Investors Mutual Investment Director Anton Tagliaferro provides an update on the fund manager’s views on the state of and outlook for the sharemarket.

The unprecedented amount of government monetary and fiscal stimulus is making the medium-term outlook for the economy and sharemarket unclear. Major sectors such as tourism, hospitality, and entertainment are effectively currently on ‘life support’ from government intervention and the suspension of borrowing costs by their lenders. The sharemarket is likely to be more volatile in coming months, and the key issue is determining what the ‘new normal’ will look like following the anticipated reduction in stimulus and supports as we head into 2021.

While some commentators are predicting a sharp V-shaped recovery in the economy, IML believes that conditions are likely to remain challenging as various travel bans and lockdowns persist. In anticipation of a tougher 2021, many companies are also looking to reduce their labour costs and cut their capital expenditure, further reinforcing our view of positioning our portfolios defensively.

Throughout history, when ‘creative concepts’ have captured investors’ imagination, this has led to massive bubbles in various asset classes including the sharemarket. There seems no doubt that we are currently seeing some bubble-like conditions in certain parts of the sharemarket, such as in the ‘buy now pay later’ companies and the ‘medi-tech’ sector. Similar trends are being seen in many overseas sharemarkets. History has shown that sharemarket conditions can change very rapidly and quickly revert back to reality and fundamentals, so that an unglamorous packaging company can suddenly look much more attractive when investors assume a more realistic stance.

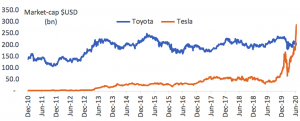

We can see this exuberance and irrationality in current sharemarkets when we look at the recent share price performance of Tesla and Toyota. As the graph shows, Tesla’s shares are now trading at close to double its pre-COVID price and its total value as measured by its market capitalisation has now climbed to well above that of Toyota, one of the largest and most profitable motor manufacturers in the world. This is despite Toyota’s revenues being more than 10 times higher than Tesla’s, while Toyota’s profits dwarf that of Tesla.

Source: Bloomberg as at 13 July 2020

Locally, the market-caps of the so-called ‘WAAAX’ stocks – WiseTech, Afterpay, Altium, Appen, and Xero – have also taken off despite the highly uncertain economic outlook. In our view, this is a clear sign that the sharemarket is getting overheated, and for investors to be particularly cautious about companies like these which have captured many investors’ imaginations.

This environment remains extremely challenging for value-style fund managers focusing on investing in companies with real and recurring earnings, a strong competitive advantage run by experienced and capable management teams and which have a proven ability to grow their earnings, rather than chasing market momentum and the latest fad.

However, we believe that after the current period of excessive valuations for sectors such as ‘buy now pay later’ and ‘medi-tech’ stocks abates, market conditions will eventually return to valuing companies on the basis of their fundamentals. In our next article, we’ll outline how we have positioned our listed investment company, QV Equities (ASX: QVE), in good quality, well-established industrial companies from a diverse range of sectors, which in the challenging economic environment ahead of us should enable the portfolio to perform well for shareholders.

Investors Mutual Limited AFSL 229988 (IML) has prepared this information, as the Investment manager for, and on behalf of, QV Equities Limited ACN 169 154 858 (QVE). This information has been prepared for the purposes of providing general information only and does not constitute personal financial product or investment advice as it does not take into account your investment objectives, taxation situation, financial situation or needs. An investor must not act on the basis of any matter contained in this article in making an investment decision but must make its own assessment of QVE, conduct its own investigations and analysis, and seek independent financial, taxation and legal advice. Past performance is not a reliable indicator of future performance.