of $30,000 ($21,000 in fully franked dividends and $9,000 in franking credits). At this level, a retiree subject to the Seniors and pensioners tax offset would pay no income tax, and thus should currently get a full refund of all franking credits.

Should the ALP policy come into play, this retiree would lose those franking credit refunds, a loss representing 30% of a retiree’s after-tax income. Above $32,915, which is the point this tax year when the Seniors and pensioners tax offset phases out, retirees start to become liable to pay income tax, so the dollar and percentage level of franking credit refunds will start to decline.

We estimate the loss in after tax income is around 23% for someone on a taxable income of $40,000, 15% at $50,000 and 12% at $60,000. Even a single retiree earning up to $130,000 in taxable income from Australian shares would stand to lose a small refund of franking, effectively paying a higher rate of tax than a standard PAYG wage-earner.

The loss in franking credits would vary if an individual had other income such as interest received or wages (likely be lower), or tax deductions (likely be higher).

Of course, it is somewhat unrealistic to assume that a retiree only has income from Australian shares, so below we show a real case study of a self-funded retiree who has other investments in addition to fully franked Australian shares.

A Case Study – Mrs H2

Mrs H was a fully self-funded retiree, owning a modest home in the outer northern suburbs of a capital city, living off the income from a portfolio of direct shares and some bank deposits. Her assets, other than the home, totaled $650,000, with $50,000 in non-income bearing assets. Of her investments, $500,000 are invested in fully franked dividend paying Australian companies and $100,000 invested in term deposits and cash. Mrs H is ineligible for a part aged pension, since her assets exceed the maximum assets test level (currently $564,000 for a single homeowner).

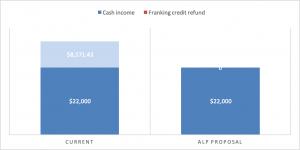

Mrs H currently has a taxable income of $30,571. The $100,000 in deposits only earns $2,000 in interest, while the share portfolio yielded an average 4% cash dividend providing $20,0003. Importantly the dividends were all fully franked, receiving $8,571 in franking credits (these are included in taxable income). With no tax payable due to the Seniors tax offset, Mrs H received a full refund of her franking credits, considerably boosting her cash income from $22,000 to $30,571.

Since Mrs H is not eligible for any pension entitlements, she would no longer receive those franking credits under the ALP proposal. The loss of $8,751 would reduce Mrs H’s income by 28%, reducing her weekly income by $165, from $588 per week to just $423 per week.

This means her income would actually fall below the full aged pension for a single homeowner ($23,889 p.a. or $916.30 per fortnight /$458.15 per week).

Figure 2 highlights the expected fall in annual income if the ALP proposal comes into force.

Figure 2. Estimated income for Mrs H now and should the ALP franked credit proposal be implemented.

To put Mrs H’s position into perspective, we have tried to provide a measure of how her income compares to others. Mrs H’s current level of income would place her amongst the poorest 30% of single households according to www.comparyourincome.org/income_inequality_in_australia, and in the bottom 10% should the franking refunds be stopped. According to the “Poverty in Australia 2018” (ACOSS and UNSW Sydney) report, Mrs H’s level of income post the franking credit loss would place her under the Poverty Line (based on 60% of median income, after housing costs for a lone person using 2015-16 numbers).

A generalised model

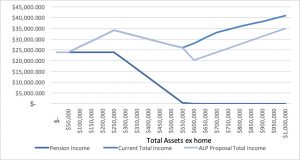

Of course, not everyone has the same value of assets as Mrs H, so in Figure 3 we vary the level of total assets, again assuming the first $50,000 of assets are non-income bearing (eg. car and home contents) and the same investment asset mix. We plot the total cash income now and should the ALP policy come into play. For reference purposes we have shown the value of the current single aged pension, which declines as assets grow, stopping completely at $564,000 (note the graph numbers are only calculated at rests of $50,000 in assets so that the $564,000 point is not shown). Single home-owning retirees will remain the same if they have below $564,000 in total assets (excluding the home) as pensioners will continue to receive full franking credit refunds. For non-pensioners, the ALP policy has a large impact, with income initially falling by 28% relative to the current situation, as one loses the value of franking credits. The percentage loss in net income declines as assets rise, but we still estimate the loss in net cash income to be around 15% for someone with $1m in assets outside the home.

Figure 3. Estimated variation in incomes for single home-owner retirees investing predominantly in Australian shares should the ALP franked credit proposal be implemented.

Source: Plato

On our estimates, a single home-owning self-funded retiree needs to have more than $750,000 in assets ($700,000 investible assets) under the ALP proposal in order to earn the same income as a part pensioner with $550,000 in assets based on our asset mix.

