by Mark Hawtin, Investment Director

Analysis of 2020

Casting our mind back to the start of 2020 is a surreal exercise. The year started with great optimism off the back of a strong 2019 (the S&P 500 had appreciated 29% and the Nasdaq 38%). The markets were focused on the US and China moving forward with a trade deal. It also looked like there would be a deal in regard to Brexit in Europe. Within a matter of weeks that optimism faded away as news of a devastating virus in China hit the wires. Yet even as this news made global headlines, the consensus view was that it was another SARS or Bird Flu, and the impact would be constrained to Asia. No-one could have conceived that within two months, a third of the world’s population would be in lockdown, unable to leave their homes. From the perspective of those stewarding client assets, 2020 was a year of profound change.

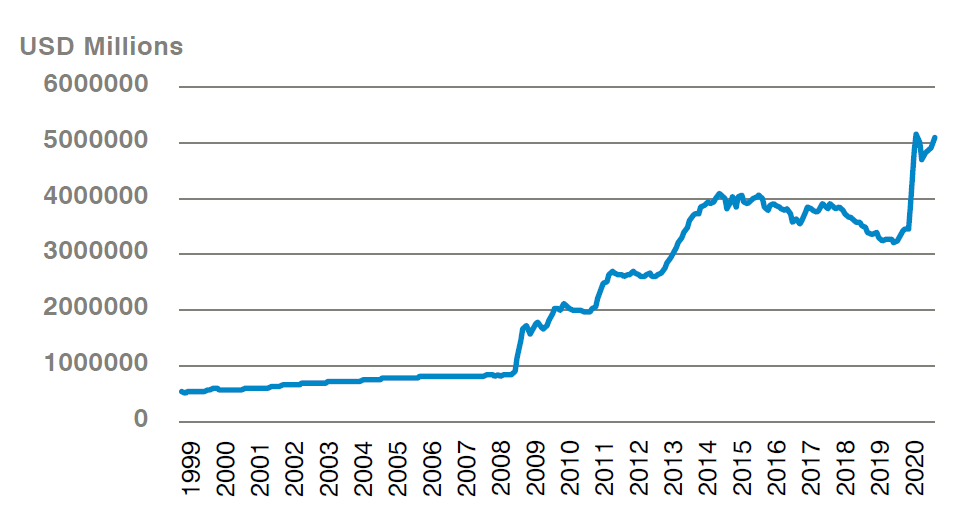

What started as a virus in China ended up being the dominant story of the year, not just dominating headlines and topping the ‘Year in Search 2020’ chart, but driving global monetary and fiscal policy, supercharging technology adoption and decimating many industries. In USD alone, the dollar monetary base was increased by 40%. The debasement of fiat currency since the global financial crisis is quite astonishing.

Chart 1: Total monetary base

Source: Federal Reserve Bank of St Louis.

As it became apparent that the ‘R’ rate of Covid-19 was high enough to categorise it as a pandemic, and that its fatality rate was high, investors started to fear that the impact would stretch beyond disrupted Chinese supply chains and could cause widespread turmoil. Consequently, markets started to sell off at the end of February as news of the virus spreading to new countries emerged. One by one, countries started to lock down their citizens. By the middle of March, not only was Asia almost totally locked down, but much of Europe was closed and the US was following suit. As panic and fear set in, markets collapsed from February highs, with the S&P 500 falling 34% and the Nasdaq 28%. Both indices fell over 12% on 16 March, the biggest one day fall for either since 1987.

Although the market sell off was broad, losses were focused on sectors that would be disproportionately hurt by the pandemic and subsequent lockdowns. Travel and retail were hit hardest. Governments and central banks leapt into action reducing interest rates, commencing quantitative easing and stimulative fiscal policy. This huge monetary stimulus and accommodative fiscal policy reached levels that had not been previously seen, fuelling one of the biggest bull markets in history. From their March lows, the S&P 500 and the Nasdaq then rallied 68% and 84% respectively. As managers of concentrated portfolios, identifying which specific stocks will generate the most client alpha is somewhat complicated when the rising central bank tide seeks to lift every boat.

With exuberance comes irrational behaviour and this reflationary rally was no exception. Everyone wanted in on the ‘game’. The retail investor in particular struck with a vengeance, reminiscent of the dotcom boom some 20 years ago. As global lockdowns forced people inside, and major sporting events were cancelled globally, people looked for new forms of entertainment. In the US specifically, casinos closed and with online gaming banned in many states, taxpayers also received up to USD 1,200 stimulus cheques. The combination of these factors turned the stock market into the biggest casino on earth. This was summed up by Dave Portnoy, CEO of Barstool Sports and messiah of the retail investor (with 1.8 million followers on Twitter) – “It’s the combination of no sports – so you can’t bet on that – and you can’t go outside. There’s a lot of people sitting in front of their computers who ordinarily can’t be day trading. For a gambler, investing has a ton of similarities.” During this period trading volumes multiplied. From a reasonably steady 2 million average daily trades over the previous four years, daily trades leapt by over 3x to more than 6 million.

