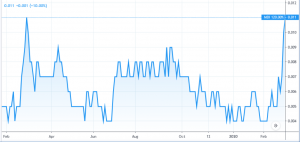

Middle Island Resources – (ASX: MDI, Share Price: $0.011, Market Cap: $18m, coverage initiated @ $0.021 in Aug 2017)

Key Catalyst

MDI’s share price trebles on the back of proposed off-market takeover offer for ASX-listed neighbour, Alto Metals (ASX: AME), by a Chinese group.

We initiated coverage of MDI during August 2017, on the basis that the company possesses a potentially very large (albeit low-grade) gold resource base at Sandstone in Western Australia, with potential for commercialisation through either a stand-alone development, or a deal with its ASX-listed neighbour, AME. The synergies of a merger between the two groups have always made sense – with MDI maintaining a treatment plant (on care-and-maintenance) and a large resource, whilst AME possesses a significant acreage position. A merger would provide initial mill feed and critical mass to support an early recommissioning of MDI’s Sandstone gold processing plant. MDI’s efforts to merge the two groups have proven unsuccessful, however AME’s share price surged by 80% in Monday’s trade as it considers a possible $0.065 a share bid from a subsidiary of China’s Shandong Goldsea Group.

Latest Activity

Regional Corporate Activity

Neighbour Alto Mining (ASX: AME) surged by more than 80% on Monday to a current price of $0.065, as the company weighs its options regarding a possible bid from Goldsea Australia Mining, a subsidiary of China’s Shandong Goldsea Group.

Goldsea has announced its intention to make an off-market takeover to acquire all of AME’s shares at a cash price of 6.5c each. The offer represents a 93% premium to the company’s one-month volume weighted average share price (VWAP) and a 103% premium to the junior explorer’s closing price on February 20, the last trading day prior to the bid.

AME has urged shareholders not to take any action, with the board considering a formal response. AME has pointed out that the Goldsea offer was subject to a number of conditions, including Foreign Investment Review Board approval and a minimum acceptance of at least 90%.

Technical Significance

Not surprisingly, MDI’s own share price has surged from a low of $0.004 this month to a high during Tuesday’s trade of $0.012 (a trebling in price), before closing at $0.011.

As we’ve previously discussed in our prior coverage, MDI’s own bid for AME consisted of six of its own shares for one AME share, valuing AME shares at around $0.054. The offer lapsed in November 2019, after failing to reach its minimum 50% acceptance condition.

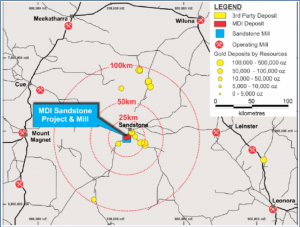

Shandong Goldsea’s bid for AME further demonstrates the attraction of a revitalised gold operation at Sandstone. AME’s principal asset is the Sandstone Gold project, covering ~80% (800 sq km) of the Archaean Sandstone greenstone belt that surrounds and lies immediately adjacent to MDI’s tenure. The project hosts a JORC (2012) Inferred Mineral Resource Estimate comprising 2.58Mt @ 1.49g/t Au for 124,000 ounces for the Indomitable and Vanguard deposits. Together with existing deposits at Lord Nelson and Lord Henry, AME’s JORC (2012) Mineral Resources comprise 1.2Mt @ 1.9g/t Au for 65,000oz (Indicated) and 3.67Mt @ 1.66g/t Au for 196,000oz (Inferred).

A combination of MDI and AME’s gold assets could provide a substantial growth opportunity for shareholders, consolidating the entire Sandstone greenstone belt and dataset under a single entity. It would have the capacity to fast-track gold through utilisation of MDI’s existing processing plant (after refurbishment) and access to AME’s gold resources, together with significant resource upside and exploration potential.

Access to MDI’s processing plant would provide AME with an immediate, proximal and cost-effective processing solution for AME’s gold resources, that is not otherwise available to AME. Meanwhile, MDI’s Two Mile Hill deposits offer considerable scale and project longevity.

MDI hosts the only gold processing plant for 150km and is pursuing broader regional consolidation for long-lived production around a central processing hub, with up to 15 stranded third-party deposits hosting a total of ~1.8Moz, identified within potential economic trucking distance.

Figure 1: Location of MDI’s Sandstone Project and nearby deposits

Overview

A recommissioning decision for MDI’s Sandstone gold operation is predicated on defining adequate gold resources (at an acceptable grade), to justify the recommissioning costs and ensure sustainable production. This is being progressively achieved via a dual approach – systematic exploration on MDI’s own tenure and engagement with neighbouring companies to consolidate adjacent deposits.

The company’s exploration to date at the Sandstone project has been largely focused on the successful assessment of brownfields targets – such as the Two Mile Hill deposit – with the majority of greenfields targets remaining untested or inadequately tested. Accordingly, MDI is this year undertaking one of the largest gold drilling programs by a junior in Western Australia (comprising ~17,400m), in order to define additional open pit Mineral Resources at 14 gold deposits and targets at Sandstone.

MDI’s 100%-owned Sandstone gold project comprises 180 sq km and includes a fully-permitted, 600,000 tpa processing plant and all associated infrastructure on granted Mining Leases that pre-date Native Title. JORC 2004 & 2012 Indicated & Inferred Mineral Resources comprise 537,000oz of gold, with an underground Exploration Target of 900,000oz to 1.5Moz of gold. An updated Sandstone stand-alone PFS is expected to be completed during mid-2020.

Summary

MDI’s has surged from a low of $0.004 this month to a high during Tuesday’s trade of $0.012 (a trebling in price), before closing at $0.011.

Given the record A$ gold price and growing corporate activity within the Western Australian gold sector, it was inevitable that Sandstone once again came onto the corporate radar. MDI had itself tried last year to organize a merger with AME, which failed to pass the minimum 50% acceptance condition.

With China’s Shandong Goldsea Group becoming involved, there is perhaps potential for a regional corporate play, or possibly room for negotiation between MDI and Shandong if it is successful with its bid. We look forward to seeing how things play out.