by Matt Peron and Andy Acker, CFA

This week – less than a year after the COVID-19 coronavirus first emerged – biopharma companies Pfizer and BioNTech announced that their novel vaccine candidate for COVID-19 was more than 90% effective in preventing the deadly disease in a late-stage clinical trial. Although the data are preliminary, the results were better than expected and ignite new optimism about economic growth in 2021, a sentiment we increasingly share.

The significance of 90%

This is the first data readout of nearly a dozen large-scale clinical trials for COVID-19 vaccines. To put it simply, the outcome was highly encouraging. Consensus expectations had forecast the efficacy rate for the vaccine, currently known as BNT162b2, at between 60% to 70%. If the 90% efficacy rate continues to hold for the remainder of the trial, it would put the drug’s effectiveness on par with the measle’s vaccine and well above that of flu shots (on average 50% effective). In addition, although safety data were not made available, Pfizer noted that among the more than 43,500 people currently participating in the global trial, no serious safety concerns have been observed so far.

What comes next

To be sure, these numbers could change as more data come in. The results were based on 94 patients with confirmed symptomatic cases of COVID-19 (patients received two doses of either the vaccine or a placebo over three weeks, with protection achieved 28 days after the initial dose). The companies say the trial will continue until 164 cases are reached. In the meantime, Pfizer and BioNTech can apply for emergency-use authorization from the U.S. Food and Drug administration (FDA) after accumulating a median of two months of safety data, a goal that is on track to be reached by the third week of November. With the FDA expecting a vaccine to have at least 50% efficacy, we think Pfizer and BioNTech have now given themselves a comfortable margin for potential approval.

A good day for biopharma innovation and collaboration

BNT162b2 is based on a novel approach to drug development called messenger ribonucleic acid (mRNA) technology, which essentially instructs the body to make proteins to fight disease. In the case of COVID-19, BNT162b2 carries the blueprints for building a protein spike that SARS-CoV-2 (the virus that causes COVID-19) uses to enter host cells, prompting an immune system response. Thus far, no mRNA-based therapies, including for other indications such as cancer, have been granted regulatory approval. Should Pfizer and BioNTech’s effort be successful, it would be remarkable not only for proving that the technology works, but also in light of the timeline: BNT162b2 will have been developed and approved for emergency use in less than a year, while historically vaccines have taken 10 years or longer to come to market.

Furthermore, the drug’s development has been the product of a unique collaboration. BioNTech, a German biotech, designed the drug’s architecture but lacked the resources to execute a global clinical trial. Thus, earlier this year, BioNTech reached out to pharma giant Pfizer, which agreed to help. Critically, Pfizer has also led the scale-up of manufacturing and distribution capabilities. mRNA therapy poses a unique challenge as it must be transported and stored at extremely low temperatures to remain viable. Investing billions of dollars, Pfizer devised shipping containers with reusable GPS temperature sensors and specialized freezers that can store vials for up to six months. Thus, based on current projections, Pfizer and BioNTech are on track to produce 50 million doses by the end of 2020 (covering 25 million people) and up to 1.3 billion doses in 2021 (covering 650 million people), another remarkable feat.

A new day for global markets

Plenty of unknowns remain about BNT162b2’s ability to help end the global pandemic. The FDA, for one, must ensure Pfizer and BioNTech can manufacture vaccine doses safely and consistently. Further research is needed to confirm the efficacy and durability of the treatment, particularly among different age groups, as well as whether the shot will prevent serious infections and reduce subsequent hospitalizations and death. Emergency-use authorization would allow the vaccine to be administered initially to critical populations, such as frontline health care workers, with the earliest vaccinations potentially starting by the end of the year. Meanwhile, the pandemic is accelerating, with deaths from the virus topping 1.2 million globally and many countries in Europe and the U.S. reporting new daily cases hitting records.

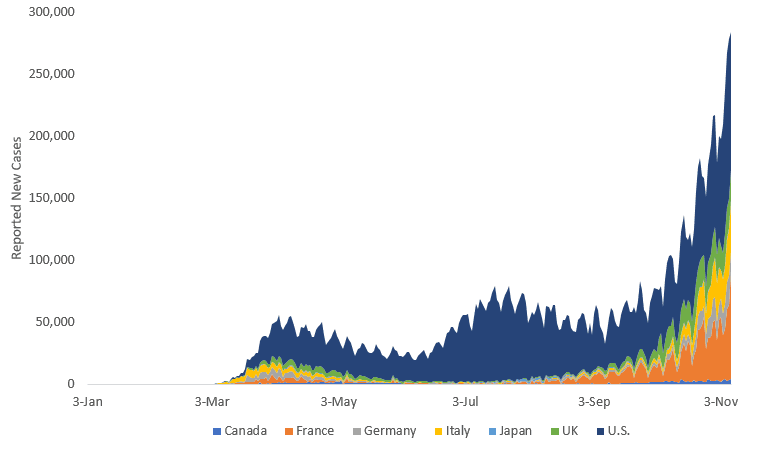

COVID-19 cases surge

Positive vaccine news comes at a critical time, with more than 50 million confirmed cases globally and the number of new cases across G7 countries accelerating rapidly.

Source: World Health Organization. Data from 3 January 2020 to 8 November 2020. Chart shows cumulative new cases by date and country contribution to total. The Group of Seven (G7) is an informal bloc of seven major industrialized nations: Canada, France, Germany, Italy, Japan, the United Kingdom and the United States.

Even so, equity markets soared after the trial results were announced, with the Dow Jones Industrial Average and S&P 500® Index hitting record highs, led by industries that have been hurt the most by the pandemic, such as travel and energy. Indeed, in the last 48 hours, the outlook for risk assets has turned markedly more positive, thanks not only to vaccine news but also the conclusion of the U.S. presidential election (with the potential for a divided U.S. government to result in moderate policy changes). Both events could lead to improved economic growth in 2021, the return of investor confidence and positive net flows into risk assets.

Importantly, it could also result in the broadening of market gains. Throughout 2020, outperformance has been largely concentrated in companies with high growth rates that offered digital solutions for a socially distant world. Should a vaccine help restore “normalcy” to the global economy, we would expect that narrowness to finally widen out.

Volatility is not out of the picture, particularly if more economies must go into lockdown near term as we await the global distribution of a vaccine. But the news from Pfizer and BioNTech raises hope that a solution may be on the horizon and that other vaccines targeting the same SARS-CoV-2 protein – including a second mRNA therapy from Moderna – may be successful. The approval of multiple vaccines is viewed as critical to quickly and effectively protecting the world’s population, with important implications for the global economy. What’s more, mRNA platforms, by their nature, could be readily modified to address new versions of the virus in the future, should that become necessary.

The typical market cycle (from the bottom of a bear market to the top of bull market) lasts roughly five years. The COVID-19 pandemic brought an abrupt end to the last bull market in March. This week’s news could mark an important step on the path to a new one.