Oklo Resources – (ASX: OKU, Share Price: $0.25, Market Cap: $93m, coverage initiated @ $0.08 in Nov 2015 – current gain of 213%).

Key Catalyst

Strong results from two step-out diamond holes over the northern portion of SK1 at Seko, showing down-dip continuity of high-grade gold mineralisation confirmed in both holes.

OKU has been an overall success story since our coverage initiation back in late 2015, with its share price at one stage hitting an all-time high of $0.50 during January 2018. Through extensive drilling activity, OKU has managed to identify extensive gold mineralisation over a 12km long corridor at its Dandoko project in Mali. Within the project, the Seko prospect has proven to be a particular highlight, with strike and depth extensions identified to the already-significant shallow oxide gold mineralisation. From a regional perspective, mineralisation is of a similar style to many other large deposits found nearby in western Mali, which augurs well for OKU’s attempts to outline a large, multi-million-ounce open-pittable gold deposit. Ongoing drilling activity is being incorporated into a maiden Mineral Resource estimate, which OKU has scheduled for completion during Q2 2020. OKU is currently attending the 121 conference in Cape Town.

Latest Activity

Seko Prospect Update

OKU has today released further encouraging assay results from its ongoing and expanded ~3,000m drilling program over the northern portion of the SK1 target, located within the Seko prospect at its flagship Dandoko Project in Mali.

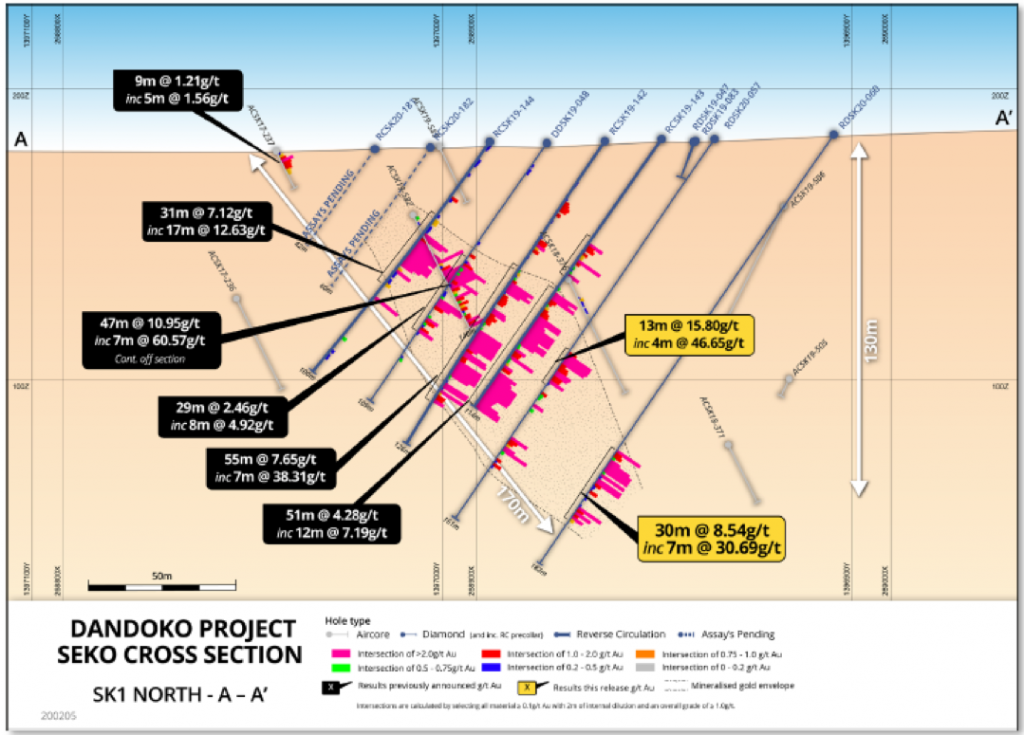

Significant intersections include 30m at 8.54g/t gold from 135m (including 7m at 30.69g/t gold from 142m and 13m at 15.80g/t gold from 91m) in hole RDSK20-060; and 13m at 15.80g/t gold from 91m (including 4m at 46.65g/t gold from 92m in hole RDSK20-057.

Figure 1: Seko SK1 North Cross Section A-A

Technical Significance

Results from the first two step-out diamond holes have successfully outlined depth extensions to the existing wide, northeast-striking zone gold mineralisation, which dips ~60° towards the southeast. The deepest hole – RDSK20-060 – has confirmed that the gold mineralisation extends to at least 170m down-dip (~130m vertically) and remains open at depth. This will be of significance when it comes to future resource statements, with a maiden estimated due to be announced during Q2 2020.

The gold mineralisation is associated with gossanous (after sulphides) and locally-brecciated altered sediments with up to 10-20% sulphides in transitional material. Individual samples returned up to 106g/t gold (equivalent to ~3.4oz/t gold) corresponding to the gossanous zones.

Project Overview

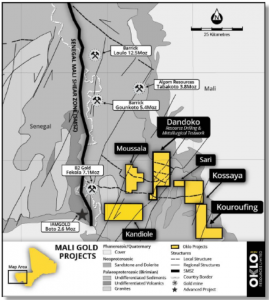

OKU’s Dandoko Project is located within the Kenieba Inlier of west Mali, approximately 30km east of B2Gold’s 7.1Moz Fekola Project and 50km south-southeast of Barrick’s 12.5Moz Loulo Project . The company currently holds ~500 sq km of highly prospective ground in this emerging world-class gold region.

The Seko prospect comprises five coherent auger gold trends (SK1 – SK5), with a combined strike length of ~7km. OKU’s current field program is focused on infill drilling and closing off areas of near-surface mineralisation at Seko anomalies 1-5 and surrounding areas, in advance of a maiden Resource estimate.

Figure 3: Location of OKU’s gold projects in west Mali.

The Dandoko Project is by far the most advanced of OKU’s Mali projects. A series of dominant NNE-trending faults, displaced by a second set of ESE-trending faults, have been mapped or interpreted from aeromagnetic data. OKU considers that the NNE-trending structures are splays emanating from the Senegal-Mali Shear Zone (SMSZ), a regional NNW-trending strike-slip fault that plays an important role in controlling gold mineralisation in the region.

The SMSZ is extensively mineralised and hosts no fewer than six major gold deposits for an endowment estimated at greater than 40Moz, including Sadiola (13.5Moz) and Loulo (12.5Moz).

Summary

OKU’s current field program is focused on infill drilling and closing-off areas of near-surface mineralisation at Seko and surrounding areas. Seko is just one of numerous extensive gold mineralised alteration systems within the company’s Dandoko Project. Importantly, the mineralisation is similar in style to many other large deposits found nearby in western Mali, which augurs well for its attempts to outline a large, open-pittable gold deposit.

We look forward to the reporting of further drilling results during what is shaping up to be an exciting period for the company in advance of its maiden Mineral Resource estimate during Q2 2020. OKU’s share price is already moving in anticipation, having more-than-doubled since October 2019.