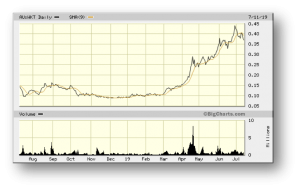

Walkabout Resources – (ASX: WKT, Share Price: $0.39, Market Cap: $123m, coverage initiated @ $0.12 in April 2016 – current gain of 225%)

Key Catalyst

Work advancing on securing funding requirements for Lindi Jumbo project, various funding options being progressed with international investment bank for non-bank debt alternatives.

WKT has been a steady performer since our coverage initiation during April 2016, but it’s share price has strengthened dramatically since March 2019 as it has made strong progress in terms of commercialising its high-grade Lindi jumbo graphite project in Tanzania. WKT has recovered from a period of political uncertainty in Tanzania that impacted all resource companies operating there, with proactive steps by the government restoring industry confidence. WKT has since accelerated project activity, culminating in resource/reserve upgrades that fed directly into a recent positive DFS. The results demonstrate that ‘grade is king’, establishing Lindi as one of the world’s highest-grade graphite projects and one of the lowest in terms of operating costs. WKT’s has seen its share price quadruple over recent months, on the back of confirmation of three separate off-take arrangements for output from its Lindi jumbo project.

Latest Activity

Lindi Jumbo Project Update

WKT has released an update with respect to development activities at its Lindi Jumbo Graphite Project in Tanzania, together with ongoing exploration activities. The company is currently targeting commercialisation of Lindi, its first graphite project, with strong support from the Tanzanian Government.

Funding

On the project funding front, WKT is advancing work on potential funding options with an international investment bank for non-bank debt financing. Due diligence activities are underway and detailed discussions are ongoing. While funding discussions and due diligence activities are progressing, the early-start program will continue and be closely managed to ensure a smooth operational start when applicable.

Site Work

At the Lindi project site, the early start program is progressing according to schedule and within budget at the processing plant, tailings storage facility and explosive magazine and topsoil storage areas.

At the processing plant area, good progress has been made with the clearing, topsoil removal and stockpiling, terracing and levelling and ROM pad, with the first phase to be completed by mid-July. The clearing of the area for the explosive magazines and topsoil management area is complete and levelling and base preparation for the planned civils in progress. Clearing and grubbing for the starter area of the tailings storage facility is underway and once completed the stripping of the topsoil material for stockpiling will commence.

Figure 1: Terracing and Levelling at the Processing Plant Area.

Relocation

Approximately two thirds of the Relocation Assistance Program has been finalised, with all affected persons being satisfactorily disposed to the compensation payments. The final third of the program will be concluded by the end of July 2019.

Procurement

In China, all procurement of out-purchase long-lead time items for the manufacture of long lead items has been completed and manufacturing activities have commenced. WKT’s project engineer has returned from Yantai and reports that the rod mill and float cell banks are currently in the manufacturing workshop. Once the EPC contractor, Jinpeng Mining and Machinery, is mobilised for full manufacture and construction, the early-start program on long-lead items will have advanced their time-table considerably.

Other Recent Activity

DFS Results

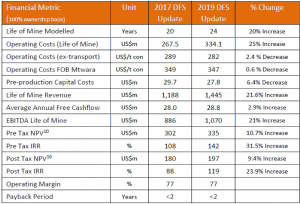

WKT also recently released results from its much-anticipated and enhanced Lindi Project Definitive Feasibility Study (DFS), which refined outcomes generated in the previous 2017 DFS.

Key Project Highlights:

o Life-of-Mine revenue of US$1.445Bn – a 21.6% increase

o Very high cash margins of >US$1,000 per tonne Free on Board (FOB).

o Payback period of less than 2 years

o High post-tax NPV10 of US$197Mn – a 9.4% increase

o Robust post-tax IRR10 of 119% – a 23.9% increase

o Low development capital cost of US$27.8M – a 6% reduction

o Operational costs within the lowest industry quartile at US$347/t of concentrate FOB

o Long mine life of 24 years – an increase of 4 years at 40ktpa produced

o Robust economics based on current sales assumptions, weighted average basket price reduced to a US$1,515 per tonne.

o Low economic sensitivity to operating and capital cost risks

Technical Significance

The key factor with respect to both the DFS outcome and the recent ore reserve upgrade, is project grade. Lindi hosts the highest-grade graphite reserve in Africa, with a current life-of-mine of 24 years that can produce 40,000 tonnes of graphite concentrate annually.

WKT’s development philosophy is underpinned by the unique and very high-grade nature of three discrete and visually distinct domains within the Measured and Indicated Resource. Mine planning indicates that these may be extracted with minimum contamination from lower grade associated domains, enabling the production of an average life-of-mine (LOM) mill feed grade above 17% TGC – an outstanding grade.

Table 2: Project financial indicators as per the Updated Definitive Feasibility Study of 2018

As a result of the increased life-of-mine grade, the average annual mill feed requirement has been reduced by almost 20% from an average of 280,000 tpa to 230,000 tpa. This has potentially created a near “capital-free” expansion opportunity that will be assessed during future optimisation studies.

This provides a significant competitive advantage in terms of both capital and operating cost reduction, as well as being able to maximise prising through the ability to provide a premium graphite product. This gives WKT a competitive edge over its graphite peers in a crowded market.

Summary

WKT’s share price performance – having quadrupled over the past few months – reflects renewed confidence in the company’s ability to commercialise Lindi, following on from the granting of its mining licences by the Tanzanian authorities during H2 2018.

WKT will look to minimize production and financial risks by avoiding a large, overly complex operation in the early stages, instead looking to increase production from a stable economic base that utilizes modular design. There is potential for further upside, including the capacity to produce and sell more graphite than designed for, and also expanding into not-yet utilised high-grade deposits to the south.