Someone famously once said, “The best qualification of a prophet is to have a good memory.”

Accordingly, when trying to identify what’s going on in the resource sector, it’s always handy to have some grasp of history. If we revert back to the post-GFC environment, there are parallels with what we are seeing now. Back then, the aftermath of the GFC led to resource companies flourishing, driven by strong base metal and precious metal prices, as governments around the world flooded markets with stimulus.

Over recent months, junior resource companies in Australia have burst out of the blocks, propelled by robust investor support. The sector is undergoing a significant renaissance, which is allowing quality companies to flourish. Exciting grassroots discoveries are being made, companies are once again able to raise cash to fund their exploration activities, and share prices of many quality junior companies are surging.

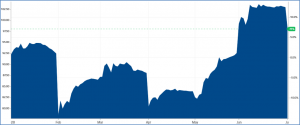

Markets Recover Strongly From March Lows

To get an idea of how well markets are performing, let’s take a look at some revealing graphics.

The first relates to the benchmark Australian junior resources index, which has seen a 60% resurgence since its March 2020 low. The Australian resource scene is heavily leveraged to iron ore and gold prices, both of which have excelled so far in 2020.

While Australia’s unbroken 29-year stretch of economic growth will be ended by the COVID-19 pandemic, the resource sector is proving to be key in cushioning the blow and likely ensuring Australia outperforms other developed economies.

The Australian government’s flagship resources report forecasts that earnings from exports of resources and energy will reach a record A$293 billion ($201 billion) in the recent fiscal year that ended on June 30. This will drop to A$263 billion in the 2020-21 fiscal year, according to the Department of Industry, Science, Energy and Resources.

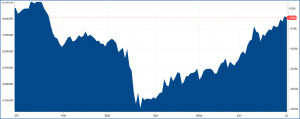

Figure 2: Spot Iron Ore Price

Now, while a 10% decline in export earnings from minerals and energy may seem like quite a blow, the report notes that earnings from exports will be 50% higher in real terms than during the 2008 global financial crisis (GFC). It is iron ore that is doing the bulk of the heavy lifting in keeping Australia’s resource exports buoyant, with the report forecasting export volumes of 852 million tonnes in 2019-20, rising to 893 million in 2020-21 and 912 million the following year.

The other stand out commodity for Australia is gold, with the government forecasting exports will rise to 418 tonnes in 2020-21 from 362 tonnes in 2019-20, with revenue jumping to A$32 billion from A$27 billion.

Figure 3: Spot Gold Price

And it’s not just Australia – the resurgent gold price in the face of money printing, trillions of dollars of stimulus, negative real interest rates and ongoing uncertainty about the ultimate scale and impact of the COVID-19 pandemic, has energised resource and commodity markets internationally. The following graphic charts the 30% recovery in the Dow Jones Commodity Index since its April 2020 low.

Figure 4: Dow Jones Commodity Index

Enhanced Access To Funding

What we are currently seeing is the emergence of investors that are prepared to back companies through the cycle, irrespective of what is happening with underlying commodity prices. Many of these are sophisticated investors. For a company that generates a world-class discovery, it doesn’t matter what the underlying price is, it’s going to be an outstanding, world-class deposit that will make money.

Furthermore, having access to cash is proving explorers with the financial security to explore ‘frontier’ areas and test new ideas. They can look at something that is a little bit left field perhaps, because they have the confidence of knowing they have the funds to do it. They can avoid the lower-risk, ‘nearology’ targets and really try and identify greenfields discoveries.

Furthermore, more major miners are increasingly teaming up with junior explorers through lucrative joint ventures. They are like the extension of a sophisticated investor, who can see which explorers have a really good chance of making a discovery. The bigger miners realise that it makes financial sense to team up with the juniors, who are typically a lot better at finding things, and provide them with the funds to go out into the field and explore.

Growing Numbers of Greenfields Discoveries

If we look at things in the context of the Australian resource market, it’s fair to say that there have been an extraordinary number of company-making, ‘frontier-type’ mineral discoveries over the past nine months. But are there common denominators between these situations?

In September 2019, small cap gold producer Alkane Resources (ASX: ALK) discovered a potentially massive porphyry gold-copper system in Central NSW. Later the same month, explorer Stavely Minerals (ASX: SVY) made a huge copper discovery at its namesake project in Victoria.

In December, Legend Mining (ASX: LEG) announced a ‘Nova-like’ nickel-copper intercept in Western Australia’s Fraser Range. For Pilbara province explorer De Grey (ASX: DEG), the first signs of a discovery at the Hemi prospect at Mallina emerged in December last year, but it wasn’t until early February, when thick, high-grade gold intercepts were returned from two zones, now known as Brolga and Aquila.

That same month Sky Metals (ASX: SKY) returned strong gold intercepts from maiden drilling at the Hume prospect in NSW. Then in March, Chalice Gold Mines (ASX: CHN) gave investors something unexpected to cheer about, hitting high-grade nickel-copper-palladium with the first-ever drill hole into the Julimar project, about 60km from Perth in Western Australia.

These new project discoveries have created a huge amount of value for these explorers and their shareholders. But the common denominator is that Boda, Hemi, Julimar and Thursday’s Gossan, are virgin discoveries in areas that have had limited exploration in the past. This is what generates market excitement.

Positive Commodity Outlook

If we examine three of the key commodities that are driving resource sector interest in Australia at the present time, we see solid market fundamentals.

Gold is benefitting from the growing concern that the COVID19 has been badly underestimated in terms of both its immediate and longer-term impacts on global economies. Along these lines, the irrational exuberance displayed by equity markets has been hard to fathom. Gold is also benefitting from the trillions of dollars of stimulus that is being fed into the economy by central banks, together with the likelihood of negative real interest rates in the US. It’s a double-whammy that’s enormously supportive for gold prices, which will likely push them to record highs. The next milestone for gold is the all-time record around $1920/oz.

Iron Ore at a current spot price around US$100 per tonne is well above the US$30 per tonne long-term average that the industry endured for many decades. As China, which buys about two-thirds of global seaborne iron ore supplies, has sought to ramp-up industrial production via government stimulus in order to boost domestic economic growth, its access to iron ore has been hamstrung by lower levels of output from Brazil, the world’s number two supplier, due to COVID-19. This has left Australian iron ore producers in the box seat.

Copper has rallied steadily, fuelled by sentiment over consumption prospects as first China and then other large economies began to ease lockdowns. While a new wave of infections adds risk to the demand outlook, the market is getting support from global economic stimulus and concern over mine shutdowns. I note Morgan Stanley estimates global mine-supply losses of 560,000 metric tons this year, with demand outstripping production amid mine and scrap-supply disruptions.

Figure 5: Spot Copper Price

Conclusion

The resource sector internationally is benefitting from renewed interest, driven by supply-side issues related to COVID-19 that have led to concerns over the amount of metal in warehouse inventories. Whilst, the production side will eventually recover, the growing number of cases worldwide (especially in major resource countries in South America) has put a major question mark – at least temporarily – over metal supply. This uncertainty, combined with resurgent China demand that’s being generated by government stimulus, has led to prices of most commodities bouncing strongly off their March lows.

The key in all of this is gold, which whilst having different supply-demand dynamics, has led the charge as far as the commodity space is concerned. There is no commodity like gold when it comes to generating interest in junior companies. Investors are excited by the prospect that the market circumstances that we are witnessing today, are strongly reminiscent of the GFC environment in 2008. The post-GFC environment proved to be enormously fruitful for gold, which hit record highs. Gold is once again set to be the torch-bearer for the junior resource sector over the coming years.