This would provide a significant incentive for any retiree with between $564,000 in assets (the assets test maximum) and $750,000 in assets to “spend” enough in order to get their assets below the $564,000 assets text maximum so as to receive a part pension and full franking credit refunds.

This spending could for instance be money spent on holidays or invested on the home (which is exempted from the assets test). We have already heard of a number of retirees who are doing just that with others planning to do so.

While we haven’t shown the results here, our modelling suggests a similar situation exists for home-owning couples above their maximum assets test level of $848,000. Again there will be a large incentive for couples with up to $400,000 over the asset’s test maximum to spend that money to get access to both a part pension and franking credits.

Sensitivity to Asset Mix

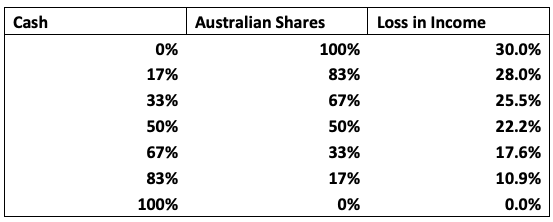

In the previous section we used Mrs H’s asset mix of 1/6 Cash 5/6 Australian shares. In Table 1, we provide a sensitivity analysis of the asset mix between cash and fully franked Australian shares, varying weights from 100% Australian shares to 100% cash based on an investment of $600,000 for a single home-owner self-funded retiree. Maximum losses (30% of current income) would be felt by investors 100% exposed to fully franked Australian shares, but even a 50% exposure to Australian shares results in an estimated loss of income of 22%.

One of the reasons why franking credits are so important for Australian retirees is that in the current environment, franking credits represent a substantial boost to income relative to income from other asset classes. Mrs H’s interest rate on cash at 2% is half the cash yield of her Australian share portfolio. Grossed up for franking, the yield on the Australian share portfolio is 5.7%, with 1.7% of that in franking credits. The 1.7% franking credit yield is actually higher than the current official overnight cash rate in Australia.

Table 1. Estimated loss in income for single home-owner retiree with $600,000 of investable assets varying asset mix between fully franked Australian shares and cash should the ALP franked credit proposal be implemented.

PAYG and other non-retired individuals

Our analysis so far has focused on retirees, assuming all income is investment income. Working individuals may also be impacted by the loss of franking, but we expect this impact to be largely restricted to individuals in the very lowest tax paying bracket (earning less than $37,000) where the marginal tax rate is 19%.

We generally would not expect PAYG individuals earning more than $37,000 from their regular wages/salary to be impacted by the loss of franking credit refunds, as their marginal tax rate should be 32.5% plus Medicare levy, meaning they would likely have to pay a small marginal tax on franked dividends.

Non-working, but not retired individual investors would likely have similar but slightly lower losses of franking credits than retirees, as they would not benefit from the Seniors and pensioners tax offset.

Summary and Discussion

We have provided an analysis of how much individuals are likely to lose should they be denied franking credit refunds under the ALP proposal.

Worst impacted individuals are likely to be retirees who just miss out on the aged pension due to having slightly more assets than the maximum assets test level. They could stand to lose up to 30% of their current income levels if they solely invest in fully franked dividend paying companies.

In a case study, we found self-funded retiree Mrs H would stand to lose 28% of her income should she be denied franking credits. Without franking credits the annual income on her $500,000 in Australian shares and $100,000 in cash would fall from $30,571 to just $22,000. The reduced income level would be less than the full single aged pension and would place her under the Poverty Line (60% of median income, after housing costs for a lone person using 2015-16 numbers Source: ACOSS UNSW 2018).

A 28% reduction in income is a substantial reduction, particularly for someone who is retired and would be highly unlikely to be able to re-enter the workforce to make up for the loss of income.

There would, however, be strong incentives for such retirees to spend sufficient money (on for instance holidays or the home) to bring them below the assets test maximum, so as to receive a part pension and full refund of franking credits. This, of course, defeats the purpose of the ALP policy.

Our modelling also reveals that the maximum dollar and percentage loss of income will be felt by the least well off self-funded retirees with taxable income levels around $30,000 a year for an individual home-owner. Franking credit refund losses reduce as taxable income rises, mirroring the rising average (and marginal) tax rate of the Australia personal tax system.

1 Many articles have showcased individual examples of people who may lose franking credits, but to our knowledge no-one has broadly documented who might be affected.

2Full name withheld

3 Unusually, Mrs H’s portfolio was not dominated by high yielding banks and Telstra, hence the relatively low cash yield.