by Michael Brown

Last year, we looked at some interesting data for total ASX ETF net flows across asset classes. (In case you missed it, you can see the post here.)

Given the positive feedback we received on the article, we thought we would provide an update on the top asset class flows of 2021 so far. A picture is worth a thousand words…

ASX ETF Flows

(1 Jan 2021 to 30 Apr 2021)

Source: ASX monthly ETP data (April 2021).

Key points:

- International equity exposures have dominated ASX ETF net flows with more than double the next highest category.

- Australian equities continue to see strong flows at a similar rate to 2020

- Fixed income has seen strong inflows relative to 2020

All inflow figures in this article are drawn from monthly exchange traded product (ETP) data issued by the ASX.

1. International Equities

Coming in at a whopping $2.8 billion in net inflows is international equities. Further breaking down the asset class, we can obtain a better understanding of the exact exposures these flows have gone into.

International Equities ETFs Net Flows

(1 Jan 2021 to 30 Apr 2021)

Source: ASX monthly ETP data (April 2021).

Source: ASX monthly ETP data (April 2021).

Leading the international suite with approximately $200 million each in net flows are the following three ETFs:

- Vanguard MSCI Index International Shares ETF (ASX: VGS)

- BetaShares Global Sustainability Leaders ETF (ASX: ETHI)

- BetaShares NASDAQ 100 ETF (ASX: NDQ)

For investors looking for a broad market international exposure, we saw a passive exposure to the MSCI World ex-Australia Index (VGS) take in around $200 million in net flows for the calendar year to 30 April 2021. Not far off, ETHI saw an inflow of just over $190 million over the same period. With younger investors becoming more educated about ethical options within the ETF universe, and companies increasingly making the shift to becoming carbon neutral, ethical ETFs have seen a significant rise in demand, resulting in strong inflows across the board (see Australian equities summary below).

The range of BetaShares ethical ETFs provides ‘true to label’ ethical exposure to companies or bond issuers that are well-positioned to thrive in a more sustainable and increasingly digital economy. BetaShares ethical funds have captured around 80% of total ethical asset class ETF flows for the calendar year to 30 April 2021.

Further, with continued strong performance (26.4% p.a. over the five years to 30 April 20211), it was no surprise to see the BetaShares NASDAQ 100 ETF (ASX: NDQ) maintain a consistent level of inflows so far this year.

2. Australian Equities

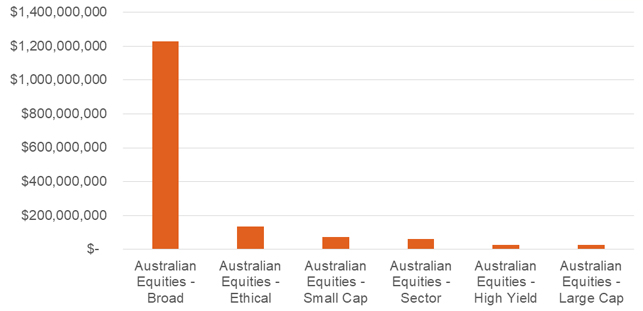

Australian Equities ETFs Net Flows

(1 Jan 2021 to 30 Apr 2021)

Source: ASX monthly ETP data (April 2021).

When considering Australian equities flows, there is one clear observation – broad market exposures continue to dominate, with just over $1.2 billion in net flows. Within broad market equities, passive ETFs tracking the ASX 200 and ASX 300 were the clear winners, making up $1.1 billion of total broad market Australian equity flows. Linking with the above trend of strong ethical flows, the BetaShares Australian Sustainability Leaders ETF (ASX: FAIR) had the third highest net flows.

3. Fixed income

Following a tough year for bond markets in 2020, fixed income has seen a strong rebound in flows so far in 2021. Given low yields, many yield-hungry investors have been turning to absolute return funds. Similarly, given their lower historical volatility than equities, some investors also have been purchasing hybrids. Many investors have been accessing hybrids exposure via the actively managed BetaShares Active Australian Hybrids Fund (managed fund) (ASX: HBRD) that is paying a 12-month gross distribution yield of ~3.5% (as at 24 May 20212).

For more defensive investors seeking diversification benefits along with a yield pickup from longer duration exposures, we saw strong flows into the BetaShares Australian Government Bond ETF (ASX: AGVT)), which received the third largest inflows of ETFs within the fixed income asset class in the calendar year to 30 April 2021.

For monthly updates on inflows into ETFs, and discussion of the state of play in the Australian ETF industry, please refer to our regular Australian ETF Review series.

|

Investing involves risk. The value of an investment and income distributions can go down as well as up. Before making an investment decision you should consider the relevant Product Disclosure Statement (available at www.betashares.com.au) and your particular circumstances, including your tolerance for risk, and obtain financial advice. An investment in any BetaShares Fund should only be considered as a component of a broader portfolio. |

1. Past performance is not indicative of future performance.

2. Source: BetaShares. Yield figure calculated by summing the prior 12-month gross fund per unit distributions by the fund closing NAV per unit. Past performance is not indicative of future performance.