When investors choose to invest internationally, they also need to consider the implications of movements in the Australian dollar relative to the associated foreign currency exposure.

As a baseline, investors that think the Australian dollar is likely to increase should currency hedge and those that are bearish should remain unhedged.

To form a decision, investors should consider the following points.

Investment time horizon

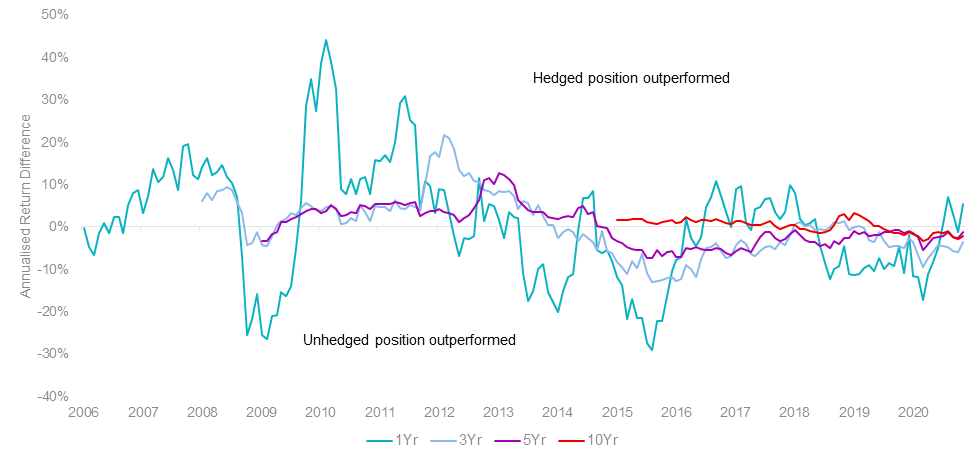

Investment return differences between currency hedged and unhedged equity exposure are more volatile over shorter periods. It may be tempting to try to influence returns by timing the exposure to a currency but there is material downside risk over the short term if the outcome is different to expected. Over the long term, differences between currency hedged and unhedged returns diminish. The graph below illustrates differences between AUD currency hedged and unhedged annualised returns for US exposure represented by S&P 500 over various periods.

