With massive fiscal and monetary stimulus now in place, some are now contemplating whether the knock-on effects will be the long-awaited return of inflation.

And rightly so.

We have been inflation bears for some time. However, the sheer scale of fiscal intervention in 2020 does raise the inflation stakes – and therefore even interest rates. So maybe it’s time to re-examine the relationship between interest rates and REITs.

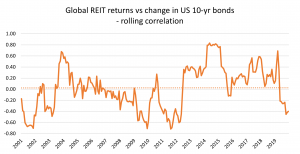

In the past, we regularly cited our analysis showing no long-term correlation between bond yields and REIT returns. The past year has been a big ride to say the least – but considering negative REIT returns despite new lows in global interest rates, we have decided to update our analysis.

Index: FTSE/EPRA NAREIT Developed Total Return Index (AUD) Source: Bloomberg, Quay Global Investors

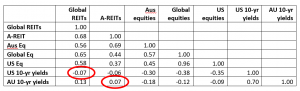

The chart above graphs the correlation of 12-month rolling monthly returns of the Global REIT index versus the change in US 10-year bond yields over the same period. A positive correlation means lower bond yields and higher REIT prices. A negative correlation is the opposite. We believe the chart speaks for itself, with no correlation between REIT returns and bond yields over the long term, despite periods of positive and negative correlation. The results appear consistent with different asset classes – the A-REIT sector also has no correlation with Australian 10-year yields over time. The correlation matrix below highlights other cross correlations of note.

Source: Bloomberg, Quay Global Investors Persisting perceptions Source: Bloomberg, Quay Global Investors

We believe the perception that interest rates influence REIT returns is grounded in two assumptions.

The first is the assumed impact interest rates have on real estate ‘cap rates’. Falling interest rates mean lower required returns: ergo, cap rates for real estate portfolios in the private market fall, leading to higher real estate capital values.

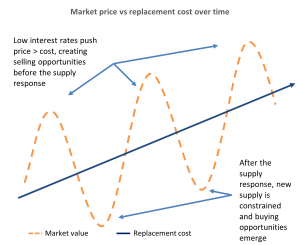

The problem with this idea is that a real estate cap rate is a proxy for ‘real returns’, and therefore more likely to be impacted by a change in real interest rates. Being mostly a commodity, real estate over the medium to long term is driven by the marginal cost of supply. However, the price signal prompts real estate developers to begin supplying the market with new real estate until the point where it is not profitable for them. This increase in supply lowers real estate prices, and this remains the case until supply becomes constrained and capital values begin to recover. We have stylised this market dynamic in the chart below.

Source: Quay Global Investors

The example above is based on an individual asset or portfolio of similar assets. This leads us to the second assumption behind the perception that interest rates influence REIT returns – that listed real estate is simply a composite of static portfolios, with long-dated leases and fixed rental growth.

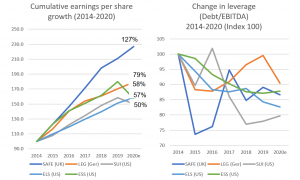

We know this isn’t the case; our investees are real estate businesses, run by management teams with in-place strategies, managing operating and financial leverage. This means their earnings profiles don’t comply with such a stable, low-growth assumption. And it means most portfolios hardly remain the same. Through a combination of growing portfolios, capital management and leverage, REITs can grow earnings far beyond inflation. We have graphed cumulative earnings growth and changes in leverage for a select number of our investees below.

Source: Company reports, Quay Global Investors

E comes before P

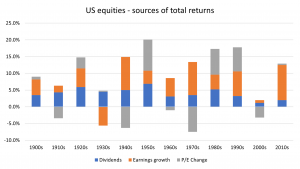

All in all, the best explanation of returns come down to earnings – as it is the source of the initial dividend and it is earnings growth that drives returns. The chart below breaks down equity total returns over the past 120 years between dividend yield, earnings growth and multiple re-rate. The result is interesting.

Data through to 30 September 2019 Source: Ben Carlson, Jack Bogle

It is interesting to note that the past 20 years, when interest rates have mostly declined and central banks have employed significant levels of quantitative easing, PE change has not accounted for much total return at all. Rather, earnings growth and dividend yield has accounted for the lion’s share of returns over the past twenty, fifty, hundred years. In equities – and in REITs, no less – the key to explaining returns lies in company earnings.

Conclusion

As markets continue to navigate the risks of COVID and a potential vaccine, investors are rightly beginning to focus on the risks associated with the massive stimulus put in place during 2020. One of these risks is inflation and the potential for higher interest rates.

But, despite a long-held belief that interest rates influence REIT total returns, there has been a total breakdown in the correlation between REITs and the US 10-year bond yield this year. While there are indeed short periods where correlation is high, over the long term there is no relationship between REIT returns and interest rates.

At Quay, we have found replacement cost and earnings growth have explained REIT returns far better. This makes sense, given REITs are nothing more than real estate businesses operating in a commodity market. With this in mind, we believe it is a better use of REIT investors’ time forming a view on earnings, rather than interest rates. While we have top-down opinions, it is our bottom-up research process that matters.