Sheffield Resources – (ASX: SFX, Share Price: $0.575, Market Cap: $150m, coverage initiated @ $0.50 in Sep 2015).

Key Catalyst

Meeting in Sydney with MD Bruce McFadzean and fellow director David Archer, as part of a roadshow highlighting release of enhanced DFS for the Thunderbird Mineral Sands Project in WA.

Since its 2010 listing, SFX has remained focused on exploration, appraisal and commercialisation of its 100%-owned Thunderbird deposit in Western Australia. Thunderbird is a remarkable and rather unique asset, representing one of the world’s largest and highest-grade undeveloped zircon-rich mineral sands deposits. SFX was in the right place at the right time to acquire the project when RIO sold it in the wake of the GFC. During 2017, SFX completed a high-quality Bankable Feasibility Study (BFS) on the project, highlighting its robust economics, low technical risks and long operating life of 42 years. Then in July 2019 the company released an enhanced BFS, featuring a material reduction in project capital requirements and execution risk, increased zircon production and a 30% lift in project revenue – which has substantially enhanced overall project financial metrics and significantly improved funding prospects.

Recent Activity

Enhanced Thunderbird BFS

I had the opportunity this week to meet with two of the key directors of SFX, Bruce McFadzean and David Archer, as part of their investor roadshow designed to promote the company’s recently-released and updated Thunderbird BFS. After spending two days last week in London, the pair are spending a total of five days this week road-showing in Sydney and Melbourne.

In our most recent coverage on 23rd July we highlighted the securing of additional binding offtake volume with respect to the future zircon concentrate sales from Thunderbird, as well as the impending release of the revised Thunderbird BFS. SFX has since released the outcome of the updated BFS, which has generated excellent results.

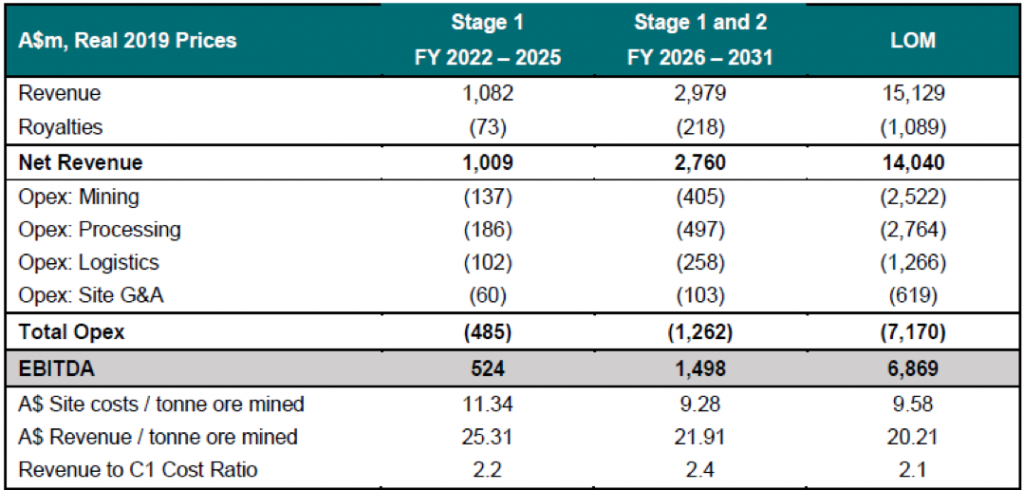

Results Overview

The BFSU has set out to materially improve project financial metrics by re-scoping the project in order to reduce capital expenditure, boosting zircon production to meet strong demand from consumers globally as the structural supply deficit widens, and supplying primary ilmenite into the high growth chloride slag market.

The updated BFS estimates a material reduction in project capex requirements and execution risk, a boost to zircon production and project revenue of more than 30%, whilst substantially enhancing overall project economics.

In particular, the growth in the chloride pigment sector and the projected supply shortages of high-grade titanium feedstocks have created a new market dynamic, whereby chloride slag production and demand has continued to grow strongly. These changed market conditions have enabled SFX to remove the low temperature roast (LTR) ilmenite circuit from the project scope and sell the primary ilmenite into the chloride slag sector under a seven-year binding offtake agreement.

The mining and processing rate has been increased by 38% to 1,085 dry tph feed rate at the wet concentrate plant (WCP), targeting an average annual zircon production of 202ktpa over the 37-year LOM, elevating Thunderbird into the top-tier of global zircon producers. The strong demand for Thunderbird products has resulted in approximately 100% of Stage 1 revenues being contracted under binding offtake agreements, substantially reducing market and revenue risk.

Upscaling of the zircon circuit will increase zircon production by 34% over the first 10 years of the project and almost 40% over the life of the project. This additional zircon production, in conjunction with the sale of the primary ilmenite, has had a transformational impact on Thunderbird’s economics.