Figure 1 – Rolling S&P 500 AUD hedged less unhedged annualised returns

Timing the entry and exit point

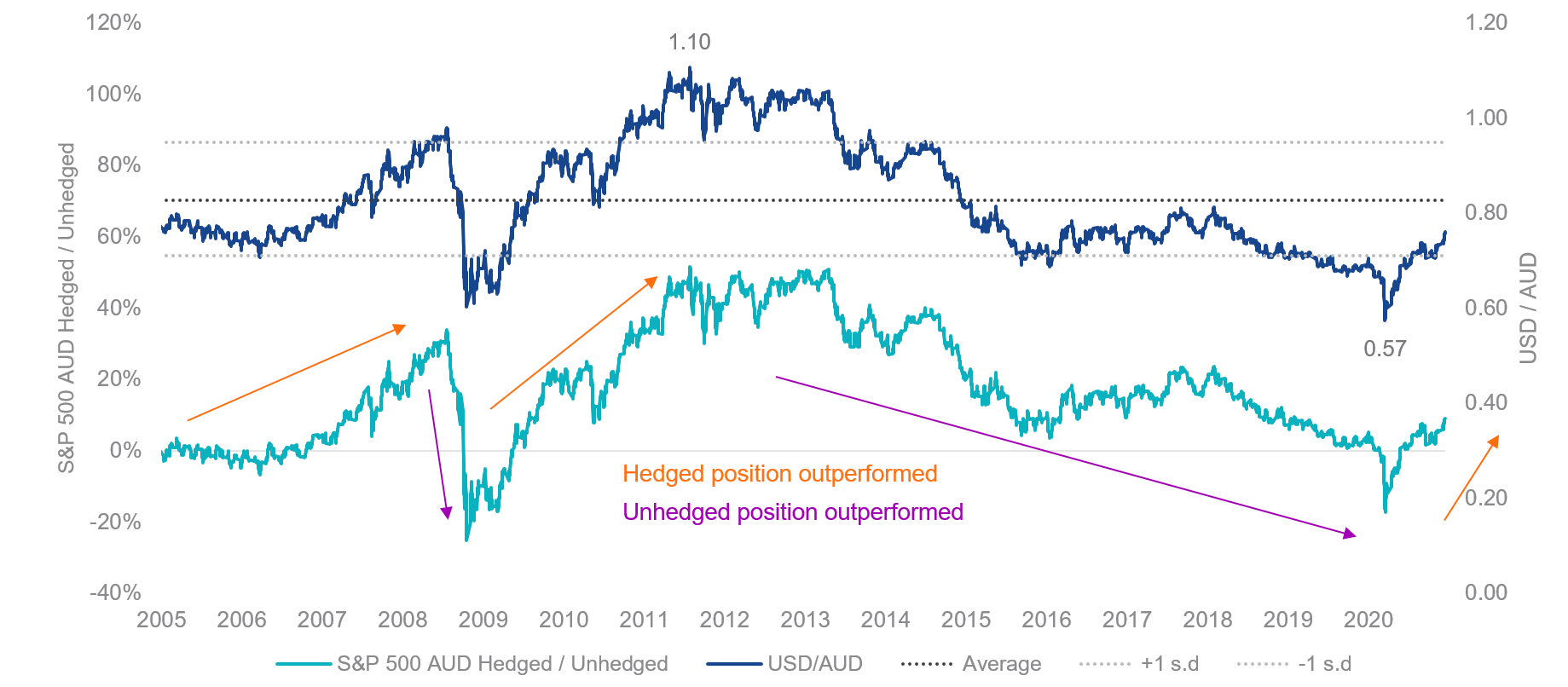

The Australian dollar has oscillated between 0.57 and 1.10 US dollars over the last 15 years. When deciding whether to currency hedge or not it is important to consider where you think AUD is valued now relative to your end investment time. If you think AUD is at the lower (upper) bound, you should hedge (not hedge). Likewise, if you think AUD will be valued at a similar level to your end investment date, you should be indifferent to taking a hedged or unhedged currency position. Below is an illustration of how AUD/USD currency movements has influenced S&P 500 AUD hedged and unhedged returns.

Figure 2 – S&P 500 AUD hedged versus unhedged cumulative performance and USD/AUD

Diversification benefits

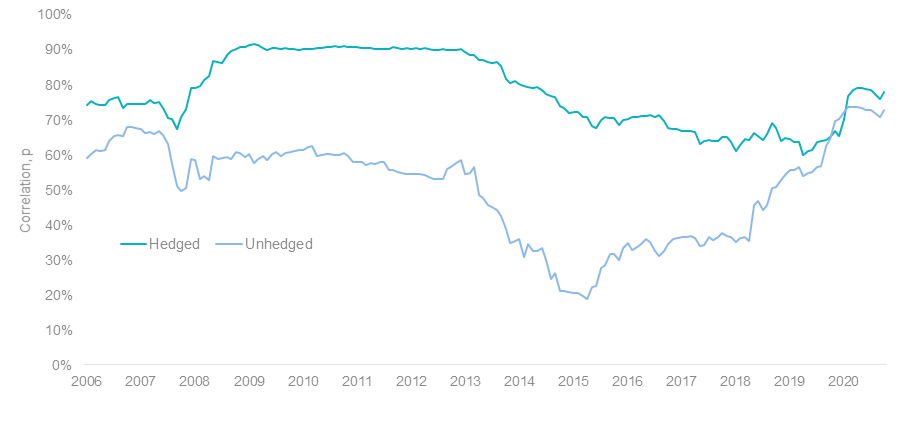

Unhedged currency international equity exposure has historically provided more diversification benefits, illustrated by having a lower correlation to Australian equity returns compared to international currency hedged exposure. Below is a comparison of AUD hedged and unhedged international equity correlations to Australian equity returns represented by MSCI World and ASX 200 respectively.

