The Australian December half earnings reports season hits top gear this week with more than 40 companies reporting. In the US 65, S&P 500 companies are down to release quarterly figures as the earnings season there slows.

Major companies reporting include JB HiFi, Aurizon and GPT (Monday), Transurban, Challenger and Amcor (tomorrow), Beach Energy, HT&E, Tabcorp, Orora, Virgin Australia, Cochlear and CSL (Wednesday), Evolution Mining, Healthscope, Newcrest Mining, Suncorp, Super Retail, Telstra, Treasury Wine Estates, South32, Woodside and AMP (Thursday) and Medibank Private, Macquarie Media, Domain holdings, McGrath and Sonic Healthcare (Friday).

The AMP’s chief economist Dr. Shane Oliver reckons that “2018-19 consensus earnings growth expectations have fallen to around 4% for the market as a whole not helped by slower growth globally.” As well, he says “a large number of Australian companies warning of tough trading conditions, with resources profit growth running around 8% and the rest of the market around 2%.”

He believes that resources, building materials, insurance and healthcare “look to be the strongest with telcos, discretionary retail, media and transport the weakest and banks constrained.”

“Key issues will be around the impact of the housing downturn, possible changes to franking credits and how the consumer is holding up,” Dr. Oliver wrote at the weekend.

Of the results the annual from AMP on Thursday will attract the most attention – the troubled wealth manager and insurer has already revealed a huge drop in earnings for the year in an update last month.

This week will see the final damage for what has been the toughest year for the company since its last crisis about 15 or so years ago.

Other results worth watching for include: Amcor and the timing (delayed) of its big US takeover of fellow packager, Bemis Co which was announced last August; McGrath for its losses from the Sydney property market, Domain Holdings – will the Sydney and Melbourne property price slump hurt it?

Analysts expect solid results from Amcor, Orora, Super Retail and J&B Hi-Fi (two bellwethers for the troubled retailing sector), South 32 and Transurban.

In the US and Europe, the December quarter earnings reporting season slows this week. Analysts say it has been stronger than expected but not as good as previous quarters as the Trump tax boost and underlying earnings growth has slowed.

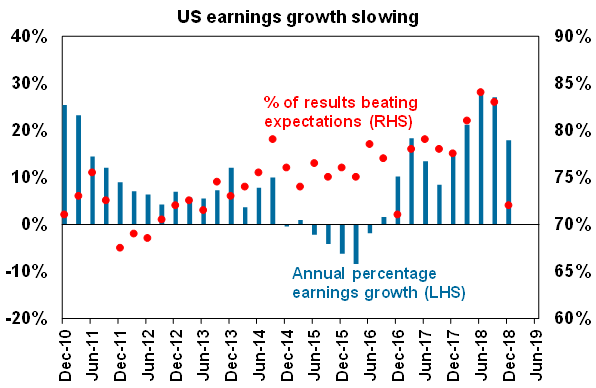

The AMP’s Dr. Oliver says that 325 S&P 500 companies have now reported with 72% beating on earnings with an average beat of 3.1% and 59% beating on sales. “Earnings growth is running at 17.9% year on year for the quarter. As can be seen in the next chart the level of surprises and earnings growth is slowing down (See below),” he wrote.

“US earnings growth is likely to be around 5% this year, “ he believes.

Bloomberg agrees: “After lurching into Christmas, U.S. stocks had staged an almost uninterrupted rebound in 2019 before hitting a wall this week and ending virtually flat. It happened against a worrisome backdrop in which skeptical analysts have cut estimates for first-quarter profit growth below zero for the first time in three years,” the article pointed out at the weekend.

US companies reporting this week include chipmaker Nvidia, which warned last month that fourth-quarter revenue would be lower than forecast, airline makers Bombardier and Airbus and farm equipment maker Deere & Co. It will be hit by higher steel costs and lower international activity and falling sales to the US farm sector.

Also due to report are Cisco, AIG, Credit Suisse, Nissan and Michelin, Dana Inc, Du Pont, the newspaper group, McClatchy, CBS, Hyatt and Hilton; Coca-Cola, PepsiCo, Kraft Heinz, and Nestlé; athletic apparel maker Under Armour; and video game developer Activision Blizzard.

US financial data group, FactSet said at the weekend:

To date, 66% of the companies in the S&P 500 have reported actual results for Q4 2018. In terms of earnings, the percentage of companies reporting actual EPS above estimates (71%) is equal to the five-year average. In aggregate, companies are reporting earnings that are 4.0% above the estimates, which is below the five-year average.

“In terms of revenues, the percentage of companies reporting actual revenues above estimates (62%) is above the five-year average. In aggregate, companies are reporting revenues that are 1.2% above the estimates, which is also above the five-year average.”

But looking to the current quarter, FactSet is not upbeat:

“Looking ahead, analysts predict a decline in earnings for the first quarter of 2019 and low single-digit growth in earnings for the second and third quarters of 2019. The forward 12-month P/E ratio is 15.8, which is below the five-year average but above the 10-year average,” FactSet analysts wrote.

It doesn’t help that the first quarter of 2018 was boosted by the sugar hit from the Trump tax cuts, so watch for a lot of companies to try and minimise the impact of the adverse comparison by reporting figures tripping out the benefits from those changes.