Many environmental stocks have shown outstanding share price performance since their listing on the ASX.

Here are seven examples that prove that good stock selection among environmental stocks can lead to excellent share price performance and capital gains. Eco Investor classifies all seven stocks as core securities and so their total shareholder return would be higher as they also pay dividends.

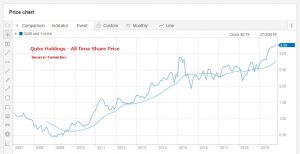

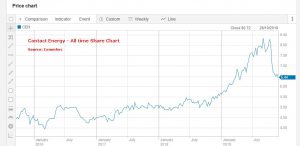

In alphabetical order the seven are: Contact Energy, Ingenia Communities Group, Mercury New Zealand, Meridian Energy, Qube Holdings, Reece, and Tassal. There are other core securities that could also have been included such as Bingo Industries, Duxton Water and Kathmandu.

Water and waste management products supplier Reece is the outstanding long term performer, showing a continual uptrend since 1990 and the greatest gain.

Holiday parks owner and operator Ingenia has a 10 year chart as it was formerly ING Real Estate Community Living Fund and it internalized its management and became Ingenia in May 2012.

The three New Zealand renewable energy utilities – Mercury New Zealand, Meridian Energy and Contact Energy – have shown remarkable uptrends since their dual listings on the ASX. However, this may have come to an end for the time being as all three have suffered a recent downturn. This was due to Rio Tinto, the major owner of New Zealand Aluminium Smelters Limited, announcing a strategic review of the smelter. The Tiwai smelter accounts for 12 per cent of New Zealand’s electricity demand and its long term future has been uncertain for some time.

Meridian is a major supplier. Any decision to reduce output or cease production is expected to have a major impact on the NZ energy market and could lead to over supply. An update on the strategic review is due by the end of the first quarter in 2020, and any change to the supply contract will need 12 month’s notice.

The review has thrown great uncertainty into the market and all three New Zealand utilities have seen their share prices turn down as a result, with Meridian showing the greatest fall.

On another issue, this article began when I read another of those annoying articles that said some Australian ethical funds and sustainability funds have not performed as well as their sin-filled equivalent funds, even though in the main example all three funds were run by the same major asset manager.

Unfortunately, the article had no analysis of why that may have been so. When I looked up the shareholdings in the examples, the ethical fund had BHP as its second largest holding at 6.1 per cent and Santos as its ninth largest asset at 3.4 per cent; the sustainability fund had BHP as its third largest asset at 7.5 per cent; and the ‘normal’ share fund had BHP as its fourth largest asset at 5.8 per cent and Santos as its seventh largest holding at 4.3 per cent.

Sorry, but no ethical investor I know invests in BHP or Santos. The funds are ethical and sustainable in name but not in hard practice.

The other interesting observation is that there was almost no difference in the top 10 holdings for all three funds. And CSL was the top stock in all three.

To paraphrase a famous line in Star Trek, “It may be ethical investment, Jim, but not as we know it.”

Importantly, this was the first time for some time that I had heard, in essence, the old line that ethical investors forsake returns. Hopefully that line is dying. Using pale green and pale brown funds to drag out that old chestnut is doing real ethical investment a big disservice.

Do it yourself investors can avoid such managed funds. They can also do better as most advisers say that 15 to 25 stocks is enough for retail investors to gain sufficient diversification. If an investor cannot find up to 25 top performing ethical stocks then they need to get better at investing or perhaps hand over to professional managers or advisers.

The 10 environmental stocks mentioned here are not presented as recommendations. They are presented to show that the environmental sector is able to deliver significant long term returns and outperformance. They show that environmental stocks can form an important and even substantial theme in an investor’s share portfolio.

The ethical investment universe is much larger than the environmental investment universe. Together they are big enough for a serious environmental and ethical investor to be able to find enough good performers to assemble a quality retail portfolio of up to 25 stocks. If they are well chosen, there need be no loss of performance, and serious outperformance is available.