From being one of the most aggressive bulls in April I have moved to much more cautionary stance on financial markets as there are notable signals that suggest a steep and aggressive pullback could be in the offing.

Remember it is price that creates risk and not headlines. Risk comes from things being overvalued or undervalued and then need to re-adjust. For example, if Microsoft is priced at the same as its cash backing then it doesn’t matter what else is happening in the world, the risk of owning Microsoft is very low. Likewise, we could have the greatest headlines in the world but if its valuation is absolutely ludicrous then the price can fall. That’s why market’s bottom on bad news and peak on good news. So price is crucial and valuation is crucial not headline news.

That is why during the wave of panic and shocking headlines I suggested (and did) accumulate many stocks – particularly US Nasdaq companies like Microsoft – but am offloading them now. Rapidly.

Why? While I believe we are in the midst of biggest bubble in history, even during the 1999 tech wreck (for those of us old enough to have been there), had huge swings and sudden drops. Drops of 5-10% in a day were the norm for the Nasdaq back then, and it seems markets are ripe for one again.

Last month I highlighted how stupidly priced Flight Centre and Webjet were, with their market caps reaching levels greater than before Covid-19. Headlines about the economy opening up were positive but the supporting valuation was no there and subsequently they have plummeted since.

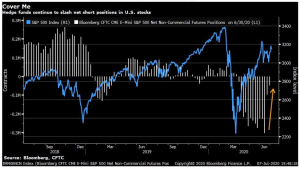

The signs of inherent risk that I am witnessing are several fold. Firstly, sentiment has drastically improved to the point where the huge S&P 500 short position in March was a sign that market views were extreme and that the path of least resistance was higher. Now these shorts are covering aggressively. Who is willing to buy stocks now at these levels when they weren’t prepared to 50% lower? Makes no sense. A clean out is needed. Look at the shorts covering during this squeeze higher. Traders that sold me their stock in March and April and now buying it off me here in June and July.

Second I am seeing more signs of risk off within other markets. I have repeatedly shown how bond yield movements have preceded large market sell offs. The February sell off is an example of this. US Treasury yields have started to dip again in the past 48 hours and look headed to retest their lows in March. This flight to safety is surfacing in some intra-day volatility in equity markets but is yet to evolve into a full blown sell off. This coming at a time when Covid-19 cases are rising aggressively and the speed at which the US (and the Australian) economy were opening has slowed.

Basis this and parabolic nature of many stocks, the inherent risk has built to be sufficiently high that a significant cash or short position is warranted. Add to this, the number of economically sensitive stocks that are testing support or breaking lower is noticeably increasing as well. Everything from IAG to BSL to Lend Lease to Transurban to Challenger all look troublesome. I know that when I find a lack of value and technically attractive setups, it is a time to be concerned.

Remember, cash is a position and now is a time to take profits and have higher levels of cash. And if you don’t have any profits to take because you are in cash, then now is not the time to begin deploying it. Buy dips and a decent dip could be just around the corner. Remember every 1,000 point fall starts first with a 10 point fall.