by Phil Strano, Portfolio Manager – Yarra Absolute Credit Fund

Looking back 12 months brings back a myriad of emotions, especially for anyone unlucky enough to endure Melbourne’s second lockdown.

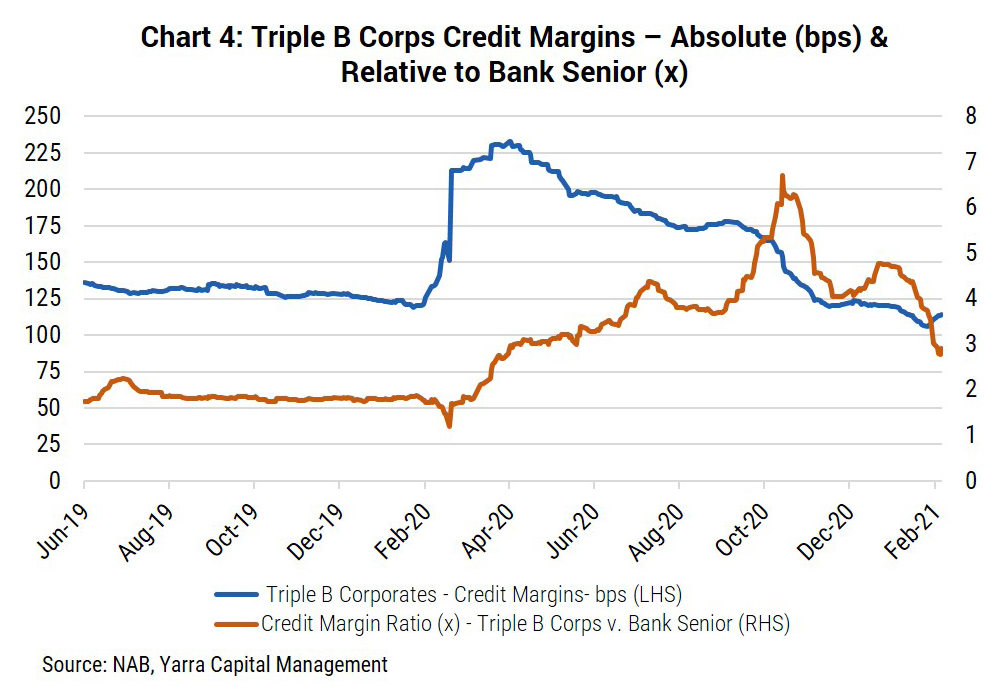

Lockdowns aside, the most striking memory for anyone in markets was the almost uniform decimation observed in March 2020 on the back of the shutdown of non-essential services. Over that period, we saw credit margins more than double and, in some segments, even triple.

That observable volatility, however, provided fantastic buying opportunities throughout the months to follow, with Yarra’s average investment grade credit portfolios delivering 4-5% in the six months to February 2021.

At the heart of this outperformance was a significant allocation to triple B industrials. As evidenced in financial results to December 2020, most industrial companies have taken action to preserve their balance sheets. Many companies raised equity, sold non-core assets and/or cut non-essential expenditure. Most have also benefited from lower funding costs and government stimulus.

Infrastructure servicer Downer EDI’s credit profile, for example, was resilient through 2020, buttressed by an equity raise, the sale of non-core assets and demand from rising government infrastructure investment. Credit margins on their 2026 bonds, which subsequently more than halved from their March 2020 peak, currently trade at ~+150bps.

