Since the lows in the market I have been projecting a bullish view and pointing to the areas of the market which are likely to see an exceptional recovery and re-rating as the global economic shutdown triggers an evolution in investor action.

I have noted why the market would rebound and do so aggressively and furthermore pointed out which areas of the market – primarily the NASDAQ and tech heavyweights like Microsoft and Amazon would be the leaders in such a recovery. In fact, these stocks have experienced a resurgence.

This week I am here to push forward the view that this resurgence will evolve into one of the biggest bubbles in history. It is important that investors appreciate the changing dynamics and put aside the media headlines, employment stats and other negative data and understand the financial market consequences (not economic) that will result.

I think I have already made the case strongly enough as to why “tech” is the place to be and what psychological effect a fear of missing out does, so let’s not cover old ground.

Instead, let’s start with a blank sheet and ask – what do we want to see for a bubble to emerge? I will spoil the conclusion right now and say we have all the ingredients.

1) A Federal Reserve pumping trillions of dollars into the financial system. We definitely have that. On top of this we also have a Fed with a “whatever it takes” attitude.

2) A Government introducing trillion-dollar programs to stimulate an economy. Check. A new $3 trillion dollar package is also being debated as we speak.

3) Low interest rates.

4) Bad economic data. Think about it, you can’t improve on perfect. So when the economy is booming, at full employment etc, the likelihood of ever improving data points is lower and the potential for disappointment is higher. Instead, when coming out of a recession (especially a deep one) the news flow of improving data can be consistent and overwhelming. This has an ongoing positive effect on sentiment because the average person can see times are getting better.

5) Fear and a market that is short and skeptical. We definitely have that. I spent the last few weeks highlighting how this market position will see a consistent sea of buying support on any minor dips. Markets DO NOT peak on FEAR and uncertainty!

6) One sector that is outperforming all the others. Clearly we have that in technology. Not only are these business experiencing higher demand for their products and services (that includes biotechs) but this is now the place that investors feel most safe to park their capital. Balance sheets are strong and in the event of almost any worse case scenario they continue to operate.

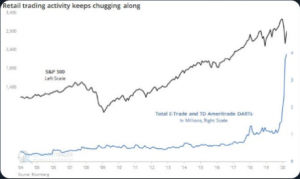

7) Retail investor interest spiking. During the sell-off in March one of the top three most Googled terms was “how to buy stocks”. Furthermore the chart below shows the spike in account openings which are off the scale. Ameritrade and Etrade saw over 600K accounts opened in the first quarter – one of the best quarters on record. Now these investors will lose their money eventually. But what occurs first is success. Beginners luck. The ease of making money in one sector generates a false sense of skill and this can last months and even a few of years. They mistake the markets gains for their own skill and eventually begin considering trading for a living. These stats were present at the peak in 2000, 2007 and we are seeing it again.

So the combination of all these seven factors point to a bubble forming. Trillions of dollars needing to find a home, primarily in one narrow field. The performance of technology companies reflects this already. But we are still in the early stages. The gains to come will be enormous and the opportunity to make a lot of money if you can look beyond the headlines and understand the complete dynamics of that is unfolding. #Investintech