While the US March quarter earnings season slows this week the most important set of results will be released in Brazil by Vale, the big global iron ore exporter.

Around 60 S&P 500 companies are reporting this week, with the emphasis on media led by the New York Times and the Murdoch family companies – the new Twentieth Century Fox midweek and News Corp on Friday morning, Sydney time.

Investors in the US will now also be watching to see what the dispute between Kraft Heinz and its auditors is all about after Berkshire Hathaway and Warren Buffett (who own 26.7% of Kraft Heinz) revealed the existence of the dispute which has prevented Kraft Heinz from issuing its March quarter results.

The dispute also prevented Berkshire from including its share of Kraft Heinz’s results in its quarterly report (see separate report).

Other media companies due to report this week include EW Scripps, Tribune Media, Viacom, Alliance Media Holdings, AMC Entertainment, Cable One, EchoStar, Liberty Media and its various arms (such as Liberty media-Trip Advisor), Tegna, McClatchy, Sinclair Broadcasting (buyers of the Fox sports networks), Tribune Publishing and Electronic Arts (games publisher).

Walt Disney, the big buyer of Fox assets (and seller, with the $US9.6 billion sale of Fox’s regional sports networks, revealed on Friday), reports its first-quarter figures this week as well.

In Australia Westpac releases its interim figures Monday morning (see separate story), Orica is down to release its half-year figures later in the week as well, along with CSR, Eclipx, GrainCorp, News Corp and REA Group (61% owned by News).

In Brazil, it will be Vale, the big miner, who will grab attention. It is due to release its quarterly production, sales, and financial data on Friday morning, Sydney time.

The iron ore production and sales data will be scrutinised worldwide for the impact of the January 25 dam wall disasters in Minas Gerais state, as well as forecasts for the rest of the year.

Vale’s figures and forecasts will be of considerable interest in Australia to investors and analysts and the management on BHP, Rio Tinto and Fortescue and Chinese and the management of Chinese steel mills. They could very well move stock markets.

A bullish estimate for production and exports for the rest of the year for Vale could very well trigger a slide in global iron ore prices, currently around $US94.17 a tonne on Wednesday at the start of the Chinese May Day holidays. Trading resumes later today when China returns to work.

Another quarterly reporter to be watched is Albemarle, which is the biggest US investor in the Australian lithium industry in joint ventures at Greenbushes (the biggest lithium mine in the world) and with Mineral Resources in the Pilbara.

Last week’s $700 million-plus takeover bid for Kidman resources by Wesfarmers has underlined the rapid growth in a key future mineral in Australia that most politicians, especially those on the East Coast, continue to ignore.

Albemarle’s comments on lithium and its pricing and on the outlook for the still-evolving sector will be required reading in Australia for investors after the Wesfarmers bid.

Other US groups reporting include Wendy’s, Bunge, GoPro, Hecla Mining, Tenneco, Office Depot, McKesson, Symantec, and Revlon.

Besides the media companies, the Financial Times says investors should watch the first set of figures from the ride-sharing group, Lyft’s when they are released after the market close on Tuesday (After 6 am Wednesday in Sydney).

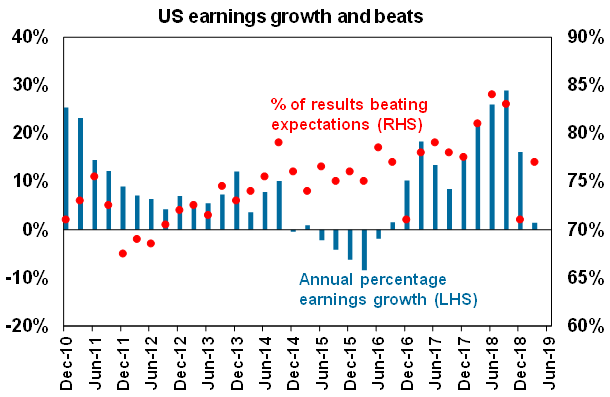

The AMP’s Chief Economist, Shane Oliver says more than 75% of US 500 companies have now reported March quarter earnings results “and while corporates are cautious results overall remain far better than expected.”

“77% have beaten on earnings with an average beat of 6% and 56% have beaten on sales.

“Earnings growth started the reporting season with expectations for a 2% fall on a year ago but has now risen to around 1.5% and this is likely to mark the low point for this year,” Dr Oliver wrote at the weekend.