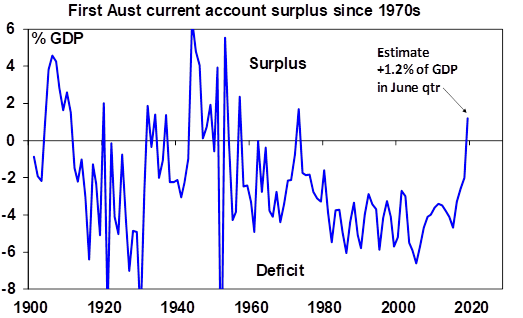

The first current account surplus for 44 years and the last for a while and possibly a slightly better than expected GDP report later today.

The Australian Bureau of Statistics reported that the current account moved into surplus in the June quarter – the first time that has happened since 1975.

The current account recorded a June quarter surplus of $5.9 billion

And net exports are estimated by the ABS to contribute +0.6 percentage points to June quarter GDP growth and 1.2 percentage points over the last year. Seeing the 0.9% slump in business inventories will cut GDP by 0.6 percentage points, they net themselves out, leaving GDP to be influenced by the hard to quantify government finance transactions which produced a $15 billion-plus excess of inflows over spending according to the ABS.

The AMP’s Chief Economist, Dr. Shane Oliver says “This is a big turnaround after decades of worrying about the deficit and rising foreign liabilities.”

“The improvement reflects strong resource export volumes, high bulk commodity prices, strong growth in services exports like education and tourism and reduced imports after the end of the mining investment boom.

“With iron ore and coal prices falling we will likely see a return to deficit but at far smaller levels than seen in the past. It all means that Australia is becoming far less dependent on foreign capital.

Even though iron ore prices jumped 7% on Monday to more than $US90 a tonne (according to the Metal Bulletin), they are still well down on the $US125 a tonne peak hit in early July.