There has been a proliferation of Environmental, Social and Governance (ESG) products hitting the market as product providers seek to meet the growing demand from asset owners and investors alike. Whilst more choice is good for consumers there is growing concern around ‘Greenwashing’ (overstating a product’s ESG credentials). How true to label are ESG investment products and what ‘shade of green’ are they? We will provide readers with a broad overview of what ESG investing is all about, how it has evolved and offer some guidance on how to navigate the current market.

ESG Investing

Thus far most ESG products have been equity funds which is the focus of this blog. ESG equity funds have fared relatively well so far in 2020, despite the market volatility.

Sustainable funds have seen solid inflows – Russell’s own Russell Investments Australian Responsible Investing ETF (RARI) and the Russell Investments Low Carbon Global Shares Fund have both benefited from this trend. Australian Ethical, an ‘active’ ESG manager, has also seen strong inflows as highlighted in a Morningstar report 1 along with Russell Investments.

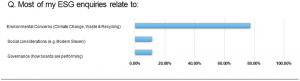

Russell has been running ESG equity strategies in Australia for the last 5 years. Russell’s RARI ETF hit this important milestone in April 2020 and Russell’s low carbon global equity strategy will do so in the next few months. There has been a significant pick-up in demand for these strategies with the bush fires without doubt being a catalyst for many. It is clear the ‘E’, or Environmental aspect of E, S & G investing is the biggest concern for most investors – a clear theme that has developed over the past couple of years. A recent ESG teach-in to advisers emphasises this point:

Source: Russell Investments

As part of the adviser teach-in we conducted, we also asked the question – ‘Has the interest

in ESG changed’? Over 40% of advisers suggested interest had exploded. ESG investing is here to stay.

ESG Solutions – Negative Tilts

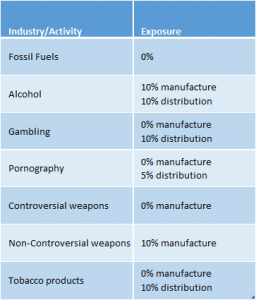

Typically, ESG products will have negative tilts or exclusions to ‘sin’ stocks and sectors. This approach is an important aspect for most of our ESG products. Some ESG clients prefer to use Russell Investments engagement process (proxy voting, active ownership and direct contact with the companies we invest in), rather than outright exclusions. This is an important part of our process for all equity funds that we manage. However, for RARI, in addition to our engagement activities we use the following set of rules to screen out Australian stocks:

Source: Russell Investments

RARI’s exclusion process is governed by Russell Investments Responsible Investment (RI) Committee – a separate group that meets semi-annually ahead of the index reconstitution (when the RARI portfolio is rebalanced to reflect the latest data). We have seen other ESG ETF launches in Australia adopt a similar RI Committee structure. The objective of RARI’s exclusions is to apply a broad set of widely held ESG beliefs in our exclusion process.

Hence, we exclude fossil fuels (Environmental) and addiction-based stocks (alcohol, gambling, tobacco) which provides a Social screen. This removes over 20% of the Australian share market by market cap. When comparing products, advisers and investors should be wary of ‘ex-tobacco’ products in Australian shares funds – this typically amounts to nothing as there are no Tobacco stocks listed on the ASX. Given that the RARI approach does remove a significant part of the Australian share investment universe, we apply a disciplined approach to how we positively tilt to stocks.

ESG Solutions – Positive Tilts

Most ESG strategies exclude stocks or at the very least use a negative tilt. Hence, an important part of the portfolio construction process is how these ‘underweights’ are re- invested. We use two positive tilt metrics for RARI:

1. ESG scores

2. Dividend yield (and franking credits)

When Russell Investments launched RARI in 2015 the demand was from low taxed investors – and thus we tilt to dividend yield looking through to the grossed-up dividend (including franking credits). This uses the same methodology as our high-income ETF, Russell Investments High Dividend Australian Shares ETF (RDV), which recently celebrated 10 years since launch. This methodology therefore suits many SMSF investors and those seeking income.

RARI also has a higher than average ESG score thanks to a positive tilt to ESG scores in the index methodology. This is where aspects of Governance, the ‘G’ in ESG, are captured in our approach. ESG scores also consider ‘E’ and ‘S’ factors too. ESG scoring has received plenty of criticism, not least due to the wide dispersion (low correlation) of ESG scores for stocks between different ESG scoring providers. We have partnered with Sustainalytics for our ESG metrics on companies and have recently developed our own ‘Material ESG Scores’ using this data for internally managed funds initially. Material ESG scores focus on the financial materiality of ESG attributes that are specific to each company with frameworks aligned with the Sustainability Accounting Standards Board (SASB). Results from these internal strategies have been very encouraging and we expect the RARI ESG scoring methodology to be updated accordingly. Methodologies for ESG scores will continue to evolve across product providers, and we will also see better ESG data developed for the scoring methodologies.

RARI’s ESG Credentials

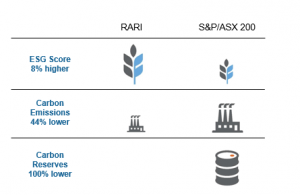

As a result of our index portfolio construction approach, RARI has the following attributes:

Source: Russell Investments, as at 31 July 2020

ESG scores are relatively harder to differentiate against, hence the modest improvement versus the broad market. However, RARI has much lower carbon emissions and has nil exposure to carbon reserves (which are companies that have fossil fuel assets [coal, oil & gas] in the ground and yet to be mined). We implemented a hard carbon reserves exclusion in March 2019 in an update to our fossil fuel screen. This reflected a desire from investors to have a ‘greener’ fund and RARI now has nil exposure to Energy stocks. Thus, RARI aligns well with the direction client demands have moved to as concern over climate change grows.

RARI is not the cheapest ESG ETF on the market, nor is it the most expensive. ETF fees continue to look attractive versus active managers but we do note that there are some very good active ESG specialists in Australia that develop excellent products for clients willing to pay higher fees. Investing during Covid-19 has challenged smart beta style strategies like RARI, as well as active managers, with dividends particularly difficult to source in the current environment. The outlook for yield stocks should become a little clearer during reporting season and our September blog will provide an update on this again.

We remain convinced that RARI offers investors a true to label ESG ETF which we are committed to evolving in the future. We also hope (and expect) to see the trend of assets shifting in to ESG funds continue. Finally, whilst dividends have been hard to come by recently, RARI investors can be assured that they are invested in a much more ‘environmentally friendly’ strategy than the broader Australian share market 2.

1 Morningstar – Global Sustainable Fund Flows Report, May 2020

2 RARI’s ESG Credentials chart within article, Russell Investments 31 July 2020