The Australian December half earnings reporting season has now ended with the companies balancing at the end of January February and March to report between next week and early May (especially Macquarie, three of the big four banks, Bank of Queensland, Grain Corp, Orica, Premier Investments, Brickworks/Soul Patts, TPG, New Hope, Elders and CSR).

Department store Myer is due to release its financial report to the end of January on Wednesday which will make for interesting reading given the changes seen at the retailer in the last year.

Most analysts say the December season wasn’t brilliant (except for the spate of buybacks and higher dividends from the likes of BHP and Rio Tinto) but was a bit a better than feared. However, it showed a slowdown for companies exposed to the domestic economy and caution regarding the outlook.

The AMP’s Chief Economist, Shane Oliver says 54% of companies have seen their share price outperform on the day of reporting (which is in line with the long term average).

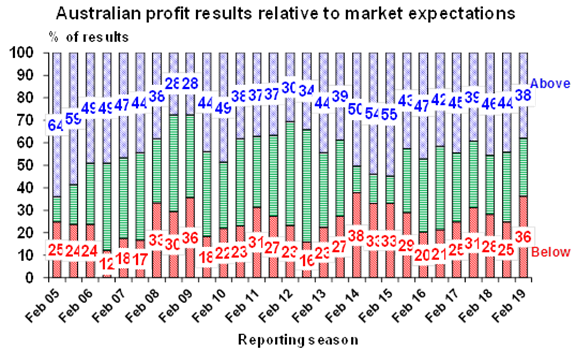

He says that only 38% have surprised analyst expectations on the upside which is below the long run average of 44% while 36% have surprised on the downside which is above the long run average of 25%.

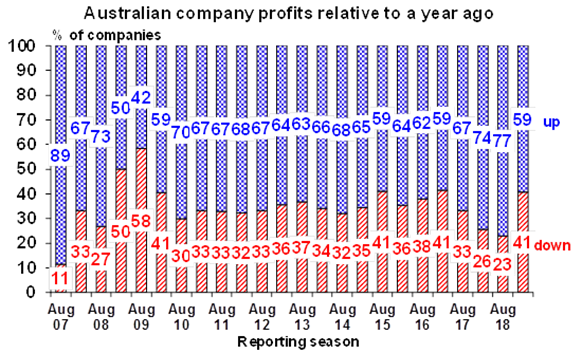

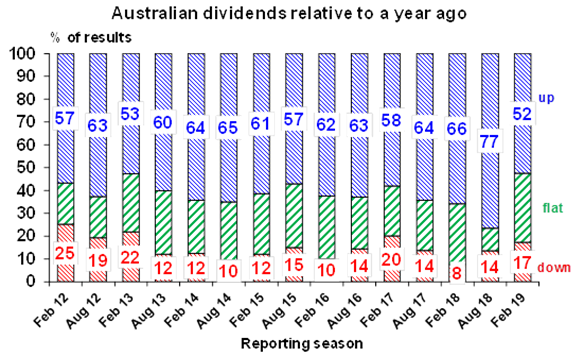

“The proportion of companies seeing profits up from a year ago has fallen to 59% and only 52% have raised their dividends which is a sign of reduced confidence in the outlook – six months ago it was running at 77%,” Dr. Oliver wrote at the weekend.

“Concern has been most intense around the housing downturn and consumer spending. While 2018-19 consensus earnings growth expectations have drifted up to 5% (from 4.3% at the start of the reporting season) this was due to an upgrade for resources stocks as higher iron ore prices were factored in.

“For the rest of the market consensus earnings expectations have slipped to just 2% reflecting the tougher domestic environment. While several cashed-up companies announced special dividends ahead of Labor’s proposed excess franking credit cutback, overall dividend upgrades have fallen,“ Dr. Oliver noted.