For the last ten years, many Australians have been successfully utilising “limited recourse borrowing arrangement” (LRBA) to buy direct real property in super. In the right circumstances, this has enabled people to potentially increase the rate of growth of their greatest retirement asset or help them get into the property market earlier and help combat the issue of housing affordability.

However, it’s very important to note, that when considering an LRBA that you meet the many regulatory requirements.

At its core an LRBA is a loan to a super fund and is generally only available to Self-Managed Super Funds (SMSF). Typically, a super fund cannot borrow as per the SIS Act, however by meeting specific criteria, the loan can be allowed and is designated a “limited recourse borrowing arrangement”.

The criteria include:

- If the lender were to call in the loan in the event of default, they are restricted to only liquidate the asset with which the loan was used to purchase. They cannot access any other amounts of superannuation to clear the debt. This constitutes the “limited recourse” aspect of the arrangement.

- The money can only be used to acquire a “single acquirable asset”, e.g. A direct real property or a parcel of identical shares.

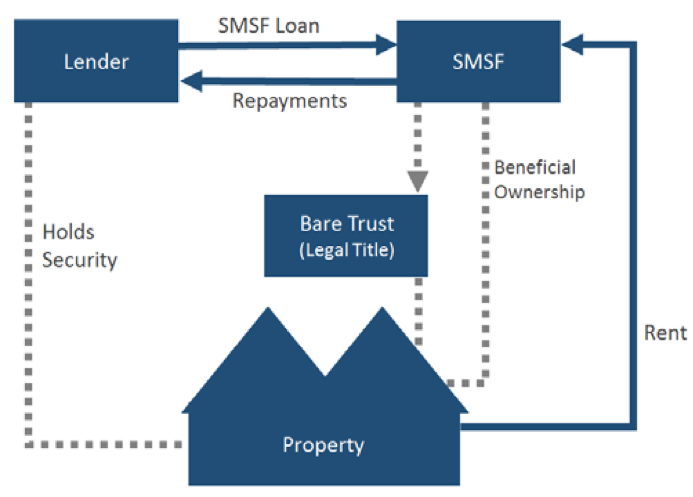

- The asset must be held within a separate trust arrangement to the benefit of the SMSF. The SMSF will have the right to acquire legal ownership of the asset once the loan is repaid.

- There can only be one loan against the asset. This means redraw is not possible.

It is also crucial that the SMSF is set up correctly to facilitate the loan including ensuring that the SMSF trust deed allows for borrowing and the purchase of the intended asset. A corporate trustee is often considered best practice for SMSFs. Additionally, as mentioned above, the asset need to be held in a separate trust. A “bare trust” is commonly used for this purpose and while it will have the legal ownership of the asset, the SMSF will list the asset in its financial statements, collect all earnings and make the loan repayments.

The diagram below gives a visual presentation of the structure of an SMSF direct real property investment funded via limited recourse loan.

There are many potential benefits to using an LRBA including:

- Injecting capital into super: By borrowing, a larger capital base is acquired allowing the potential for greater long-term growth than what would otherwise be possible.

- Access to specific asset types: This is also a benefit of using an SMSF, however, the LRBA can give access to assets classes that either have a high minimum investment or wouldn’t otherwise be accessed via retail or industry super e.g. direct real property.

- Preference of asset class: There are also many Australian’s who have a preference towards direct real property (as opposed to listed securities) and wish to have their retirement savings invested in the asset class they are most comfortable with.

However, there are also risks and disadvantages:

- Losses are magnified via gearing. While the loan is limited recourse by nature, if the loan is defaulted upon there will still be significant losses.

- Interest rates for LRBA’s are typically higher than non-super loans and there is the risk of rate increases.

It should be clear from the above that the setting up of a loan to acquire an asset in an SMSF can be quite complicated. Details of the above conditions and the arrangement is explained in more detail in our eBook which can be accessed by clicking here.