The S&P ASX Resource 300 Index is currently trading at levels seen in early December 2019. This seemingly bland statement masks an intervening 8-months of incredible volatility. The 300 Resources have recovered 52% from the 23rd March lows. Yet our proprietary Australian producers’ Commodity Price Index priced in AUD has actually fallen 3.4% over the same period.

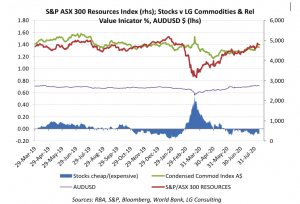

We have charted the Resource Index in Red below and that Commodity Price Index in Green. Stocks in March and April quickly anticipated commodity price falls that fell far more slowly. This created a super-attractive “cheapness signal” of stocks versus commodity prices – represented in blue shading. By Mid-May Australian Resource stocks were no-longer cheap relative to Commodity prices and is now trading somewhat expensive on the static version of the model.

While some commodities prices are riding high like gold and iron ore; others like coal, LNG and oil remain relatively depressed. This combined the Australian/US dollar exchange rate’s 25% lift since Mid-March to nearly 3% above the 2019 average – has created substantial AUD commodity price headwinds. A weak US dollar has been positive for stocks and commodities; however, it also points to economic weakness that ultimately influences aggregate demand and commodity pricing.

Conclusion – while price momentum in Resource stocks has been powerful and could continue, there appears to be a rising chance of market consolidation or pullback. Added caution usually means focussing upon areas of emerging relative commodity price strength or company specific drivers for maintaining/switching resource stocks exposure in the next couple of months.

NOTICE: This communication explicitly does not constitute a recommendation to trade any security. Investors should seek appropriate professional advice prior to trading any listed or unlisted security or asset. See further disclaimers below