Figure 3 – 60 month rolling MSCI World ex Australia AUD hedged versus unhedged to ASX 200 correlation

Type of international exposure

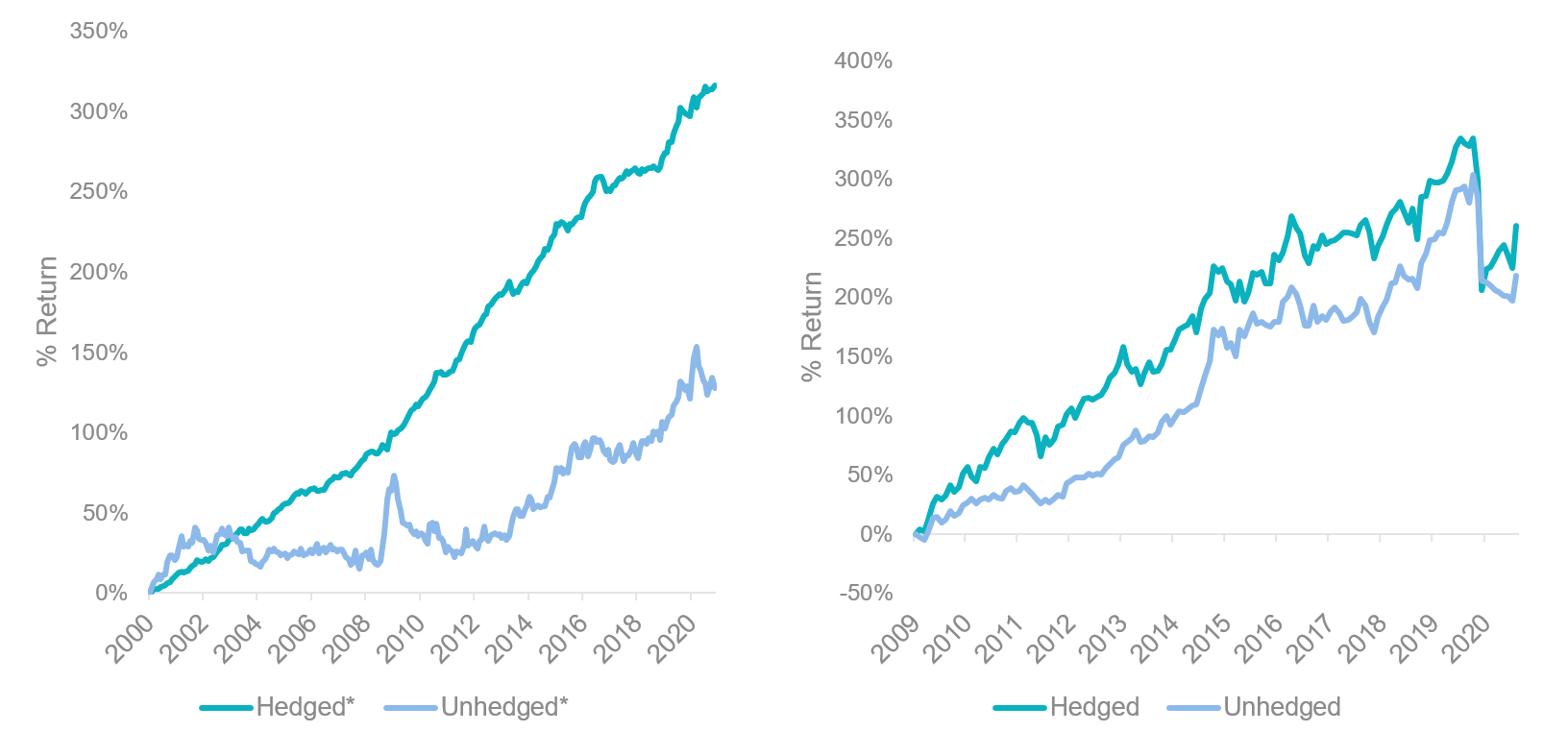

Market consensus is to currency hedge exposure of high-income, lower volatility assets, such as global fixed interest, infrastructure and REITs. Income producing assets’ cash flow is largely sourced domestically so it makes sense to remove currency exposure. Currency hedged exposure has historically produced stable returns as shown below.

Figure 4 & 5 – Fixed Income | G-REITs AUD hedged & unhedged returns

Source: Bloomberg. Figure 4 (left) *Hedged – Bloomberg Barclays Global Aggregate AUD Hedged, *Unhedged – Bloomberg Barclays Global Aggregate AUD. Figure 5 (right) Hedged – FTSE EPRA Nareit Developed ex Australia Rental AUD Hedged, UnHedged – FTSE EPRA Nareit Developed ex Australia Rental

And finally…

Ultimately, much like investing in equities, timing currency exposure is difficult to assess. We always recommend speaking with your financial advisor or broker to determine if currency hedging is appropriate for your circumstances. Currency movements are unpredictable and volatile and are just one of the many risks investors have to navigate when investing overseas.