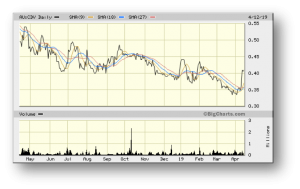

Cardinal Resources – (ASX: CDV, Share Price: $0.41, Market Cap: $158m, coverage initiated @ $0.29 in June 2016 – current gain of 41%)

Key Catalyst

Namdini gold project Feasibility Study progressing rapidly and now expected to be delivered this quarter, one quarter ahead of schedule, strong interest from potential project financiers.

CDV has performed solidly since our coverage initiation back in June 2016, being driven by ongoing and highly successful exploration drilling programs at its flagship Namdini project in Ghana, which in turn has led to the establishment of a multi-million-ounce gold resource base. Whilst CDV pursues additional resource growth, it’s also strongly focused on advancing Namdini to production status and is undertaking a Bankable Feasibility Study (BFS), detailed metallurgical test-work and process flow-sheet studies. CDV has also enjoyed immediate exploration success at its new Ndongo East discovery, 24km north of its Namdini project, with high-grade near-surface gold mineralisation over a 1.2km strike length that’s hosted within a larger target area measuring approximately 7km in strike length. CDV is also maintaining exploration programs at its Bolgatanga (Northern Ghana) and Subranum (Southern Ghana) Projects.

Latest Activity

Namdini Progress Update

CDV has advised of significant updates with respect to corporate progress at its flagship, multi-million-ounce Namdini project in Ghana.

Firstly, the Namdini Feasibility Study is progressing rapidly and is now expected to be delivered one quarter ahead of schedule, during Q2 2019.

Secondly, Project Finance Advisor, Cutfield Freeman (London), is assessing term-sheets for project finance from banks and other project financiers, where there has been strong interest.

Technical Significance

Finalisation of the Feasibility Study ahead of schedule will be a major milestone for the company, following the Pre‐Feasibility Study that has already demonstrated the robust nature of our Namdini Gold Project. The soon-to-be-completed Feasibility Study will also factor in an optimisation study that has recently been undertaken on the Namdini Gold Ore Reserve, in order to ensure the optimal Stage 1 pit design is configured so as to accelerate capital payback and maximise project returns.

Simultaneously, Project Finance Advisers, Cutfield Freeman, have been working closely with CDV to ensure that the company is well positioned to execute project finance as swiftly as possible following completion of the Feasibility Study. Given the very strong level of interest received from a range of potential financiers, CDV has strong confidence that it will be capable of securing the required project funding package on favourable terms.

Namdini Ore Reserves Upgrade

CDV recently announce an optimised Ore Reserve estimate for its Namdini Project, comprising at total of 5.1 Million ounces of Proved and Probable Ore Reserves from 138.6 Mt @ 1.13 g/t Au (at a 0.5 g/t Au cut‐off). This means that 80% of the current 6.5 Moz Measured and Indicated Mineral Resource has been converted into Proven and Probable Ore Reserves. A US$1,225 gold price has been used to generate the optimised pit selected for Life-of-Mine design, with a very low strip-ratio of 1.9:1.

Technical Significance

CDV has undertaken a process of optimisation of pit designs, wall angles and mining schedules, which has resulted in the Life-of-Mine Ore Reserve position growing from 4.8 Moz to 5.1 Moz, reinforcing Namdini as of one of the largest undeveloped gold discoveries of the past decade.

Another very important aspect if the fact that there is a significant higher-grade portion within the Life-of-Mine Ore Reserve starting essentially at surface. This allows for a rapid capital payback during production of the First Stage Pit.

It is anticipated that the First Stage Pit will see approximately 1 Million ounces of gold produced over an approximate three‐year period at an expected lower strip-ratio and a higher average head-grade of approximately 1.3 g/t gold, based on a process plant throughput of 9.5 Million tonnes per annum.

Figure 1: Cardinal Resources’ Tenements in Ghana

Summary

The next few months will be an exciting time for CDV, with the imminent release of the Feasibility Study and the continuation of ongoing funding negotiations. The recently upgraded Life-of-Mine Ore Reserve estimate is likely to enhance the Feasibility Study outcomes. Given the Namdini project’s large Ore Reserve, low strip-ratio, high conversion of Mineral Resources and rapid payback from the anticipated higher grade/lower strip-ratio of the First Stage Pit, CDV should be able to generate attractive project financing terms.