A big week ahead for the December (half and full year) earnings season with 64 ASX-200 companies due to report, led by mining giants Rio Tinto BHP and Fortescue plus the high performing retailers, JB Hi Fi and Super Retail.

The AMP’s Dr Shane Oliver says that while there have been some notable disappointments, there has been a big turnaround from the lockdown impacted June half.

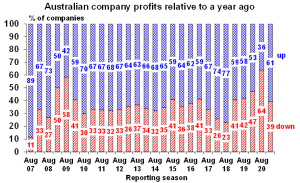

“So far 61% of companies have seen profits rise which is up from just 36% six months ago, 46% have beaten expectations compared to just 32% six months ago and 54% have increased dividends compared to 55% cutting dividends six months ago (see graphics below)

“Retailers and miners are doing well, and banks are boosting dividends, but insurers and utilities have been weak,” He wrote at the weekend

They include Aurizon, Seven West Media, GPT, JB HiFi and Bendigo & Adelaide Bank (today); Adairs, BHP, Breville, Domain, Seven Group Holdings, GWA, Nearmap, Asaleo Care, Super Retail Group, Brambles and Scentre (Tuesday); Rio Tinto (full year), Charter Hall, Coles, Whitehaven, Beacon Lighting, Bapcor, Carsales.com, The Reject Shop, Tabcorp, and Treasury Wine Estates (Wednesday); CSL, Fortescue Metals Group, The Shaver Shop, Sonic Healthcare, Stockland, OZ Minerals, Coca-Cola Amatil, South32, Woodside, Orora and Wesfarmers (Thursday); and on Friday, Platinum, Cleanaway, Cochlear and QBE (Full year).

Earnings are expected to rebound in 2020-21 by 25% after the pandemic driven 24% plunge last financial year. In terms of sectors, earnings for resources are expected to rise by 47%, banks by 31% and IT stocks by 109%.

Healthcare, media and gaming stocks are likely to see around 17% earnings growth and retailers are likely to surprise on the upside.

According to Dr Oliver the key themes are likely to be a rebound in dividends, stocks benefiting from a surge in housing activity and a likely outperformance of value and cyclicals over growth stocks, and small caps outperforming large caps.

Source: AMP Capital

…………

The US earnings season slows this week with the results to be dominated by the January quarter figures from Walmart, the world’s biggest retailer.

The company is expected to report a third successive quarter of better-than-expected results as it rides out the COVID pandemic and lockdowns to grow sales, especially online.

Other US majors to report include Liberty Global, Deere and Co, EchoStar, Dish, Hormel, ViacomCBS, Albermale, Newmont, Hecla Mining, Avis Budget.

Tourism and travel related stocks such as Hilton Worldwide Holdings Inc and Hyatt Hotels Corp are also expected to release their results on February 17, followed by Marriott, Norwegian Cruise Lines and TripAdvisor on the 18th.

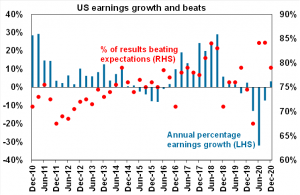

The US December quarter earnings reporting season is now about 75% complete, with results remaining strong. Earnings are back above pre -coronavirus levels.

79% of companies have surprised on the upside (compared to a norm of 75%) by an average 19% and 72% have beaten on revenue.

As a result, consensus earnings expectations have been revised up to +2% year on year.

This means that earnings are about 11% higher than expected a month ago and are back above pre coronavirus levels, AMP’s Chief Economist, Dr Shane Oliver wrote in his weekend note.

FactSet pointed out at the weekend that more S&P 500 companies are beating EPS estimates for the fourth quarter than average, and beating EPS estimates by a wider margin than average.

“As a result, the index is reporting higher earnings for the fourth quarter today relative to the end of last week and relative to the end of the quarter.

“Due to this increase in earnings over the past few weeks, the index is now reporting year-over-year growth in earnings in Q4 2020 for the first time since Q4 2019.

“Analysts expect double-digit earnings growth for all four quarters of 2021,” FactSet analysts wrote.

Source: Bloomberg, AMP Capital