For the past month I have written about how the market recovery would be V-shaped and April ended with the US markets having their second-best month in history and the biggest gain since 1987. The market will now transition into what I call a “grind” where the underlying trajectory is still higher but it’s at a much slower pace. With time another bubble will emerge.

This is similar to the recovery in 2009 and certainly throughout 2013 when the market was supported by the final instalment of quantitative easing. As I continue to promote, the massive liquidity being injected by central banks and Governments around the world has to find a home somewhere. Bonds are unappealing (and the Fed is in the market now buying the junk) with little to negative return. So investors will be left with either cash or “other assets” to park their money – with the choice primarily precious metals, equities or property. Property is illiquid, precious metals are mixed with gold a long-term beneficiary with equities the logical place.

The best proof for this liquidity story is to compare the performance of the ASX200 vs S&P500. Or compare US indices with any other global index and the results show that US indices have outperformed all others. However, the US is the country which has incurred the highest number of Covid-19 cases so how does that make sense? Central bank liquidity, is the answer and those countries with smaller central bank action are experiencing more muted reactions.

It is important to note that the areas of the equity market that investors will be willing to park their in, is very different in a post Covid-19 world. As I discussed before the main beneficiaries will be those companies with strong balance sheets, global revenues and can survive an extended period of economic disruption.

Take for example now in Europe some banks have implemented negative interest rates for accounts with more than 100,000 Euros. So be charged to put your money in the bank or take it out and put it somewhere else. What would you be willing to buy? If it is indeed in the stock market and not under the mattress, then you would naturally buy something that is as close to as safe as in the bank as possible. Something like a Microsoft springs to mind immediately.

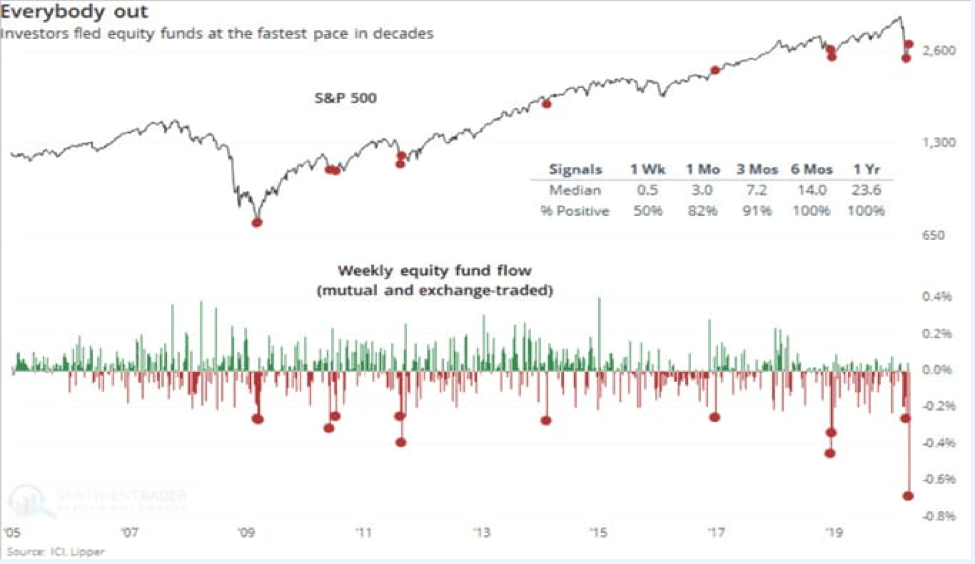

I showed two weeks ago the max exodus from equities that occurred during the equity collapse. I repeat it again below.

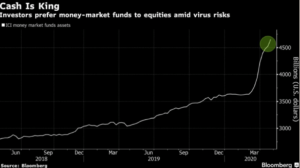

In conjunction with this max exodus and the continued redemption from equity funds in the past month (despite US indexes rising), money market funds or “cash” have risen sharply, hitting $4.7 trillion dollars, outstripping 2009 levels.

My interpretation of this is that much of this money will have an element of “FOMO” – a fear of missing out. A survey of by UBS Global Wealth Management of 4000 high net worth investors found that 61% want to see equities fall by another 5 to 20% before buying. That is, they want a second chance at buying “the dip”. They want those “bargains” again.

Markets never give investors that chance. Not with trillions of investor cash on the sidelines and a several trillion dollars of central bank liquidity.

Take a look at the post GFC recovery below in the S&P 500. Don’t be surprised if the markets just keep grinding their way higher, the short sellers get squeezed and investors start fearing they missed out. They certainly have missed out on “bargains”. That has passed with many Nasdaq listed stocks trading at fresh record highs.

Ask yourself, will it be that easy for markets to have another sell off to give those investors the chance to buy? History has shown it doesn’t .