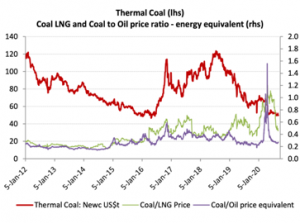

The latest coal price cycle started in early 2016 with Australian export thermal coal prices bottoming at US$45/tonne for delivery to ship at the mighty port of Newcastle. Tier-2 & 3 coal mines were being sold for a single dollar. A rebuilding of global growth momentum and delay in mine expansions saw thermal coal prices zoom to boom levels in excess of US$120/tonne by Sep 2018. This re-invigorated coal capacity expansion and coal prices have since gradually eroded to US$50/tonne, again evaporating industry profitability. To understand if coal is cheap, we need to understand key industry drivers.

Coal price’s downcycle has in part been driven by expanding renewable power generation and the huge rise in traded liquefied natural gas (LNG) that essentially took much of coal’s share of energy use’s growth. Since 2018, China’s growth overall slowed and was more domestically orientated (and less energy-intensive) leading to capacity oversupply of all energy types. Covid-19 has severely, though hopefully temporarily, pot-holed energy demand even more.

In Chart-1 we track the thermal coal price and its relative price per unit of energy compared to LNG (green line) and Brent Oil (purple line). We remained bearish on thermal coal earlier in 2020 as coal prices, relative to spot LNG, were trading at unprecedentedly high prices. While coal prices had retreated from cycle highs, LNG prices fell even more precipitously, ultimately collapsing 80% from US$10.15/MMBtu average in 2018 to the low $2’s. This was caused by rising LNG supply meeting tepid demand and customer storage capacity being maxed-out. This paralleled oil’s experience with handling excess inventory. In contrast, coal’s stockpile issues are less time-critical with slower, though still negative price reaction.

Chart-1 Australian Export Thermal Coal Price and its relative price to LNG and Oil

A partial recovery of demand and slowing US LNG exports have seen LNG prices double from its lows to around US$4.20/MMBtu. The thermal coal is once more price competitive with Spot LNG. Coal capacity is now being starved of capital and mine cutbacks and closures are mounting in producing nations, especially given the recent US-dollar weakness that relative to price, boosts AUD-dollar costs.

These conditions provide the makings of a thermal coal price revival, with perhaps the spark being a post-Covid-19 power-use surge. That demand rebound may be supported beyond 2020 as governments around the globe seek to boost growth via infrastructure spending and with it much more (coal-intensive to manufacture) cement.

With coal prices now cheap, coal producers hurting, and demand being kick-started – a new thermal coal price up-cycle appears to be drawing closer.

Sources: Bloomberg, World Bank, RBA