2020’s oil price weakness has its roots in the largely US shale-sourced production surge of 4.7mbb/day rise (or nearly half of Saudi’s entire production) in just 3½ years to 13.1m bbl/day a few months ago. This US secured the largest market-share and led to fraying of cartel cohesion of OPEC and its occasional non-OPEC allies, like Russia.

Previous production discipline that enabled a rebound in crude prices late 2017, was overturned in March 2020, just in time for the Covid-19 virus that undercut oil demand globally. This demand collapse saw producers and marketers scrambling for places to store excess oil. Meanwhile, OPEC and its allies re-pledged to output cuts. Lower prices led to an astonishing 73% fall in drilling in North America in the 5 months to early July, with US production sliding 18% to 10.7mbbl/day.

In reaction, the West Texas Intermediate Oil price marker that traded around US$65/bbl in late 2019 fell to sub-20/bbl in April. WTI has since recovered to above US$40/bbl since mid-June 2020.

But can the oil price rise continue? Inventory liquidation behaviour provides a clue as seen in Chart-1 below.

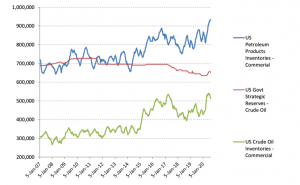

Chart 1: Private Commercial Inventories of US Products (like Gasoline) and Crude Oil, and the US Govt Strategic Crude Reserve

For oil prices to move materially higher, a reversal of above-mentioned market dynamic is required. Crucially, some removal of Covid-19 lockdowns is inspiring a building demand rise, but evidence of a virus second wave clouds the magnitude and timing of reclaiming lost oil demand. The modest demand rebound is however being captured by those liquidating inventories – happy to accept current prices (or instructed by their banks to do so?). In Chart-1 above (green line) shows falls in the US commercial stocks of crude oil inventories has been partly offset by a rise in commercial inventories of US products, like diesel & gasoline etc. The US Government’s emergency response made part of its Strategic Petroleum Reserve storage capacity available to the US private sector. As prices reached $40/bbl these commercial players are also gradually liquidating this temporary build in inventory (green line).

Magnified across the world, inventory liquidation can continue to dampen oil price upside until stronger demand arises, consolidating oil prices for at least a time.