Table 1: Key Variance to Previous Financial Metrics

The BFSU estimates a new Ore Reserve of 748 million tonnes at 11.2% HM, representing an increase of 68 million tonnes – or approximately 10%. This reflects changes in market product pricing and increased certainty with respect to in costs and revenue for Thunderbird. The new Ore Reserve boosts the period of mining higher grade ore from 7 years to 10 years and removes lower-grade ore from the process plant feed during this period, increasing the in-situ zircon grade in the Proved Category to 1.02% zircon.

The staged development strategy has been implemented to materially reduce pre-development capital, lower construction risk and increase revenues by focusing on a substantial increase in zircon production:

• Stage 1: Single Mining Unit Plant (MUP) and processing plant underpinning a 10.4Mtpa mining operation

• Stage 2: Duplication in year 5 of Stage 1 mining and processing circuits underpinning a 20.8Mtpa mining operation

The BFSU delivers a pre-finance and pre-tax IRR of 30.1% and an NPV10 of $1.13 Billion over the 37-year LOM. This approach results in negligible variation to current debt carrying capacity levels, reduces construction and commissioning risk, and materially lowers equity funding requirements to $143 million.

Table 2: Thunderbird Project Key Financial Metrics

Technical Significance

The BFS results have not only reaffirmed Thunderbird’s status as a world-class mineral sands project with a 37-year mine life, they actually enhance the ‘do-ability’ of the project. The removal of the LTR ilmenite circuit, combined with a focus on increased zircon production, delivers lower capital requirements and construction risk, together with a technically stronger project.

Market conditions are also moving in the company’s favour, with consensus forecasts indicating a structural supply deficit in the zircon market for the foreseeable future. The recent growth in the chloride slag market and SFX’s strong relationship with existing ilmenite offtake partner Bengbu Zhongheng New Materials, has resulted in a seven-year binding offtake agreement (with a three-year extension option) for 100% of Thunderbird’s Stage 1 unroasted Primary Ilmenite.

This further validates SFX’s decision to remove the LTR ilmenite circuit from the project and boost zircon production by almost 40%, most of which is now contracted with binding offtake agreements.

Next Steps

SFX expects to determine the optimal funding solution over the coming months, clearing the way for a final investment decision and the start of construction during 2019. Initial debt financing technical due diligence has been initiated, and it is anticipated that revised project financing agreements will be concluded in 2019. SFX is targeting existing debt capacity levels of $335 million, reducing the equity funding requirement substantially to a level of $143 million.

During January 2019, UBS was engaged by SFX to assist in securing third-party strategic partner interest for project funding and development, with structured and formal process underway. The introduction of a strategic party to Thunderbird could reduce the residual equity funding requirement attributable to SFX, as the strategic partner would likely be responsible for their proportionate share of residual capital requirements in the case of a project level investment.

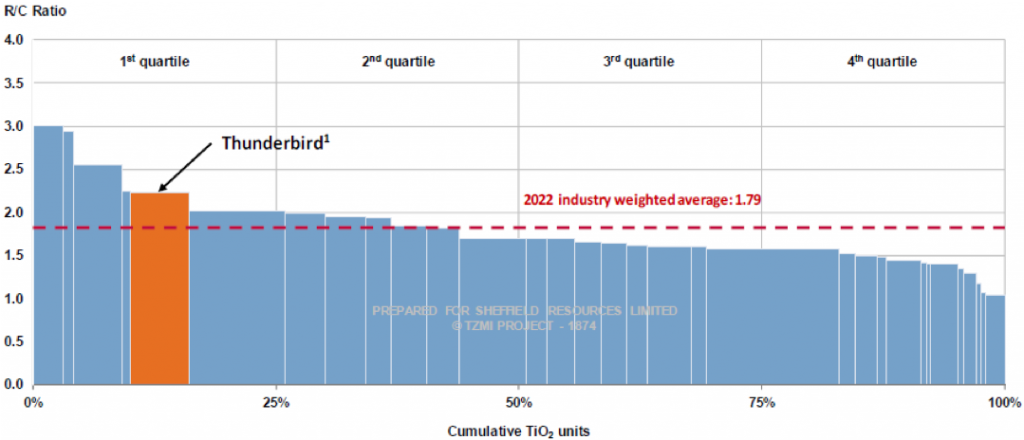

Figure 1: TZMI 2022 Industry Revenue to Cash Cost Curve

Summary

SFX’s share price since late 2018 has been negatively impacted by question marks over the company’s capacity to finalise project funding, in what is a challenging environment. This was reflected in a share price fall from an all-time high of $1.27 in October 2018 to a 12-month low of $0.30 in June 2019. Accordingly, SFX was committed to a revised BFS, with the aim of reducing project capex, enhancing project economics and making project financing easier.

The updated BFS has deferred the planned LTR ilmenite circuit to focus on increased zircon production – delivering lower capital and operating costs, lower construction risk and a financially stronger project. SFX has rebounded from its $0.30 low in June to a recent high of $0.73 – a 143% gain in a little over a month!