The COVID-19 pandemic has meaningfully hit most countries in the world, bringing with it a toll on human lives and livelihoods. As governments move to mitigate the public health crisis and support economies through monetary and fiscal policy, many are asking if governments will stimulate their economies with investments in infrastructure. While we expect some infrastructure investment as a means of stimulus, we expect it to focus on smaller projects aimed at increasing the money supply and getting money into various smaller communities and regional centers.

Yet, longer term, there are several positive drivers for infrastructure as an asset class. The need to lower carbon emissions is not going away; nor is the importance of upgrading and building new infrastructure to achieve lower emissions targets. And part of the world’s response to the pandemic, increasing the urgency of balancing stakeholders in business operations, also looks to be a positive for infrastructure’s outlook. Partly, this is because infrastructure companies are well-positioned to manage a balance of stakeholder and shareholder interests that is a key tenet of the corporate response to the pandemic. The tilt toward managing stakeholder interests has been accentuated by the crisis, as companies have found themselves needing to help employees, customers and the general public during difficult times.

Infrastructure companies have been balancing stakeholders and shareholder interests for a long time. A utility, for example, interacts closely with a regulator, which, as one of its key stakeholders, looks after the customers who are connected with the utility. The U.K. water space, for example, has grown to recognise the importance of customers as key stakeholders and to value its interaction with them accordingly. Some concession companies, like toll roads, have contracts or concession agreements with a government, which acts as a key stakeholder in almost all the company does. Infrastructure companies are uniquely positioned to manage the balance between stakeholders and shareholders and navigate risks that develop as investors and regulators seek more of this balance in the market. We expect many other corporations will look to the infrastructure sector to understand how best to undertake that going forward.

As of Sept. 15, 2019. Source: International poll: most expect to feel the impact of climate change, many think it will make us extinct, YouGov. Survey June 11 to July 22, 2019.

Green New Deals and the Momentum for Lowering Emissions

Globally, climate change is more and more registering as a critical concern. According to a 2019 survey by YouGov, a majority of people across many nations think it may cause severe economic damage and threaten the sustainability of cities (Exhibit 1). Opinions vary from region to region and can involve some drastic scenarios. Still, overall, we are starting to see some momentum build among the voting public for climate issues to be taken seriously by governments.

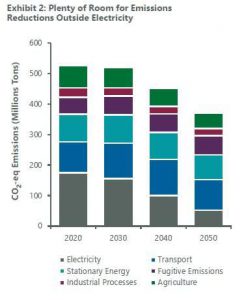

Taking climate change seriously will require substantial investment. In terms of what projects are currently being tackled and what will need to be tackled, we look at Australia as a case study. Under a business-as-usual emissions forecast, we see a considerable reduction in emissions. The decrease, which will be nowhere near net-zero by 2050, is mainly attributable to projected lower emissions in the electricity sector (Exhibit 2). Missing from this scenario, however, are the tremendous opportunities for reducing emissions in other sectors. To meet net-zero 2050, the world will have to invest in reducing emissions in infrastructure.

We expect a significant global push for a commitment to zero emissions by 2050. How will the world get there? More and more state entities are making commitments. Europe, in particular, has made a commitment to go green on electricity generation via renewables, EVs and energy conservation. The EU seeks to be net-zero by 2050, and recent fiscal stimulus includes many green initiatives. Across the U.S., seven states have committed to net-zero by 2050. Another four have committed to at least 50% renewable energy in their energy mix, and the pace of that development is increasing. In Australia, all states and territorial governments have committed to net-zero by 2050, even as the federal government continues to drag its heels.

Climate change initiatives focused around repairing and upgrading infrastructure around the building sector are compelling. The U.S. loses 7,000 Olympic size swimming pools of water every single day from leaking pipes and burst water mains. Bringing water infrastructure up to standard will require a massive amount of capital. Buildings will need to be made more efficient, and transport, manufacturing and agriculture sectors will also require significant investment.

Energetics, 2019. Under business as usual, which assumes no new policy measures nor economic disruptions, particularly through the rise of new technologies. The forecast includes the impact of the Victoria Renewable Energy Target and Queensland Renewable Energy Target. Excludes Waste & Land Use related (de minimis and largely offsetting). Stationary energy includes emissions from direct combustion of fuels mostly for heating and predominantly from the manufacturing, mining, residential and commercial sectors. Fugitive emissions are losses, leaks and other releases of methane to the atmosphere that are associated with industries producing natural gas, oil and coal. Industrial process emissions are the chemical by-products of the conversion of raw materials to various metal, mineral and chemicals (such as iron and steel, cement, fertilisers and explosives).

