Comex gold futures edged higher on Friday in New York and notched up their biggest monthly percentage gain in three years following a climb to a nearly six-year high earlier in the week.

And today gold trading today in Asia and then Europe and the US will be influenced by the apparent good news on Saturday that Presidents Trump and Xi have agreed to another trade war truce and a restart to trade negotiations.

All markets should benefit from that – but it is not news the trade war is over unless Trump issues a contrary tweet on the way home via South Korea.

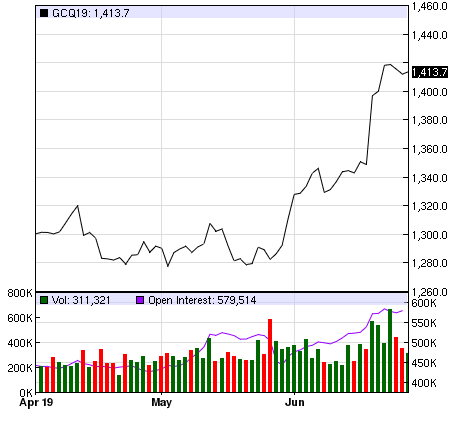

Friday saw Comex August gold futures rise $US1.70, or 0.1%, to settle at $US1,413.70 an ounce.

Prices had settled at $US1,418.70 Tuesday before pulling back. That was the highest settlement for a most-active contract since August 28, 2013, according to financial data group, FactSet.

Gold futures hit an intraday high of $US1,442.90 last week. That’s the highest the price has been for nearly six years.

Gold 0.7% gain for the week, up 7.7% for June which was the largest for a most-active contract since June 2016. For the quarter, prices rose more than 8%. Year to date Comex gold is up nearly 10% and a very solid 12.6% for the 2018-19 financial year.

A solid year for Gold

That has helped push the ASX gold sector higher – none more than the sector leader, Newcrest which saw its shares up 46.5% for both 2018-19 and the first half of 2019, while the June quarter saw a gain on more than 25%, and 17.4% in June.

It has also helped companies such as St Barbara Mines, Dacian and Evolution offset problems in some of their operations in Australia and offshore.

The rising gold price though couldn’t save Gascoyne Resources which collapsed in early June after severe problems at a new mine in WA crippled the company and forced it into administration.

Among other metals, the most-active Comex September silver contract settled at $US15.341 an ounce, up 4.7 cents, or 0.3% on the day.

That was a gain of 4.8% for June, with the contract notching a monthly rise of about 5% but that still left silver down 1.3% year to date and 5% over 2018-19.

Comex September copper fell less than half a cent, or 0.1%, to $US2.714 a pound on Friday, with the contract up 3% for the month of June. It is down 8.8% for the financial year and 3% year to date. Copper futures fell around 7% for the three months to June.

Russia had no option but to agree with Saudi Arabia to the production cap by up to nine months, and so it did on the weekend.

The alternative was to horrible to contemplate – no agreement to maintain the 1.2 million barrels a day and down oil prices would have plunged – again.

All that remains uncertain is how long the cap will be maintained – six or nine months. That will be sorted out by the OPEC meeting tonight, our time with an extension to March 2020 the most likely outcome.

Russian President Vladimir Putin said on Sunday that the cap would be continued and Saudi Energy Minister Khalid al-Falih confirmed that saying the deal would most likely be extended by nine months and no deeper reductions were needed.

Reuters reported Mr. Putin as saying “We will support the extension, both Russia and Saudi Arabia. As far as the length of the extension is concerned, we have yet to decide whether it will be six or nine months. Maybe it will be nine months,” said Mr. Putin, who met the crown prince on the sidelines of a G20 summit in Japan.

Mr. Falih told reporters in Vienna that a nine-month extension was “most likely”. And when asked about a deeper cut, Mr. Falih said: “I don’t think the market needs that.”

The cap had been due to expire yesterday (June 30).

News of the agreement replaced the market happiness of the truce between China and the US on their trade war.

While Presidents Trump and Xi seem to have kissed and made up – a little – at their one-off meeting in Japan on Saturday, the oil markets will be keeping a close eye on the two-day meeting of OPEC and its supporters like Russia today and tomorrow.

Russia knew there was no point in breaking away from the cap because it did so the oil price would collapse.

Friday saw August West Texas Intermediate (WTI) crude lost 96 cents, or 1.6%, to settle at $US58.47 a barrel in New York. That was a gain of around 9% for June.

August Brent crude settled steady at $US66.55 on Friday at a roughly one-month high. That was up 3.2% for the month. The August contract expired Friday and the new front-month contract, September Brent fell 93 cents, or 1.4%, to finish at $US64.74.

WTI crude was up 29% year to date, but down 21% for the 2018-19 financial year. But it is down 12% from the 2019 high around $US66 a barrel.

Brent crude futures gained 19.2% but is nearly 11% below its $74-plus high for the year. Brent is down 18% over the year to June.

The weak global demand is a big concern – the International Energy Agency recently trimmed its 2019 growth forecast for oil to 1.2 million barrels a day, from a previous 1.3 million.

On Friday, however, Baker Hughes reported that the number of active US rigs looking for oil rose by 4 to 793 this week. That followed a modest one -rig rise the week before.