Volpara Health (VHT) has been a stock that I have highlighted a couple of times, including at the start of the year where it was one of the few companies that was attractive according to my strict stock selection process. This week the company raised $55 million to acquire MRS Systems in the United States and accelerate their sales team and market penetration.

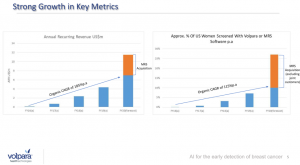

I believe this acquisition is excellent and adds another dimension to VHT’s strategy of not only screening more women but also increasing their average revenue per user. Everything I wrote about in my last analysis of VHT has now been accelerated by this acquisition and what I believed were sensible growth targets over the course of the coming 2-3 years have now been cut in half.

MRS Systems has 20% share of the US market in breast imaging (or approximately 1700 clinics). The clinical data contained by MRS is a major benefit to VHT and the power of its own screening software. The combined database will underpin more accurate readings and provide a better standard of care for each client. With this acquisition VHT aims to screen 27% of all women in the US up from 7% which cements the Company as a significant player in the industry. Add the FDA’s recommendation that all women in the US be screened for breast density and it’s clear that the title of my last article on VHT – Becoming the Industry Standard – is appropriate.

Every time I look at VHT I ask myself two questions:

1) Will breast density screening be the standard of care across the globe given everything we know about the dangers/risks of diagnosing or predicting high risk patients?

2) Will VHT be a major player in the industry and capture significant market share?

Well considering the risk of breast density and the FDA recommendation (supported by the American Society of Breast Surgeons), the current National Healthcare screening trial in the UK, VHT’s current global coverage, the answer would have to be yes.

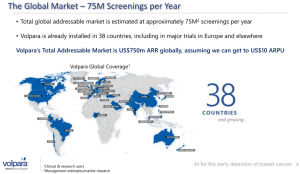

Then to answer the second question, this acquisition of MRS Systems only cements the probability of VHT increasing its market share and being the primary player. VHT is currently in 38 countries and within those countries continues to grow rapidly. It’s definitely a solid base and growing.

VHT has attempted to identify the global addressable market in the slide below from their latest presentation. 75 million screenings represents US$750 million assuming US$10 average revenue per user. Even if we were to halve the revenue per user to US$5 and assume the market share globally is same as the short-term target in the US of 27% this represents US$101 million in what I classify as probable revenue. To me this is conservative. A medical AI software company generating this revenue would have a market cap in excess of $1 billion or roughly $5.50 per share. This is a very basic back of the envelope calculation but it quickly illustrates the gravity of the opportunity and maybe helps explain why have been so keen on this stock for so long. I have said it before an I will repeat it again, I think VHT will follow the share price performances of CSL, Cochlear, Resmed and Nansonics with ongoing consistent share price growth over many years.

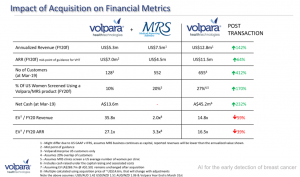

The next two slide really address the significant lift this acquisition gives to MRS. What is most significant in these two slides is the EV/Revenue multiple that VHT is acquiring MRS for – 2x. This compares with VHT at 35.8x. This is a very cheap acquisition and perfectly suited for VHT goals.

I also love the way VHT is trading. Post the acquisition the share price is knocking on the door of record highs. Clearly the market likes this deal as much as I do and I think the stock is on the verge of fresh record highs and on the way to levels well beyond $2. I managed to acquire some additional shares in the capital raising and while there will be some short-sighted investors who will sell VHT out quickly to lock in a quick gain from the $1.50 raising, I will personally be buying more on the back of any selling.

This acquisition not only accelerates the underlying growth of the business but the share price as well. Once a move through to record highs above 1.93 is made, we could see a repeat of the March to May rally of $1.00. Add this move to the recent $1.56 low and targets into the mid $2.50s could be seen very rapidly.