Back in August 2017, I wrote an article on ShareCafe entitled “Could I Be Any More Worried For Australia?” where I showed one chart that underpinned my bearishness for the local property market and in turn, for the local banks, retailers and Australian dollar due to the effects of falling property prices.

Extracted from that article is that very chart shown once more and to me, I am surprised how at that time in August 2017 – almost everyone didn’t believe the housing collapse story – but now, suddenly claim they called the property demise, bank stock correction and laughably only now forecast more to come.

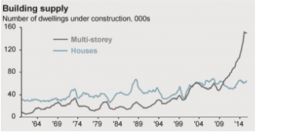

The chart below is of building supply for multi-story and houses stretching back decades. Now nothing, and I mean nothing, has supply increase by that much without creating a lull on prices. Charts like this exist everywhere in markets, where prices shoot higher due to increase demand which is followed by a supply-side response. Finally, when supply overwhelms demand, the underlying commodity price collapses. Think iron ore, oil, gold, bonds, stocks – even tulips – and the reason why we have such a large supply-side response is because of speculation and chase of easy money.

So yes, that chart scared me. A lot. As a result throughout the past 18 months, I have changed my investment strategy, maintaining a short/negative view on those companies and sectors that are directly exposed to the domestic property market, including consumer spending on housing-related products and large bulky purchases such as cars. Have you seen Automotive Holdings Group (AHG) in the past 18 months? Down 60%! Reacting now when finally we are seeing property prices decline is rather late. Markets are always forward looking to be in front of the market one needs to be thinking even further out in time.

On the flip side to the bearish view on property and the like, my longs have been concentrated in specific individual company stories. That is, those companies which are creating their own value and are not hostage to a sector or macro thematic. The issue here is that the universe of such companies is very small. And even smaller when you only consider those which you have complete faith and understanding of. I have discussed on many occasions here on Share Café those stocks – Helios Energy (HE8) which was one of my best picks for 2018 – gaining 180% so far this year and of course MGM Wireless (MWR) that has appreciated over 400%.

I want to take a moment and just stress to readers that like everybody, not all my ideas are winners. But I do try and emphasize which ones I have the most confidence in, why I do and what kind of position size I am taking in those trades compared to those that are more of an “idea”. I have had some failures and unfortunately yes I have lost money on them too. Everything I present here is a trade that I take. But weighting they hold in a portfolio is key to maximizing the profit on the right ideas and minimizing the loss on the wrong ones.

So that’s been the strategy for 2018, what is it now for 2019? Exactly the same. I do not believe we are anywhere near the end of the property correction in Australia. I think the environment will get a lot worse before the low is seen. Twenty-year booms that manifest themselves into such a bubble do not deflate with a mild 10% correction. I certainly do not believe the stock market or the Australian dollar have reflected anything remotely close to the contraction the property market will have on the broader Australian economy. We haven’t yet seen banks reducing their dividends or the lagging effect on consumer spending or property developers going “under”. Throw in the likely changes to negative gearing concessions once Labor sweep to power next year and 2019 is the year the ASX 200 drops sharply below the hugely important 5,600 support level (shown below) on its way to the 4,800/4,700 zone.

Each of the pullbacks in the 2011 and 2015 were 1211 and 1294 points respectively. A pullback of the same magnitude would generate a target of 5,000 which is in keeping with a natural correction. A small overshoot of a couple of hundred points in an economic slowdown is very mild. Therefore, if there is a real recession then my targets are very conservative.

On the flip side, there will still be companies creating their own market and opportunity. I am still sticking with MGM Wireless and Helios Energy and see 2019 a continuation of the cracking 2018 both have enjoyed. In the next couple of weeks, I will highlight a couple of other stocks currently on my watch list that I see potentially having a great 2019 despite the demise of the broader market around them.

ASX 200 chart below