This was demonstrated most clearly by the rapid growth seen at Robinhood, a popular commission-free stock trading app that allows investors to trade in fractions of stocks. During the first quarter of 2020, Robinhood reported an increase of 3 million new accounts (a growth rate of 30%) taking total accounts to 13 million. This growth coincided with the bottoming of the market and the commencement of the stimulus cheque programme. Unlike other online trading platforms such as Fidelity and TD Ameritrade (both of which also saw rapid growth with Fidelity adding 1.2 million new accounts between March and May and TD Ameritrade seeing 249% new account growth in the first quarter), the Robinhood investor has a much younger growth profile. The median age of the Robinhood investor is 31 years old, a stratum of society that has traditionally shunned the stock market. These new investors brought with them a totally different approach to investing / trading: one that is led by the amplification that social media brings, with little (or no) regard to valuation or even fundamental analysis.

Top 10 most widely held Robinhood stocks (December 2020)

1. Apple

2. Tesla

3. Ford

4. General Electric

5. Microsoft

6. American Airlines Group

7. Nio

8. Amazon

9. Disney

10. Delta Air Lines

In contrast, many institutional investors sat on the sidelines, weighing up the shocking economic data and focusing on doom and gloom predictions. Consequently, many such investors missed out on much of these gains although it remains to be seen what happens when reality (or rather, fundamental analysis and a realistic valuation) strikes some of those stocks. 2020 was also the year of the IPO, which we discussed in a recent article.

Covid as the catalyst for an accelerated digital world – Digital 4.0

As Covid-19 spread globally and governments imposed lockdowns, entire companies were forced to shift to working from home within a matter of days. This brought to the foreground a mass of technical challenges that needed to be solved. In the past, transitioning an entire workforce from a centralised office-based structure to a remote working one would have been a monumental IT task that would have taken months of planning and multiple beta tests, most likely one department at a time, before being rolled out to the entire company. Covid-19 did not provide for that luxury. Instead, major transitions had to occur within days. Companies had to ensure their technology could cope with all employees working remotely; Covid-19 ended up being the impetus for the biggest ever beta test of remote working. Our own industry was no exception although we are careful not to over-extrapolate from personal experience. Prior to Covid-19, many companies were ‘dipping their toes into the water’ of digital transformation, but the crisis jumped it up to the top of priority lists and made it a board room discussion. Enterprises that did not see digital as a priority suddenly realised that it had to be a core part of their future strategy to survive.

At the very centre of this theme is the cloud. Remote working and the ability to scale up systems quickly would not be possible without it. Similarly, adopting SaaS applications enabled companies to scale quickly and efficiently without having to invest heavily in capex. What started as fire-fighting investments to ensure that companies could remain operational, has transformed into c-suites reassessing the future and contemplating permanent changes. Prior to 2020, remote working was a luxury and a niche concept. As we look ahead into the rest of 2021 and beyond, it will become more of the norm. A Deutsche Bank survey showed 57% of financial market professionals will work remotely between one and three days a week post-Covid-19. Similarly, Hitachi Capital found that 55% of property and construction workers wanted more remote working opportunities post lockdown with the main reason cited as wanting to avoid the commute. A Gartner study conducted in April suggested that 74% of companies intend to move at least some employees to remote working permanently. This shift in attitude and behaviour places a greater emphasis on the need for digital transformations. The demand for cloud-based tools and applications is only set to increase as a result.

What happens next? Disruptive Trends for 2021 and beyond

We can already see signs that we are at the ‘beginning of the end’ of this crisis. While many of the winners from 2020 are now on higher growth paths than pre-pandemic, in many cases they do not necessarily represent the best opportunity for investors in 2021. Instead, some of the less loved companies of 2020 provide good opportunity as Covid-related restrictions are lifted. For almost all of 2020, travel (both business and leisure) literally ground to a halt and understandably travel companies suffered. Recent survey data suggests the number one activity people want to do post-crisis is travel, particularly for leisure, implying huge pent-up demand. Yet at the same time, consensus estimates do not expect a full recovery to the travel industry for several years. This gap between recovery estimates and pent-up demand offers opportunities for investors.

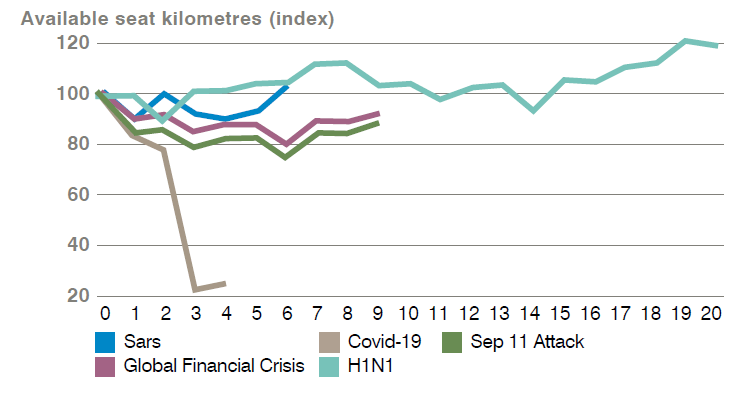

For the first half of the year, international travel was incredibly difficult and even domestic travel was shunned. The impact to the travel industry was significantly greater than any impact seen in the past, with seat capacity on airlines collapsing.

