Nothing in the inflation data for the three months to June that would cause the Reserve Bank to change its approach to monetary policy.

Thanks to higher petrol prices – a fact that had been anticipated for the past few months by the RBA and its forecasters – the Consumer Price Index rose 0.6% in the June quarter after the flat result in the three months to March.

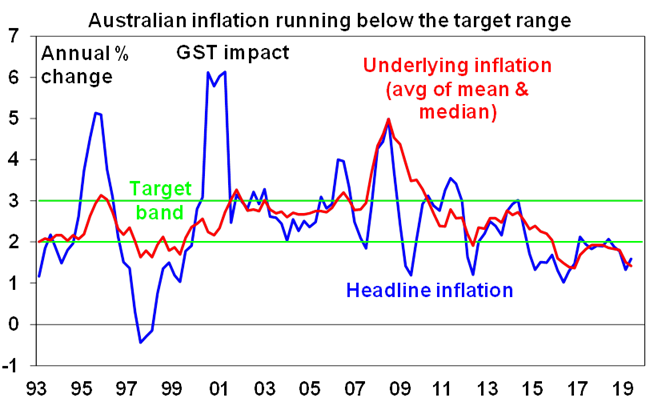

That saw the annual rate rise from 1.3% to 1.6% – about the middle of the 1.5% forecast in the 2018-19 budget and the May forecast from the RBA.

Underlying inflation – the trimmed mean and the weighted median was unchanged at an annual rate of 1.4%.

That will merely confirm to the RBA at its meeting next Tuesday that the economy generally (except for exports) remains lacklustre.

The trimmed mean inflation measure from the ABS, (it measures underlying price pressures that exclude volatile price movements), also rose 1.6 percent from a year earlier, unchanged from the March figure. The weighted median fell to 1.2% – combined they gave an average rise of 1.4%.

BIS Oxford chief economist Sarah Hunter and the AMP’s Shane Oliver both noted in comments yesterday that the RBA’s underlying core inflation measure of 1.4%- an average of trimmed and weighted mean – remained below the RBA’s 2.0%to 3.0% target, which was further evidence that upward pressure on prices was still weak.

In fact, there’s again a solid suggestion from the figures that disinflation (falling prices but not deflation with is negative price growth) remains the main concern, especially for the RBA. That’s why another rate cut later this year remains on the cards.

Source: ABS, AMP Capital

Dr. Oliver wrote in his note yesterday: “Underlying inflation may have hit bottom but there is still broad pricing weakness across many areas of the Australian economy like in clothing and footwear, rents, household equipment, and communication. As a result, corporate margins remain under pressure because of the difficulty in lifting prices, although low wages growth is providing an offset to this.

“Other measures of underlying inflation are also low, like inflation excluding food and energy (the US core measure of inflation) which is running at 1.5% year on year (in the US it is at 2.1% ) and inflation in the private sector of the economy (excluding volatile items) is at 1.6% year on year,” Dr Oliver wrote.

He reckons the CPI report provides more “evidence of weak pricing pressures remains clear across many parts of the Australian economy. With spare capacity remaining significant in the economy including in the labour market, underlying inflation is expected to remain below the bottom end of the RBA’s target band for a while.”

Dr. Oliver reckons the RBA will further downgrade its inflation forecasts in its August Statement on Monetary Policy next week.

“So while June quarter inflation was close enough to market and RBA expectations to head off another rate cut in August, we still expect the RBA to cut rates another two times, with the first being in November after the RBA has time to assess the impact from the two recent rate cuts and the tax cuts for low and middle-income households,” he forecast.

The RBA’s credit data showed a 0.1% rise in total credit over June with annual growth slowing to 3.3%. Business credit growth fell in June.

The financial aggregates data revised down May’s total credit expansion from 0.2% to 0.% and indicated overall credit rose 3.3% over the past year.

Annual housing credit grew 3.5% – the slowest growth rate since records started in 1976 – and business credit was up 4.0% in 2018-19 while personal credit fell 3.5% in the 12 months to June.