The Australian June 30 reporting season (full year and interim) has ended with the only major companies left to report being those with July 31 balance dates such as TPG, Myer, Brickworks, Premier Investments Washington H Soul Pattinson New Hope and several others.

The word from analysts is that it was a season to forget.

No revenue or earnings growth outside major resource companies focusing on iron ore or gold, or companies in the healthcare sector – though not all.

The rest had weak to middling years – some retailers did better than others but compared with a couple of years ago their performances were weak.

Capital returns are a current issue because of some illogical comments from the federal treasurer, Frydenberg last week who decried companies lifting dividends and engaging in buybacks instead of investing more.

Capital returns have come principally from the likes of BHP and Rio Tinto which have lifted dividends and made one-off returns after selling assets owned here or in the US or Europe.

Both giants continue to invest billions in brownfields expansions of iron ore mines in WA, alumina or bauxite in Australia or nickel in WA.

Fortescue Metals boosted dividends as well to record levels because of the surge in iron ore prices, but it is also investing billions in its WA iron ore mining operations.

Many companies with buyback plans such as BlueScope Steel are continuing with them as a way of supporting the share price during difficult times.

Qantas has a campaign of giving back capital to its owners while investing more in new planes and ground facilities.

The AMP’s chief economist, Dr. Shane Oliver says that while there were some positives from the season “The overall picture is soft with earnings growth barely positive in 2018-19. The weakness was pretty broad-based;”

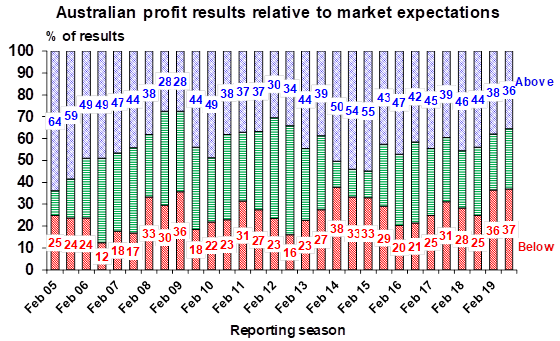

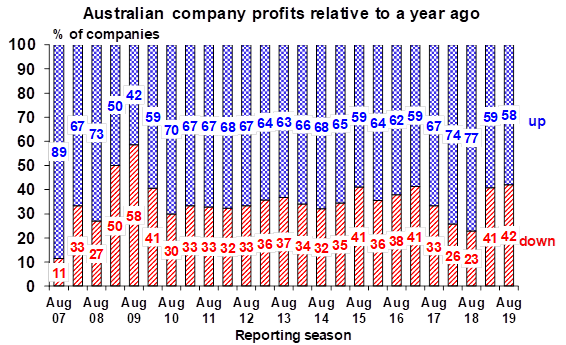

Dr. Oliver says only “36% of results have surprised on the upside which is below the long-term norm of 44% and is the lowest since 2012, only 58% of companies have seen earnings rise from a year ago compared to 77% this time a year ago.”

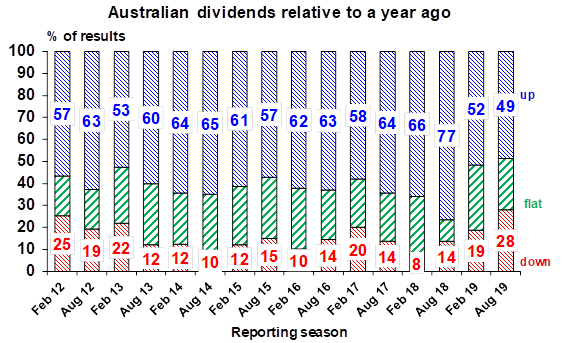

“While there have been some hefty dividend payments from some companies, only 49% of companies have raised their dividends which is well below the norm of 62% and 28% of companies have cut their dividends which is the most in the last seven years suggesting greater caution,” Dr Oliver wrote at the weekend. And earnings downgrades have dominated upgrades by more than two to one, he added.

“As a result, 2018-19 earnings growth has come in around 1.5% from around a 2% consensus expectations at the start of August. Resources stocks are seeing earnings growth around 13% compared to a 2% decline for the rest of the market, but with healthcare stocks also seeing double-digit earnings growth.

“Downgrades have been greatest amongst energy stocks, financials, telcos, and industrials. The good news though is that some retailers were upbeat about rate cuts and tax cuts boosting spending and property-related companies pointed to signs of increasing housing demand.

“While Australian shares fell around 3.2% in August this was due global trade war concerns with investors reasonably forgiving of the soft profit reporting season overall on the back of low-interest rates and hopes for a stimulus boost to growth to come, “ Dr. Oliver wrote.

And what of 2019-20? Dr. Oliver says that while “consensus earnings expectations are for a pick up in earnings growth to 7.5% this financial year, the slowdown in economic growth, cautious outlook statements and falling commodity prices suggest some downside risk to this. ”

Certainly the 28% slide in iron ore prices in August and 33% slide since the peak of around $US125-$US126 a tonne in early July means the outperformers like BHP, Rio Tinto, and Fortescue will come back to the field this half, and others will battle.

The key performers to watch will be the performance of Westpac, NAB, and ANZ (all annual, to the end of this month) and Macquarie (interim, also to the end of September). Weak profits and revenues and unchanged dividends will impact growth in revenues and profits this half and make that 7% figure more problematic.

Source: AMP Capital

Source: AMP Capital

Source: AMP Capital