When it comes to finding the next great investment there are generally two approaches. Finding some idea or product that is completely new that the market has not yet understood or reflected so you have to wait patiently until it does, or second find another stock that operates in the same (or similar) space in a sector that the market completely appreciates.

The advantage of the second approach is that the original leaders in a sector provide a “road map” and “valuation yardstick” for others. I was an early investor in Polynovo (PNV) and Avita Medical (AVH) but never really capitalized on their huge runaway rallies because I was frustrated with having to wait so long for the market to reflect the story of their tissue regenerative products to treat burns, scars and other skin defects. In addition, I will admit, I was not prepared for the kind of valuations that market was prepared to place on both companies. At their peaks AVH had a market cap of $1.5 billion and PNV reached $1.7 billion, double what I thought was probable or even possible.

AVH share price

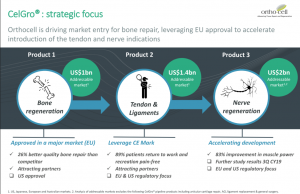

The third company in the regenerative space is Orthocell (OCC) and rather than repairing skin related defects, the Company’s CelGro technology repairs soft tissue such as Anterior Curcial Ligament (ACL), rotator cuff and other tendon injuries. More significant, in my view, is the application of CelGro to repair damaged nerves, particularly in the application of paralysed muscles. Think paraplegics and quadriplegics. A summary of OCC products are shown below.

Orthocell have made two key announcements in my view, the first being on 8th May 2019, when they announced the results of the first patients completing the nerve regeneration trial. Results of the first four patients showed they transitioned from having zero muscle usage to significant return (83%) in their muscle performance (hand and upper limb) after operations using CelGro. Following this announcement the share price surged for a day and a half by 700% and has since been consolidating.

The second follow up announcement on the 9th October 2019 in my view is even more significant because these results were based on twelve months after initial surgery using CelGro and was applied to more serious injuries affecting the spinal cord (in some cases) resulting in the loss of some or all limbs. The results are just incredible not for us investors but for these patients. After 12 months 96% of nerve repairs restored voluntary movement and in 66% of nerve repairs meaningful functionality of muscles controlled by the repaired nerves was seen. In the case of three quadriplegic patients, 73% of the nerve repairs (there is more than one nerve repair per patient) resulted in a meaningful recovery in muscle function. In one particular case a quadriplegic patient that had full paralysis was able to brush teeth and move themselves in and out of a wheel chair. Read that again and let it sink in. Remarkable.

I urge readers to read the 9th October release.

A summary from the OCC’s presentation on CelGro’s application is below

If CelGro can achieve such a significant improvement in bone, tendon and nerve repair what value will the market place on OCC as it moves towards FDA approval? Will it be anything similar to that of AVH or PNV? If so that represents a 15x upside return. But without getting ahead of ourselves, there is strong potential for OCC to be worth 2x or 3x what it is today based on further strong trial results and progression to approval in the USA and Australia.

The encouraging aspect behind OCC over the past six months has been the market’s willingness to underpin the share price in the 35-45c range. How many times have we seen biotech and healthcare companies release an announcement that sends the share price rocketing only to witness it deflate rapidly afterwards? Countless.

The ability of OCC to held up strongly and form an attractive rounding base suggests that investors are now more willing to pay higher prices as momentum begins to build. This could really accelerate once the resistance of 68c is surpassed. This breach is likely to trigger another strong re-rating in similar fashion to the runs seen in AVH and PNV. Next target is $1.00 in my view.

Following my failure to capitalize on the huge emergence of PNV and AVH, I am committed to not make the same mistake again. With those I was too early and had to endure too much volatility and pain before being rewarded. Put simply the timing wasn’t right. But with the momentum and remarkable results from OCC trials emerging, I think the timing is right to be accumulating OCC. I have been and will continue to do so as the “valuation road map” has been set of how to reach a value of $1 billion.

NEW – Greg Tolpigin’s Million Dollar Trader

Greg has just released his brand new 141-page eBook “Creating Wealth From Explosive Stocks”.

Learn how to identify stocks that are poised to increase 50%, 100% and even 500% in value and invest right as they begin to take off.

This educational path to profitable trading cuts away all the theory and hundreds of “historic examples” and uses only real trades Greg has used as a strategist and proprietary trader for the major US and Australian investment banks and continues to apply today.

Join the Million Dollar Trader club today to download your copy of “Creating Wealth From Explosive Stocks” plus watch the weekly video to learn how Greg has applied these strategies to continually identify new opportunities.