by Mark Hawtin, Investment Director

We believe the best time to invest in disruptive trends is when companies have essentially won the war but investors are still sceptical. Such was the case with Amazon and Facebook 10 years ago. Everyone now owns these names and while we also remain positive on their prospects, we are focused far more on the next generation of winners. The Q3 earnings reports from these ‘big tech’ companies led to share price declines and perhaps reflect the acceptance of the positioning in these names; they are widely owned and therefore it is harder for shares to continue to appreciate in spite of continuing growth because of a combination of the law of large numbers and over-ownership.

We have previously laid out the case for the next wave of innovation, Digital 4.0, focusing on the huge opportunity in edge computing; 5G, the Internet of Things (IoT), big data and AI, the life blood of the next wave. New investment focal points such as healthcare, the automation of knowledge work, industrials and transportation benefit from these technologies. We remain convinced that these themes will possibly see greater growth than the now incumbent mega-cap names over the next decade. With the increased potential for regulation of large-cap tech and the fight over consumer privacy we see this subset of names as remaining subdued on a relative basis for a while.

At the end of October we saw Q3 earnings reports from Apple, Amazon, Google and Facebook, which to our mind act as clear evidence for these conclusions. Three of the four names immediately traded down with Google alone rising 7%. This is a clear case of it being better to travel than arrive [financial markets price in future events] with the market finally taking stock of the extraordinary year-to-date moves and pausing for breath. Year-to-date, Amazon leads the pack up 78% while Apple is up 58% (as at the end of October). Ad tech names Facebook and Google have not done as well but are still up 38% and 19% respectively.

The overriding message was one of digital trend acceleration, much of which we have talked about extensively in terms of the opportunity. This is well summarised by the Microsoft CEO, Satya Nadella, who commented on their earnings call earlier in the week: “The next decade of economic performance for every business will be defined by the speed of their digital transformation”. We have been banging the drum on this message for some time now – Covid-19 has just accentuated and accelerated that necessity.

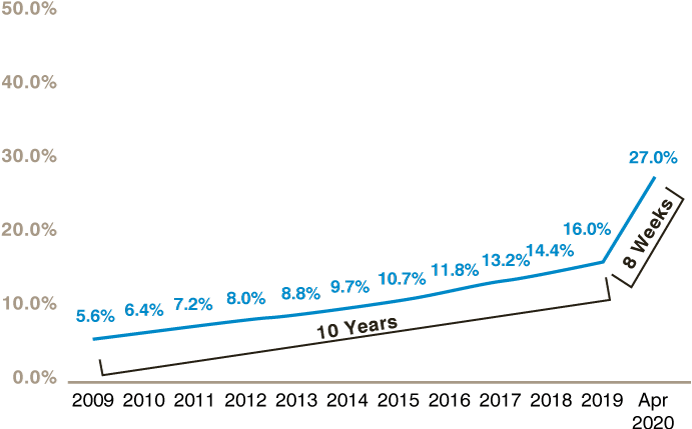

Sheryl Sandberg on the Facebook earnings call talked about how Facebook had been a lifeline for businesses struggling to survive in a Covid-19 world. She gave examples of small and medium-sized businesses that had thrived on the use of Facebook as a platform for facing the customer world. She also commented on the trend from offline to online that had been increasing by about 1% per year for e-commerce until Covid-19 and then jumped 4%in just 100 days – four years of change in three months. The chart below from Bank of America and the US Department of Commerce suggests a huge spike in online market share. This plays into the heart of the ad tech thesis and it is why both Facebook and Google reported Q3 revenue growth that was well ahead of expectations.

Chart 1: US E-commerce Penetration (% of Retail Sales)

Facebook reported revenues grew 20% in the quarter and that the Q4 forecast was for a further acceleration; again ahead of market expectations. The bounce back in growth has been impressive. Google reported 15% growth driven especially by a 32% year-on-year revenue jump at YouTube. It also pointed out on the earnings call that the pandemic had driven a sharp increase in paid YouTube usage. The same message was evident from Amazon on Amazon Prime subscriptions. However much we factor in a one-off Covid-19 jump for the digital world, it is clear that the inexorable trend to digitalising economies has taken a multi-year step in just a few months; much of that is permanent and will not be given back post-Covid-19.

Google notably broke out its cloud revenues for the first time. At USD 14 billion annualised, this is higher than we had expected and puts it in a respectable third place behind Microsoft with an approximate USD 24 billion cloud run-rate. AWS leads by a clear margin at almost USD 50 billion. Together these three are still less than USD 100 billion combined so the opportunity for cloud infrastructure is still huge in our view. Of the USD 4 trillion spent globally on IT every year about 25% or USD 1 trillion can be attributable to infrastructure, potentially addressable by the cloud.

Important legal information

The information in this document is given for information purposes only and does not qualify as investment advice. Opinions and assessments contained in this document may change and reflect the point of view of GAM in the current economic environment. No liability shall be accepted for the accuracy and completeness of the information. Past performance is no indicator for the current or future development. The mentioned financial instruments are provided for illustrative purposes only and shall not be considered as a direct offering, investment recommendation or investment advice. For more information, please visit www.gam.com