Oklo Resources – (ASX: OKU, Share Price: $0.29, Market Cap: $146m, coverage initiated @ $0.08 in Nov 2015 – current gain of 262%)

Key Catalyst

Final results from Seko 2020 resource definition drilling campaign highly successful in extending SK1 North – Koko trend to 3km, still only partially tested along strike and remains open at depth.

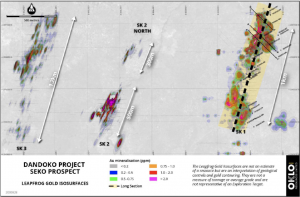

OKU has been an overall success story since our coverage initiation back in late 2015, with its share price at one stage hitting an all-time high of $0.50 during early 2018. Through extensive drilling activity, OKU has managed to identify extensive gold mineralisation over a 12km long corridor at its Dandoko project in Mali. Within the project, the Seko prospect has proven to be a particular highlight, with strike and depth extensions identified to the already-significant shallow oxide gold mineralisation. Seko comprises five coherent auger gold trends (SK1-5) with a combined strike length of ~7km. From a regional perspective, mineralisation is of a similar style to many other large deposits found nearby in western Mali. The recent 2020 field program has been focused on infill drilling and closing off previously identified areas of gold mineralisation at Seko and adjoining areas, in advance of the completion of a maiden Resource estimate.

Latest Activity

Seko Prospect Update

OKU has provided an exploration update with respect to its flagship Dandoko Project in west Mali, with the release of encouraging drilling results from its recently completed 2020 field season.

Overview

OKU has released final assay results from its 2020 resource definition drilling campaign at Seko, comprising results from the final nine diamond and 12 RC holes covering the 1km-long trend that hosts SK1 North, South and Central. Extensive gold anomalies have previously been outlined by auger drilling along the 12km long Dandoko gold corridor. The potential of this corridor to host large, gold-mineralised systems has been demonstrated by the drilling success at Seko and several other nearby prospect areas. Seko comprises five coherent auger gold trends (SK1-5) with a combined strike length of ~7km.

Results

SK1 North

As a reminder, the initial phase of drilling at SK1 North during late 2019 returned a spectacular intersection of 47m at 10.95g/t gold from 48m, with subsequent diamond drilling successful in confirming the down-dip continuity of the high-grade gold mineralisation.

Fast forward to OKU’s most recent results, where two deep diamond holes spaced 200m apart have successfully demonstrated the extension of the high-grade gold mineralisation, both at depth and along strike. The southern hole RDSK20-088 intersected 50m at 1.43g/t gold from 200m down-hole (including 21m at 2.20g/t gold from 229m); whilst hole RDSK20-089, located 200m to the north, intersected 23m at 2.57g/t gold from 219m down-hole (including 6m at 5.00g/t gold from 233m).

Both diamond intersections, hosted within oxide and transitional zone mineralisation, are highly significant and indicate an appreciable widening of the host structure. Further detailed drilling is planned to test for the potential emergence of south-plunging, high-grade shoots within the primary zone at depth.

SK1 Central to South

Assay results received from holes completed along the SK1 trend from SK1 Central to SK1 South have continued to test for an east-dipping control to the gold mineralisation, similar in style to SK1 North.

Within the Central zone, drilling intersected further zones of near-surface and deeper gold mineralisation. Significant intersections included: 33m at 0.50g/t gold from a down-hole depth of 44m in hole RCSK20-245; 5m at 1.34g/t gold from a down-hole depth of 25m (including 2m at 2.61g/t gold) and 10m at 1.48g/t gold from a down-hole depth of 123m (including 3m at 4.29g/t gold) in hole RCSK20-256.

Within the South zone, the results confirmed an easterly dip to the gold mineralisation that remains open at depth and along strike. Significant intersections included: 14m at 1.45g/t gold from a down-hole depth of 39m (including 5m at 3.03g/t gold) in hole RCSK20-248; 4m at 3.66g/t gold from a down-hole depth of 46m (including 1m at 8.15g/t gold) in hole RCSK20-246; 10m at 2.74g/t gold from 45m (including 6m at 4.30 g/t gold) and 5m at 1.11g/t from 66m gold in hole RCSK20-249.

Drilling is planned to continue both down-dip and along strike towards Koko, located 3km to the south.

Technical Significance

These final results from the company’s 2020 resource definition drilling campaign at the Seko prospect have been highly successful in extending the strike length of the SK1 North – Koko trend to 3km. At the same time, the trend remains only partially tested along strike and remains open at depth.

Field crews are scheduled to return to Seko during late September, following the conclusion of the current wet season. Drilling is scheduled to recommence shortly after, with OKU remaining on track to announce its maiden Mineral Resource estimate (MRE) during H2 2020. OKU remains well funded, with ~$20 million in working capital to complete the drilling, along with metallurgical test- work and early-stage scoping activities overseen by Lycopodium.

Figure 1: Drill plan showing Leapfrog gold isosurfaces from recent and previous drilling programs (air-core, RC and diamond) over Seko Anomalies SK1-5.

Summary

The most recent and final results from the company’s 2020 resource definition drilling campaign at the Seko prospect have been highly successful in extending the strike length of the SK1 North – Koko trend to 3km. At the same time, the trend remains only partially tested along strike and remains open at depth.

Field crews are scheduled to return to Seko during late September, following the conclusion of the current wet season. Drilling is scheduled to recommence shortly after, with OKU remaining on track to announce its maiden Mineral Resource estimate (MRE) during H2 2020. OKU remains well funded, with ~$20 million in working capital to complete the drilling, along with metallurgical test- work and early-stage scoping activities overseen by Lycopodium.

At the same time, Seko represents just one of numerous extensive gold mineralised alteration systems within the company’s Dandoko Project. Importantly, the mineralisation is similar in style to many other large deposits found nearby in western Mali, which augurs well for its attempts to outline a large, open-pittable gold deposit.