We are currently experiencing a renewed wave of volatility in financial markets. The last 10 years overall has been a golden period for investors with all major asset classes posting strong returns. Until recently, share markets globally have seen a prolonged bull market post the Global Financial Crisis (GFC), rewarding investors with capital growth and healthy dividends – particularly from Australian shares. The 2020s look set to be more challenging for investors, with further ‘bumps in the road’ ahead.

Fixed income markets have also delivered solid returns from the coupons they pay, and from price gains driven by plunging bond yields. For retirees, it is record low-interest rates and bond yields that pose the biggest challenge to fund their retirement. The question is, how do Australian retirees produce income from their investments? We take a closer look at the current investment landscape and offer a simple solution for investors looking for yield.

10 Year Bond Yields

Source: Refinitiv Datastream, Russell Investments. As at 10 March 2020.

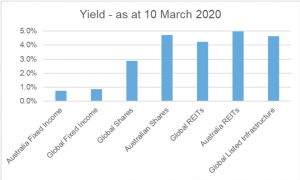

The chart above shows that back in 2010, shortly after the GFC and when Russell Investments launched their Australian ETF business – a 100% allocation to 10-year Australian government bonds would provide an investor with a relatively risk-free 5-6% of income. Fast forward to today, 10-year bonds are yielding less than 1%. To get the same income level today, investors need to invest 100% in high yielding equities or in less liquid asset classes such as property. Yields currently on offer from a variety of different asset classes are shown below:

Source: Refinitiv Datastream, FactSet, Russell Investments

Investors must now assume a much greater level of risk than they needed 10 years ago. Fixed income markets globally are yielding under 1%, only Australian shares, REITs or Listed Infrastructure can offer the kind of yields that are attractive for yield hungry investors. REITs and listed Infrastructure tend to behave like share markets in the medium term, which leads us to Australian shares. Whilst the S&P/ASX 200 is sitting on a yield of around 4.7%, high yielding Australian shares strategies are offering 6%+ – and that is before franking credits.

For a 0% taxed investor, a high yielding equity ETF like the Russell Investments High Dividend Australian Shares ETF (RDV) will offer a yield in the region of 8% (after franking). There are few investments that are so easy to access that can offer anything close to this. RDV will reach its’ 10th anniversary in May this year and has delivered a consistent 6% yield p.a. (before franking) since it was launched. An income investor that invested $1m at launch has received payments each quarter, and in total received dividends of $600k*. We take a more detailed look at a simple solution of how using RDV and a Term Deposit (TD) can help produce a steady stream of income.

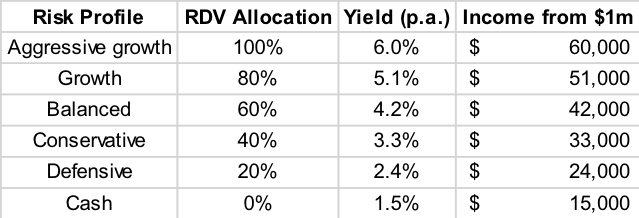

*Assumptions: Net of fees – RDV yield 6%, TD yield 1.5%

The above table shows a simple two asset portfolio of RDV and Cash (term deposit). With franking credits, RDV will offer higher yield than that shown in the table. Risk profiles are similar to those used for multi-asset portfolios within Superannuation. Australian shares offer an attractive solution for investors seeking yield – with the added boost from franking credits. However, investors need to consider such an investment to be medium to long term given the current market environment.

Australian Shares have rapidly moved from record highs into a bear market (post a 20%+ fall). A sustained period of heightened volatility looks likely during 2020 (and potentially beyond). Share markets have behaved in a relatively orderly fashion for the last decade, but we have moved to more disorderly daily movements recently.

For investors looking for medium to long term investment options, a sizeable allocation to a high yielding Australian Shares ETF like RDV may help deliver a consistent and healthy income that can help fund their retirement for years to come.