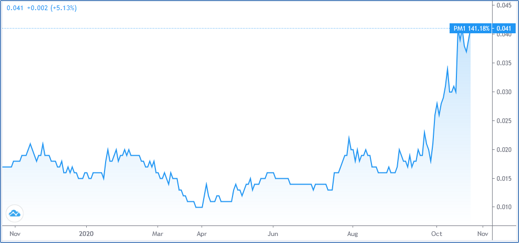

Pure Minerals – (ASX: PM1, Share Price: $0.041, Market Cap: $29m, coverage initiated @ $0.038 in October 2020).

Key Catalyst

Non-binding Memorandum of Understanding (MOU) with South Korea’s LG Chem – the world’s top EV battery maker – for the supply of nickel and cobalt from the company’s TECH Project.

We have introduced PM1 to our coverage universe after following the company’s progress for the past 12 months. The rationale for coverage is the company’s exposure to nickel for use in high-tech applications such as new-age batteries for use in electric vehicles. Through its 100%-owned subsidiary, Queensland Pacific Metals Pty Ltd (QPM), PM1 is focused on the development of a modern battery metals refinery in northern Queensland. The refinery, dubbed the Townsville Energy Chemicals Hub (or TECH), will process imported, high-grade nickel-cobalt laterite ore from New Caledonia to produce nickel sulphate, cobalt sulphate and other valuable co-products. The company’s senior management has more than 60 years’ of combined experience in nickel refinery operations, and is well versed in dealing with nickel and cobalt buyers around the world. The MOU with LG Chem is a major vote of confidence in the TECH project.

Latest Activity

TECH Project Corporate Update

PM1 has provided an update with respect to its TECH project at Townsville in northern Queensland, with the announcement of an MOU for a binding offtake agreement with South Korea’s LG Chem.

Overview

LG Chem is seeking to purchase up to 10,000t of contained nickel and approximately 1,000t of contained cobalt from the TECH Project. LG Chem’s demand exceeds the plant size in QPM’s Pre-Feasibility Study (PFS), so QPM will investigate with LG Chem the potential to increase the size of the TECH plant.

PM1 and LG Chem have agreed to negotiate in good faith to enter into a binding offtake agreement for nickel and cobalt, with LG Chem giving due consideration to assist in financing by way of a prepayment. LG Chem is the largest Korean diversified chemical company and is a major manufacturer of lithium ion batteries for the electric vehicle (EV) and other markets.

Details

Under the MOU, LG Chem is seeking to purchase up to 10,000t of contained nickel and approximately 1,000t of contained cobalt from the TECH Project. LG Chem is seeking to purchase this in a combination of mixed hydroxide precipitate (MHP) and final battery chemical sulfate forms.

The previously-completed PFS for the TECH Project considered a project that would produce ~6,000t contained nickel (~26,000t nickel sulfate) and ~650t contained cobalt (~3,000t cobalt sulfate). As part of the MOU, PM1 and LG Chem have therefore agreed to work together to evaluate the potential to increase the scale of the TECH Project to meet the greater demand of LG Chem. This will include consideration of financial outcomes, funding potential and other key measures.

A larger-scale TECH Project would offer a number of significant benefits including: a reduction in capital intensity for nickel production; more favourable project economics due to lower unit costs (economies of scale) and increased revenue; and an increase in QPM’s presence as a potential supplier of battery chemicals.

To ensure PM1 is producing products that meet the requirements of LG Chem, both parties have agreed to work together – including the provision of LG Chem specification requirements, and testing by LG Chem of product samples produced in QPM’s upcoming pilot plant activities.

Ultimately, as part of the MOU, PM1 and LG Chem have agreed to negotiate in good faith to enter into a binding offtake agreement for the purchase of nickel and cobalt by LG Chem from the TECH Project. The initial term of the offtake agreement will be for 3 to 5 years. LG Chem will also give due consideration to assist in financing of the TECH Project by way of a prepayment. The term of the MOU is for 24 months, unless extended by mutual consent.

Technical Significance

The MOU with LG Chem is effectively a tremendous vote of confidence in the TECH Project – as LG Chem is the world’s top electric vehicle (EV) battery maker – and is positioned to become a customer and partner of the project. The South Korean company currently supplies batteries from its Nanjing, China, factory for Model 3 vehicles built at Tesla’s Shanghai plant.

Just last week, LG Chem Chief Executive Officer, Hak Cheol Shin, outlined in a Reuters interview that the company was in talks with motor vehicle manufacturers to create joint ventures to produce automotive batteries. LG Chem is already moving ahead with battery joint ventures with General Motors and China’s Geely Automotive Group, and it hopes to expand to other car makers, according to Shin.

LG Chem is also looking for a site to build a new factory in Europe, as it plans to more than double its global car battery capacity to 260 gigawatt hours (GWh) by 2023, from 120 GWh this year.

With respect to the TECH Project, when PM1 was originally sizing the project, its aim was to deliver the smallest commercially-sized project that would be economically viable and fundable. With LG Chem’s involvement, there is now potential to scale up the size of the TECH Project to one which offers even more attractive capital efficiency. Once the plant size is finalised, PM1 will be able to formally commence Bankable Feasibility Study and project approvals – both very significant milestones to come.

Project Overview

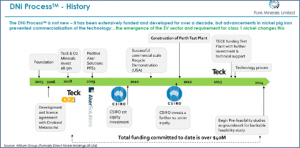

PM1’s TECH Project will produce battery-specialty metals – primarily nickel, cobalt and high purity alumina (HPA). QPM has entered into a framework agreement with Direct Nickel Projects Pty Limited announced during October 2018, to allow QPM to use its patented DNi ProcessTM to extract nickel and cobalt from laterite ore imported from New Caledonia. The DNi ProcessTM has significant cost and environmental advantages over the HPAL process that many laterite nickel producers use.

The TECH Project will be located in the Lansdown Industrial Precinct, a newly-zoned industrial area just south of Townsville in Queensland. A block within this area has been conditionally allocated to the TECH Project. The project location is ideal for the TECH Project and is well supported by existing infrastructure.

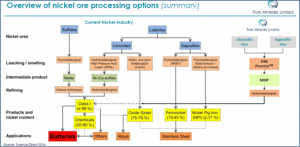

The graphic below highlights the difference between PM1’s approach compared with the traditional sulphide and laterite nickel producers in the industry. Essentially, PM1 will produce entirely battery-grade nickel for use in high-end applications. Most production from typical nickel production goes into stainless steel production, because of its inability to measure up to the stringent quality specifications required in the battery industry.

The project has a similar capital intensity (~US$58,000/tpa nickel capacity) to competing HPAL nickel projects, but its entry level cost of A$513M is just 15% the HPAL entry-level cost. Of course, funding of such a capital spend will require a major offtake partner to buy into the project – and this is where the just-announced deal with LG Chem is so important.

Because the project is designed to produce specialty chemicals for sale directly to battery makers, and has eco-friendly credentials, it is always been much more likely to attract a strategic partner from the battery or automobile manufacturing sector than would an HPAL.

Summary

I believe PM1 is a useful addition to our coverage at a time when end-users are looking for high-quality, environmentally-friendly sources of nickel for use in high-tech batteries. The company will utilize an existing technology that will allow it to produce high-quality nickel solely for use in the battery industry. Importantly, the arrival of LG Chem as a potential offtake partner and investor is a huge vote of confidence in the company’s ambitions.