This week has been a particularly important one in our offices as we have tried to answer the headline question – How much more downside is there left for property values? As readers will know I first warned of this impending crisis back in August 2017 and thankfully in the last hurrah of 2018 as the risks continued to grow, many property investors told me they got their property affairs in order by selling out. Good news.

Bond yields have continued to drop because, as expected, more economists have begun to forecast rate cuts with UBS even suggesting that if employment data were to weaken in the next couple of months, the RBA could cut mid-election in May. Over the past two weeks 3 year bond yields have dropped 20 bp and 10 year bond yields slightly more than that.

As we can see from the chart below of bond yields in blue and the RBA official cash rate in black, bonds clearly price in rate cuts well before they occur and can trade well under the cash rate for an extended period of time. Given 3 year bonds are still only roughly at the same level as the cash rate there is considerable more downside to be seen in yields as we approach an official move lower.

Luckily I have managed to be ahead of this property decline and rate cut expectation with a sizeable bond position. As always it is important to stay ahead of the curve and foresee what potential trends or roadblocks can surface, that can derail my profits and worse still – capital. So the questions I have been trying to answer are effectively where to now? Will the RBA only cut rates twice to 1.00% and all will be good again? Or will this just be the start of a deepening crisis that will lead to a recession? Finally, what are the ramifications for equities and traditionally safe yielding stocks like property trusts?

To answer these questions I was able to bring the team of one of Australia’s leading property fund managers to our offices for a “think tank” discussion where we were able to really dissect that state of the current market and to ascertain how worse it can get. This particular fund manager which manages in excess of $3 billion) has been asked by various large super fund investors to establish a new residential investment fund to take advantage of the current price declines. Because of the sensitivity of one of the current proposals they are looking at I can’t give too many details except to say they are currently in the late stages of a bid process for approximately 3,000 apartments in one line from a developer that has hit financial difficulty. If we were to say the peak of residential prices is $100, current prices are sitting around $80-85 (a 15-20% drop from the peak), then the price point bulk bidders (and there are a few circling the market) are in the $50-60 range – indicating a 40-60% decline from the peak. This roughly replacement cost.

This tells me a few things. Firstly, steep discounts like this are available because sellers are desperate. Banks are desperate. The likelihood that a floor will magically appear at a 20% dip from the peak is unrealistic. There is likely to be bigger price declines throughout 2019 and 2020 as a lot of this supply and supply still being complete comes to market. Second, the banks have to increase their provisioning for bad debts. It is impossible for them not to and a look through the past two years of bank results show little provisioning. Yes, they tell us all is ok but Lehman Brothers said that too. Everything is ok until it’s not. Next, if the banks are vulnerable to increasing defaults what does that say to some of the net tangible assets (NTA) of the listed property trusts? At our “think tank” we discussed examples of exorbitant prices paid for potential development sites by some listed developers that are largely worthless now given uneconomic state of developments. This led us to believe that in time the book value carried by several property trusts in the retail and residential space could undergo some negative revisions. Property trusts have been very aggressive in increasing NTAs to help drive share prices higher. Retail sites where a residential tower can be placed above several levels retail shopping space is a dead model and the value of such assets have collapsed.

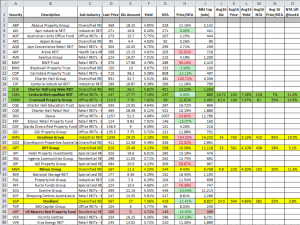

The table below is one that we referenced in our discussion and it lists all the main trusts, with dividend yields, NTA and what the current discount or premium is to NTA. Some like GMG and CHC that have benefited from the yield crunch story I discussed previously now trade at a whopping 162% above NTA! On the right as a reference I showed what the valuations looked like in August 2016 when the RBA last cut rates with the also the final column showing the valuation uplift in NTA over the prior 12 months.

Some of the interesting revelations this table shows is how aggressive in revaluing NTAs the trusts have been and how over the past two years, valuations have changed especially for retail listed trusts. As an example Stockland has moved from a 32% premium in 2016 to NTA to now trade at a 12% discount. Assuming the NTA is real. If we see valuations in some of these NTAs drop then more may trade at a discount, and some discounts may even widen. For investors in property trusts – it’s going to be a minefield. Anything with retail shopping centres and residential assets are at risk of valuation adjustments. Double check what you own and investigate what assets they have in the trust. Stockland is a primary case in point. Although it trades at a 12% discount to NTA and an attractive yield, I don’t believe the NTA is correct. It may take six months for a revaluation lower, but if property prices across the country keep falling then SGP could still be trading at a premium to its true NTA at current prices. The price adjustment could be significant. We saw all of this occur in 2008 with massive collapses in listed property trusts. This is why I like the steady returns of infrastructure and stable performance of industrial property (Charter Hall Long WALE and Centuria Metro REIT) as mentioned in my last column.

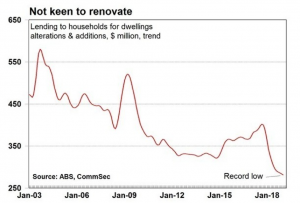

Finally, if all the above is correct, there is no doubt the residential construction sector will grind to a halt with a significant increase in unemployment. Flow on effects to other sectors will be seen. Charts like this below of record low levels of interest to renovate underpin this thematic. Moreover, I am now seeing signs of cases where landlords are having difficulty finding tenants with apartments around $500/week sitting empty for months. This will put pressure on landlord finances, in turn adding more supply to the sales market as investment properties are offloaded.

To me a 1.00% cash rate is not low enough so two rate cuts is likely to extend to 4 or 5 with time. Bonds will rally further and property prices will continue to suffer from a combination of massive, massive over supply, tight credit and falling demand. The looming cloud of a Federal Labour Government could herald a real storm across Australia. As a result I am expecting current conditions to snowball and thus those that still only see mild softening in the economy and property (plus the ASX 200) over the next year clearly get their information from somewhere different to me.