Chart 2: Impact of Covid-19 on airline capacity is catastrophic

Source: Bain & Co.

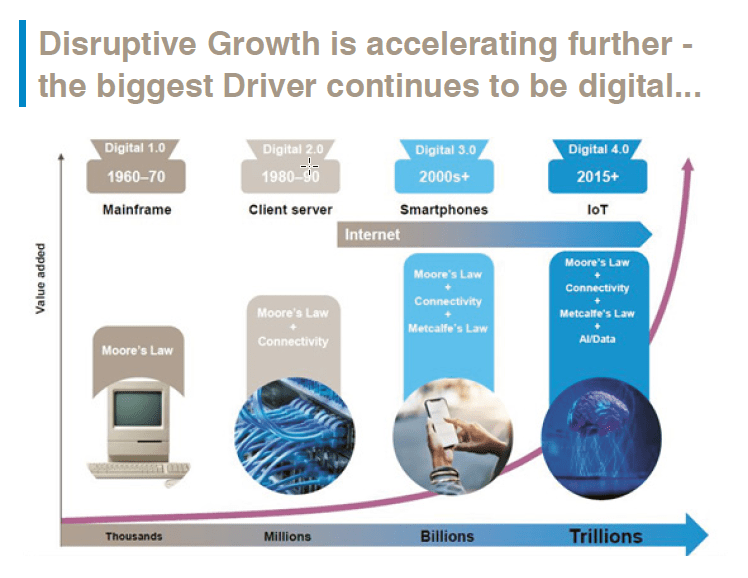

Consensus estimates indicated that the recovery for the travel sector would be slow and long, and that revenue would not return to 2019 levels for several years. This seemed to us a clear mismatch between consensus estimates and the evidence of consumer priorities, as evidenced in the surveys. In addition to this cyclical opportunity, there is a multi-year structural opportunity at play. We are moving from a world with billions of devices (digital 3.0) to a world with trillions of devices (the Internet of Things and digital 4.0). Although the concept of IoT is not new, we are at the inflection point where it really takes off. Advancements in AI, the ability to process, use and store data and the build out of 5G, means that this is now possible.

As digitalisation increases and a greater number of devices and applications are digitalised, particularly within enterprise, the amount of data generated has exploded and continues to grow at an ever-faster pace. In 2015 there were 584 data interactions per connected person per day; this is set to grow more than 8x by 2025 (to 4,909 interactions per connected person per day). It may feel like digitalisation has been a story that has been around for a long time, but we are still in the early innings: in the US, digital GDP as a percentage of total GDP is still only 5%. This theme is playing out in multiple verticals, most notably healthcare, transportation, robotics and the automation of knowledge work.

Right at the heart of Digital 4.0 is the cloud and the opportunity ahead is still enormous (penetration of the cloud is still below 10%). 2020 will be seen as the turning point, where digital transformation, forced in many cases by the pandemic, was pushed to the top of priority lists. However, 2021 and beyond will represent true implementation, underlining a widespread change in mindset to putting technology at the core. A report by McKinsey estimates that 400 million full time jobs will be displaced by 2030 by technology. Already today, 50% of current work activities can be automated by adapting currently available technology and consequently the workforce will need to adapt to survive. As companies have battled to survive in 2020, the quest to reduce costs and improve productivity has heightened. As we look ahead into 2021, the pressure to digitalise in order to achieve remote working will fade slightly. However it will be replaced by a need to utilise technology as a means of further reducing costs.

2021: What happens next?

From an investment perspective, generating client alpha in 2020 was about running with the Covid-19 winners and over the course of the year, pivoting to both post-Covid-19 winners as well as focusing on the beneficiaries of the next wave of disruption – Digital 4.0.

Source: GAM.

The roadmap for Digital 4.0 laid out above shows that the next phase of adoption within disruptive technologies involves some or all of, the Internet of Things (IoT), 5g, Data and AI. These are the drivers of what we believe will deliver the biggest opportunities over the next 5-10 years. While Digital 3.0 was the cycle of the platform, Digital 4.0 is a cycle of data creation and use for competitive advantage. The connectivity of everything, increasingly in real time, will drive change in sectors that have not yet seen the most severe levels of disruption – these include the automation of knowledge work, healthcare, transportation, industrials and fintech.

As a concluding remark, we would remind all of the need to be dispassionate in this space. The world of disruptive growth is not without hype around certain names. In contrast, the successful fiduciary investor relies on detailed, dispassionate analysis to generate client alpha.