The Australian June 30 earnings season wraps up today and tomorrow with mostly ‘rats and mice’ results (mostly losses) from the tiddler end of the market.

Friday saw a very solid result from the retailer, Harvey Norman (expected), and a big loss from building products group, Boral (also expected).

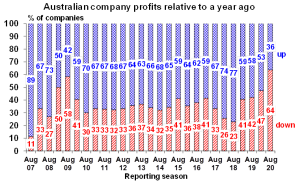

The AMP’s chief economist, Shane Oliver said in his latest summary of the earnings season that “despite the huge hit to earnings & dividends, corporate results were not as bad as feared and most companies appear to be quite resilient.”

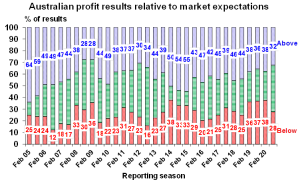

“Only 32% of results beat expectations compared to a norm of 44%, but beats outnumbered the 28% of companies that missed.

“This in turn saw 55% of companies’ share prices outperform the market on the day they reported. And its also enabled the share market to rise through August so far,” Dr. Oliver said.

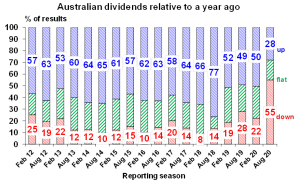

Around 55% of companies reporting cut dividends or dropped them. Some have not paid dividends for a while such as Seven West Media.

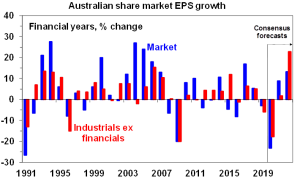

Dr. Oliver also pointed out that earnings growth expectations for the 2020-21 year are little changed at +8.9% but they have been revised up for resources and financials and down for industrials, particularly media, general industrials and utilities.

Source: AMP Capital