Helios Energy (HE8) together with MGM Wireless (MWR) have comprised 90% of my portfolio for the past 18 months as regular readers will know and are my two extremely high conviction plays. Warren Buffet did say after all, “diversification is a hedge against ignorance”, and I tend to agree.

I have discussed the exciting opportunity that Helios presents in September last year, and highlighted as one of my favourite plays back in 2017 with updates along the way. I assume most of you know the story and hopefully most of you have benefited from its performance to date.

In the early days of investing in Helios (which included from IPO for myself) it was all purely about backing management to replicate their success with Aurora Oil and Gas which was taken from a $28 million company, an oil discovery in the Eagle Ford shale in Texas along the way and then sold for $2.6 billion in 2013. This was their new venture with a theory of oil being present in South West Texas in a remote region that has not produced any oil at all. The aim was to replicate the exact same game plan with Aurora but just on a larger scale.

Fast forward and Helios is currently drilling their third well and the first as a horizontal well. This will help give more information on how strong the flows are in the Ojinga formation and support the results of the findings from their previous wells (which flowed almost 40bbl/day).

The Helios progress announcement on 26th April indicated good oil shows during the drilling process to date through all three main formations – Ojinga, Eagle Ford and San Carlos. The focus as noted, is on the Ojinga formation and a multi-stage frack is currently being prepared with results in expected in June. Anything that replicates the one-stage frack drilled mid-last year will be exceptional and continue to sure up the size of the oil discovery, as well as the cost and ease of extracting it. So far the results have been spectacular with the right rock formation – to allow for a more natural flow to surface of oil – and thus cheaper process of extracting. These are all vital inputs into determining the value ($ per acre) of the project. Naturally the more oil and cheaper it costs to extract it, the land value increases.

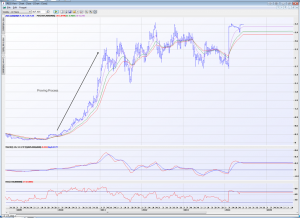

In my September 21, 2018 discussion of Helios I spent some time highlighting the importance of acreage to the value of a project and the process to getting to valuations of $100,000 per acre. Provided the results are good from this current well the process will continue to drill more wells each month, improving the value of the land bank Helios has accumulated. This is the exact road map that Aurora followed and back in 2010 during this well drilling, proving process the share price rose from 30c to over $3.00 – all in a 12 month timeframe.

Helios is now embarking on that same path. We know oil exists. The drilling and the seismic work shows that. The question now is how much is there, what type of oil, how easy it is to extract etc. We need some parameters on the project and as the evidence presents itself the value of each acre Helios holds increases.

Currently Helios has net acreage of 66,776 with plans to increase that ideally to over 100,000 acres. The combination of an increasing land bank together with continued excellent oil flows in the drilling process make for a very powerful combination in creating market value and the way the share price is testing record highs, it points to an exciting period ahead.

Aurora has shown us just how “well” it can go with some patience.