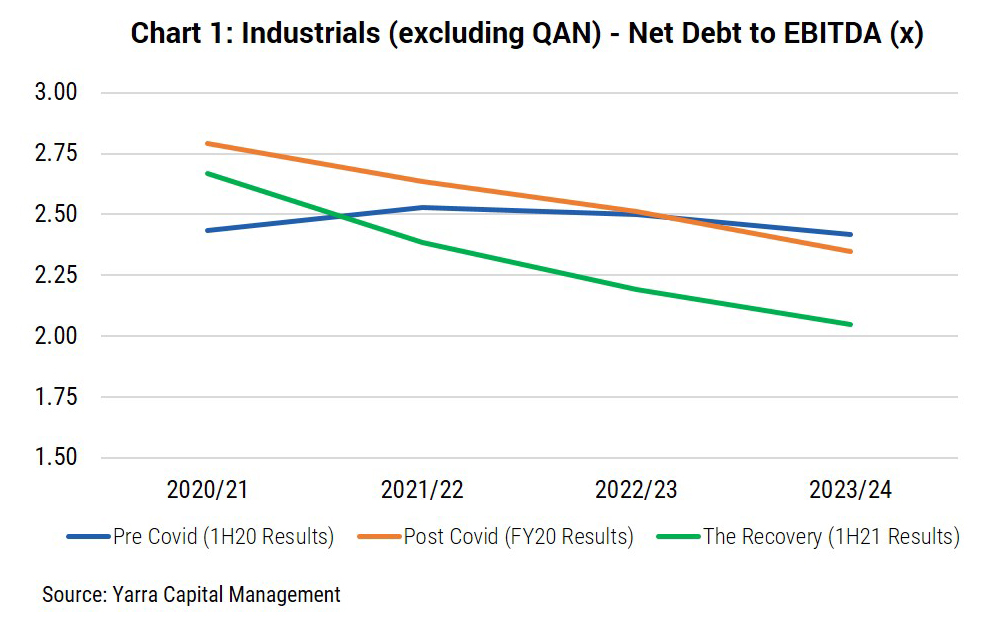

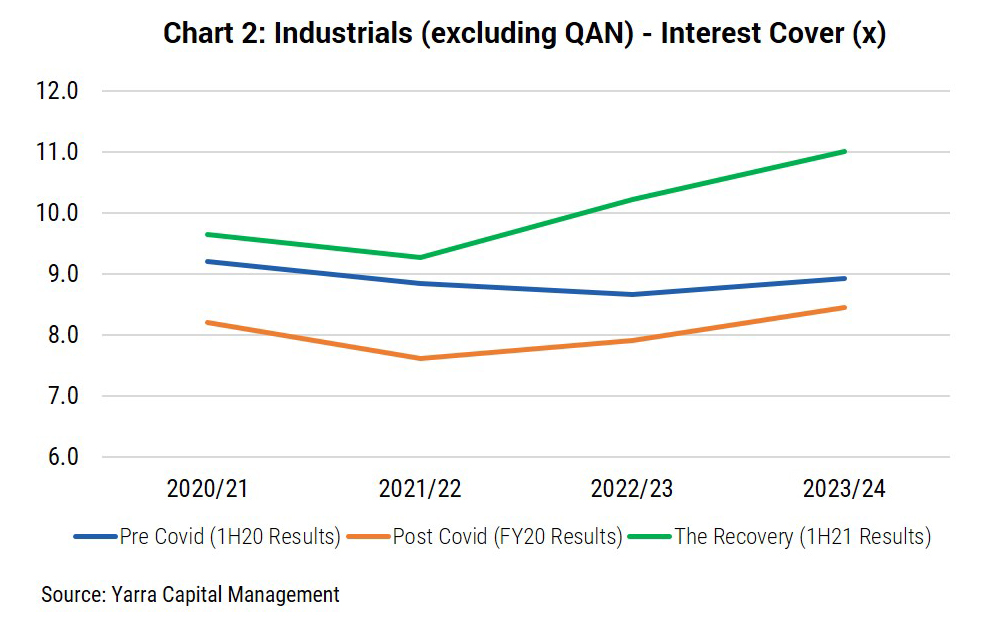

Segmental results from our proprietary credit modelling illustrate the robust recovery already underway, with both net debt to EBITDA and interest cover projected to improve and be below/above pre-pandemic levels respectively (refer Charts 1 and 2).

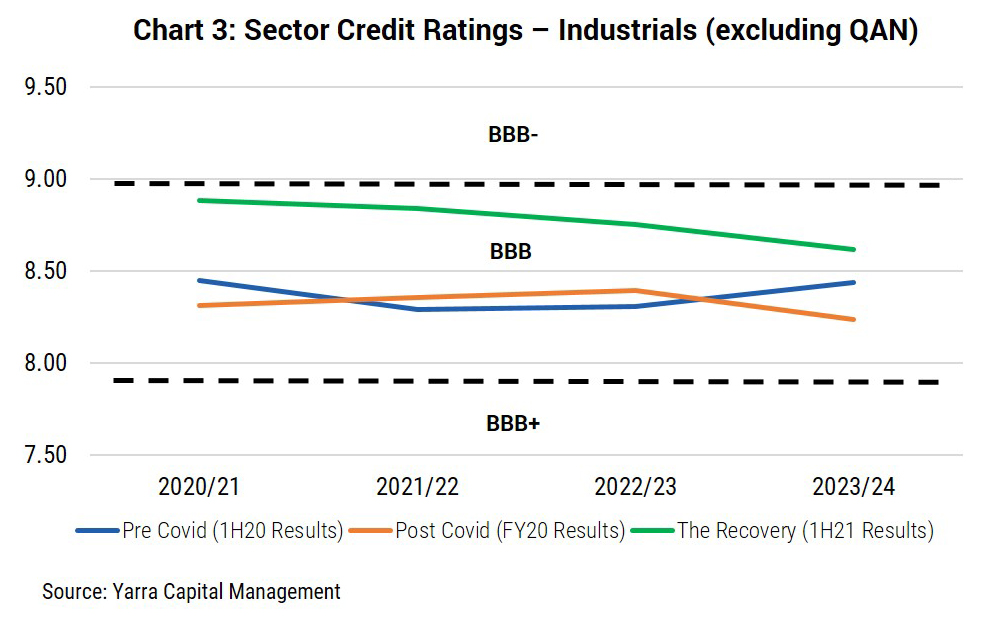

With this recovery in mind, our modelling shows stable triple B credit quality across our industrials universe out to 2024 (refer Chart 3). Management teams are unlikely to seek to de-lever sufficiently to warrant credit rating upgrades, especially with cost of debt capital at such low levels.

But what about current valuations? After a sustained period of significant outperformance, triple B corporate credit margins currently trade within their pre-pandemic range, but remain still well wide relative to bank senior (refer Chart 4).

As the market currently digests reflation (with bond yields rising), any commensurate widening in corporate credit margins is likely to present attractive buying opportunities. This is especially the case since: (i) central banks remain committed to keeping cash rates at historically low levels; and (ii) the rebound in economic growth is likely to extend through CY21, fuelled by vaccine rollouts and continued fiscal stimulus.

We remain happy holders of triple B corporates, with current valuations now representing fair value. Importantly, yields on our average investment grade portfolios remain comfortably above 3%, supported by a robust economic outlook and conservative balance sheets.