The Australian December half earnings results season wraps up this week with 43 major companies reporting.

The reports will be dominated by the yearly figures from QBE on Tuesday and Rio Tinto on Wednesday and analysts and investors will be watching to see if there are any more capital management moves from the miner after the shower of higher dividends and buybacks in 2018.

Boral, BlueScope Steel, Lendlease and insurer, QBE are due to report today (QBE will be a full year result), Caltex, Prime Media (tomorrow, another full year report), Rio Tinto, Bellamy’s, Costa Group and Seek (Wednesday), and Harvey Norman, Ramsay Health Care and OZ Minerals (final) on Thursday.

The AMP’s Chief Economist, Dr. Shane Oliver says the Australian December half earnings reporting season has been better than expected “but shows a slowdown in underlying growth, caution regarding the domestic outlook but an overall upgrade in earnings growth expectations thanks to resources stocks.”

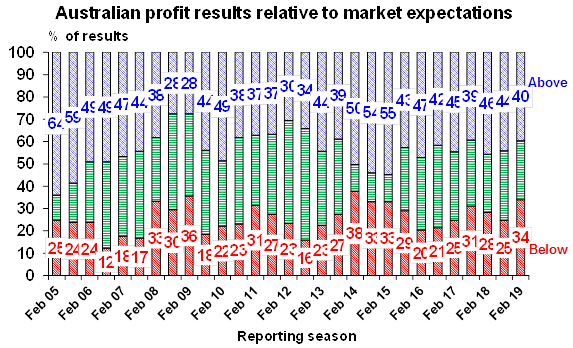

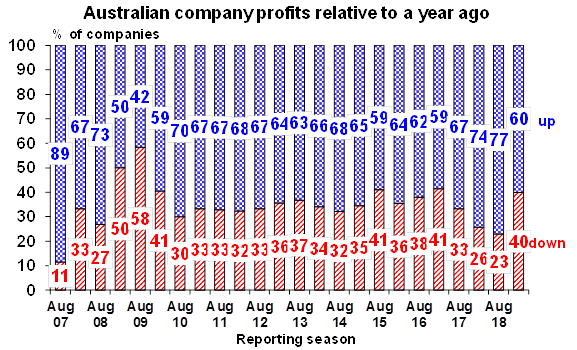

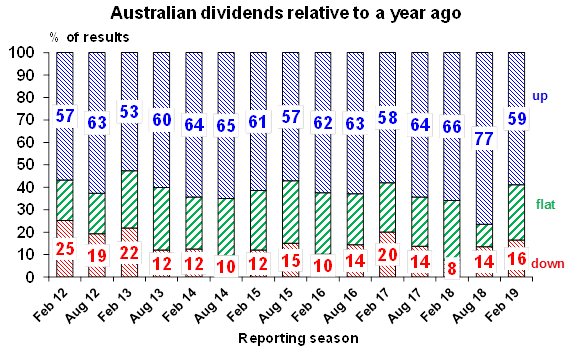

“75% of companies have now reported. 56% of companies have seen their share price outperform on the day of reporting (which is above a longer-term norm of 54%) but against this only 40% have surprised analyst expectations on the upside which is below the long run average of 44%, 34% have surprised on the downside which is above the long run average of 25%, the proportion of companies seeing profits up from a year ago has fallen and only 59% have raised their dividends which is a sign of reduced confidence in the outlook – six months ago it was running at 77%.

“Concern remains most intense around the housing downturn and consumer spending.

“While 2018-19 consensus earnings growth expectations for this financial year have slipped to 1% for the market excluding resources they have been upgraded to 14% for resources stocks as the higher iron ore price gets factored in.

“So earnings growth expectations for the market as a whole have been revised up to 5% from 4.3% a month ago. While several cashed up companies announced higher dividends ahead of Labor’s proposed franking credit cutback, overall dividend upgrades have fallen,” Dr. Oliver wrote at the weekend.