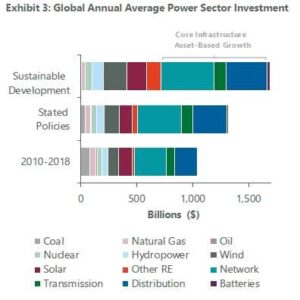

How much investment will be needed? The International Energy Agency produces an annual report on the projected amount of capital required in energy networks. The report focuses on two different cases: a baseline case, reflecting current stated public policies, and a sustainable case, which effectively accounts for spending required to lower emissions enough to keep with the UN’s climate change target of 1.5%–2% of warming. The report shows a baseline case of roughly $1.3 trillion needed to be spent annually on a global basis over the next 20 years and $1.7 trillion in the more sustainable case (Exhibit 3).

Much of this spending will be on networks, transmission and distribution and will be concerned with changing the way we use electricity and gas and other energy grids. This will mean growth in the underlying asset base for infrastructure companies and regulators, providing attractive returns to equity holders to help fund that growth. It is these areas, in particular, we think infrastructure investors should be most interested in and excited by.

COVID-19 Response Will Enhance Private Sector Role in Green Infrastructure

While public policy will play a significant role, we expect the world will rely on the private sector to fund many of these initiatives, in particular with user-pays and regulated infrastructure.

The policy response to the COVID-19 crisis, which has been to increase government borrowing as well as the size of central bank balance sheets, is reinforcing central banks’ accommodative stances developed over the past 18 months. The high level of borrowing by governments and the loading of assets on central bank balance sheets has helped lower long-term interest rates, and expectations should in our view, keep both low for a long period of time.

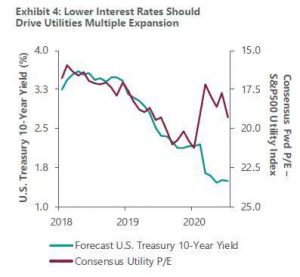

We can see the impact of a lower term premium on the financial markets, in particular utilities, by looking at the correlation between the sector’s next-twelve-month price/earnings (P/E) multiples and expectations of long‑term Treasury yields (Exhibit 4).

As of July 31, 2020. inverted). Source: Internal Calculations, Bloomberg Finance.

As the exhibit shows, the utilities P/E increased steadily as Treasury yield expectations declined (note the P/E axis is inverted). While the current environment has resulted in a material divergence (likely related to the market risk premium included in the cost of capital implied by the utilities P/E multiple), we believe this will reconnect, with Treasury yield expectations and next-twelve-month utilities P/E multiples moving higher; hence the 19x–21x peer group expectation. However, there is upside risk to utilities P/Es should the market begin to factor in an extended period of Federal Reserve quantitative easing and therefore lower bond yields for the foreseeable future. The upside scenario could result in utilities P/Es trading at 25x.

An inverse P/E ratio such as we show here also offers a form of earnings-based capitalisation rate similar to what one might find in the real estate sector. A falling utilities cap rate is important because it indicates that investors are requiring a lower return on equity or return on capital from utility companies. This means those companies will be better able to attract capital to spend on their networks to help effect some of the network adaptation and mitigation against climate change moving forward. We believe this will help utilities act as a critical element of the private sector lining up to help fund much of the spend the world will need on infrastructure to combat climate change.

Infrastructure Opportunity Will Not Be Uniform

A specialised knowledge of the infrastructure sector, with a rigorous approach to ESG analysis, will be necessary to manage risks and capitalise on opportunities as green infrastructure grows. The sector has very attractive tailwinds and attributes, but there are several risks that investors need to be mindful of.

The direction of public policy over time should have a large impact on the valuations of the underlying companies. New regulations may, for example, shorten the time natural gas spends as a bridge fuel — as the lowest GHG emitter of the fossil fuels and hence a bridge to a world where energy demand is met entirely by renewables. In such a case, pipelines will see less growth and lose value, resulting in potentially stranded — obsolete and unprofitable — assets. This is an issue we have done a lot of work to understand since it will likely entail relative value opportunities in which companies running trunk or mainline pipes will fare better than those with smaller lateral systems. As such, we believe it will be helpful to be in the listed infrastructure space where capital can be allocated more nimbly.

A corollary insight might apply to toll roads, where the growth of autonomous vehicles, rather than requiring many new roads to be built or stranding existing roads, will markedly increase capacity on existing roads, increasing their value.

For new infrastructure that will need to be built, it is important to differentiate between greenfield and brownfield expansion. Greenfield expansion (building completely new assets) bears a greater risk than brownfield expansion (building extensions onto existing assets); the riskiest part of greenfield expansion is whether demand and use of the asset will materialise once it is built. The distinction suggests to us a preference for listed infrastructure over unlisted, given the listed players are generally the incumbents and more given to less risky brownfield expansion.

In the listed markets, there is some volatility from time to time, as we have seen through the COVID-19 pandemic. But over the long term, the returns allowed by the regulators have come through in the returns reported by the companies and the returns received by investors. This gives us, as investors, confidence that as a bow-wave of investment into infrastructure to support climate change initiatives grows, we will see appropriate returns for shareholders.