Possibly the biggest week for US third-quarter earnings lies ahead of markets over the next five days with more than 150 S&P 500 companies due to report.

They will be led by giants such as Apple , Alphabet (Google) and Facebook whose earnings reports will be crucial in persuading US investors that the mega techs remain on track (after Amazon’s lower than forecast result on Thursday, thanks to heavy investment and a warning of a weaker than expected holiday season in late November and December).

Analysts will be looking at iPhone sales (of course) in what is the final quarter of Apple’s financial year, along with its forecast for the three months to December, which includes Thanksgiving and Christmas in the US and Christmas elsewhere, and the period when sales and earnings (and margins) hit their peak.

Besides Apple, Facebook and Alphabet (Google – analysts will be looking at the growth in third-party ad spending in all three groups results), other majors due to release results include:

Pfizer, Merck, AT&T, Loewes, General Motors, Walgreens, Spotify, Mastercard, Exxon Mobil and Chevron (and a host of smaller oil shale groups such as Whiting Petroleum, Apache and Chesapeake), Molson Coors, Publix Supermarkets, Cummins, Kellogg Co, Starbucks, USSteel, Ryanair, HSBC, Beyond Meat, Crane, Clorox and DuPont.

Analysts will be looking for guidance from GM about the impact of the month-long strike (settled on Friday) on the third and 4th quarter results when it reports mid-week.

One stock result that will be very closely watched is the September numbers from struggling food giant, Kraft Heinz where big write-offs, worries about sales growth and its accounting policies have seen a big sell-off in the shares on massive losses.

All that has made the company’s biggest investor, Warren Buffett unhappy.

His Berkshire Hathaway company owns nearly 27% of Kraft Heinz and is its biggest shareholder.

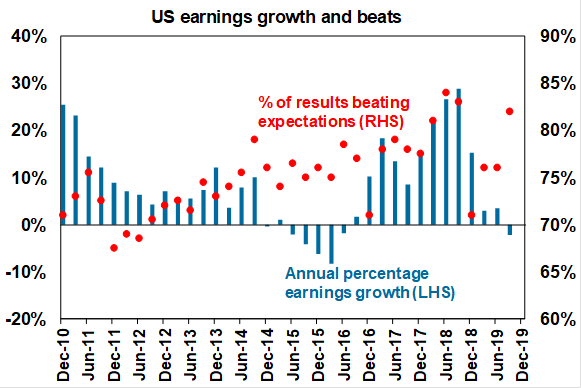

More than 38% of S&P 500 companies have so far posted quarter earnings for the third quarter. According to US financial data group, FactSet 78% have beat analyst expectations.

Consensus earnings forecasts for the quarter have increased to -2.3% year on year but the AMP’s Dr Shane Oliver thinks the earnings overall “are likely to end with a small positive.”

Source: AMP Capital