by Robert Mead and Hugh Holden

For Australian investors, the barbell strategy aims to balance high risk assets (usually equities) with very low risk assets (typically cash or term deposits). At the recent Morningstar Conference, this portfolio construction methodology was the subject of significant debate. We believe this approach is not effective in striking a balance between reward and risk, particularly with cash and term deposit rates anchored at near zero in an environment where inflation is starting to creep higher.

Below we summarise three key reasons why investors should consider a more diversified portfolio that includes an allocation to core bonds and credit.

1. Core bonds offer higher return potential than cash and term deposits

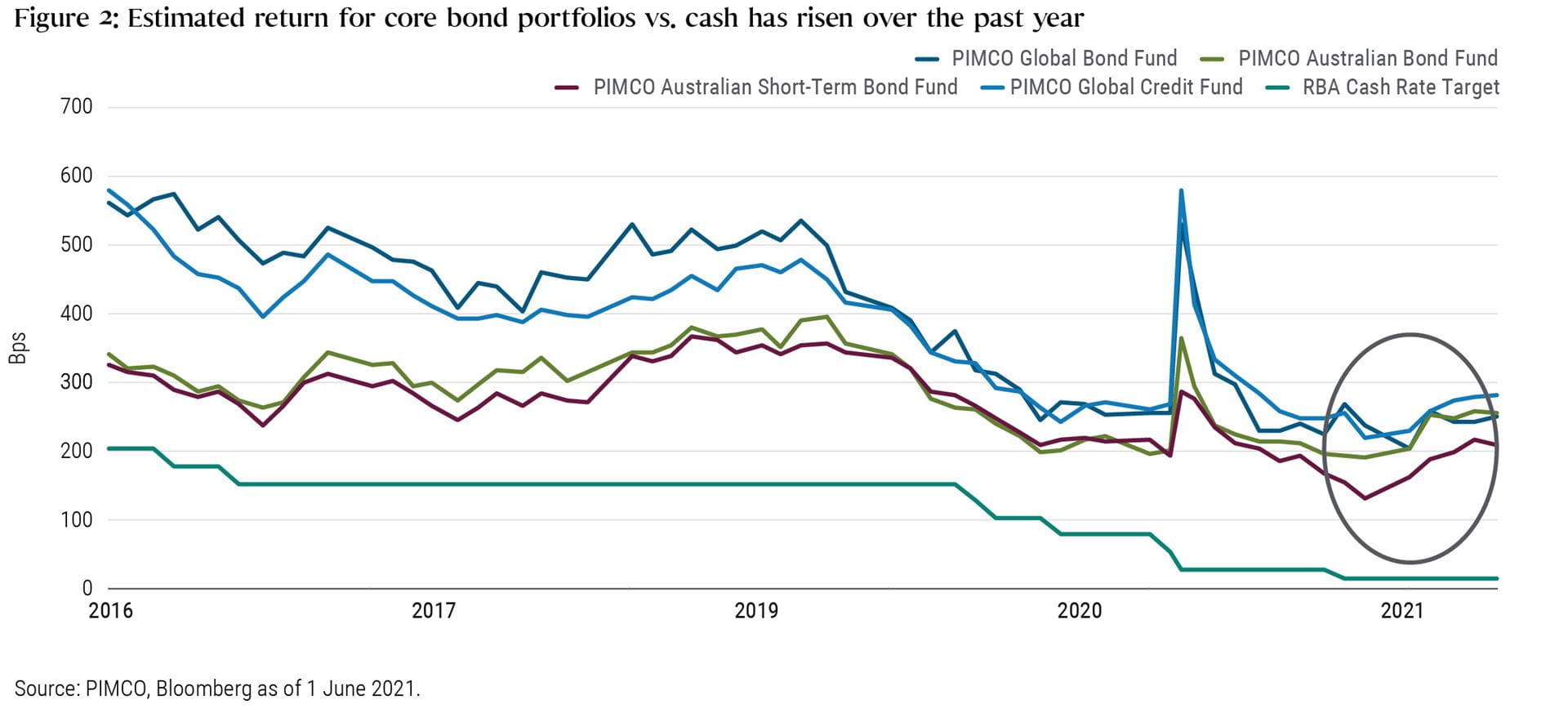

There are various risk premia available to investors looking to generate a return above the official cash rate (currently 0.10%), including equity risk premium, credit risk premium, term risk premium (also known as duration or interest rate risk) and illiquidity risk premium. While many risk premia are trading on the rich side, term risk is the only premium that has recently repriced markedly. This makes bonds one of the few asset classes that have become more attractively valued over the past year.

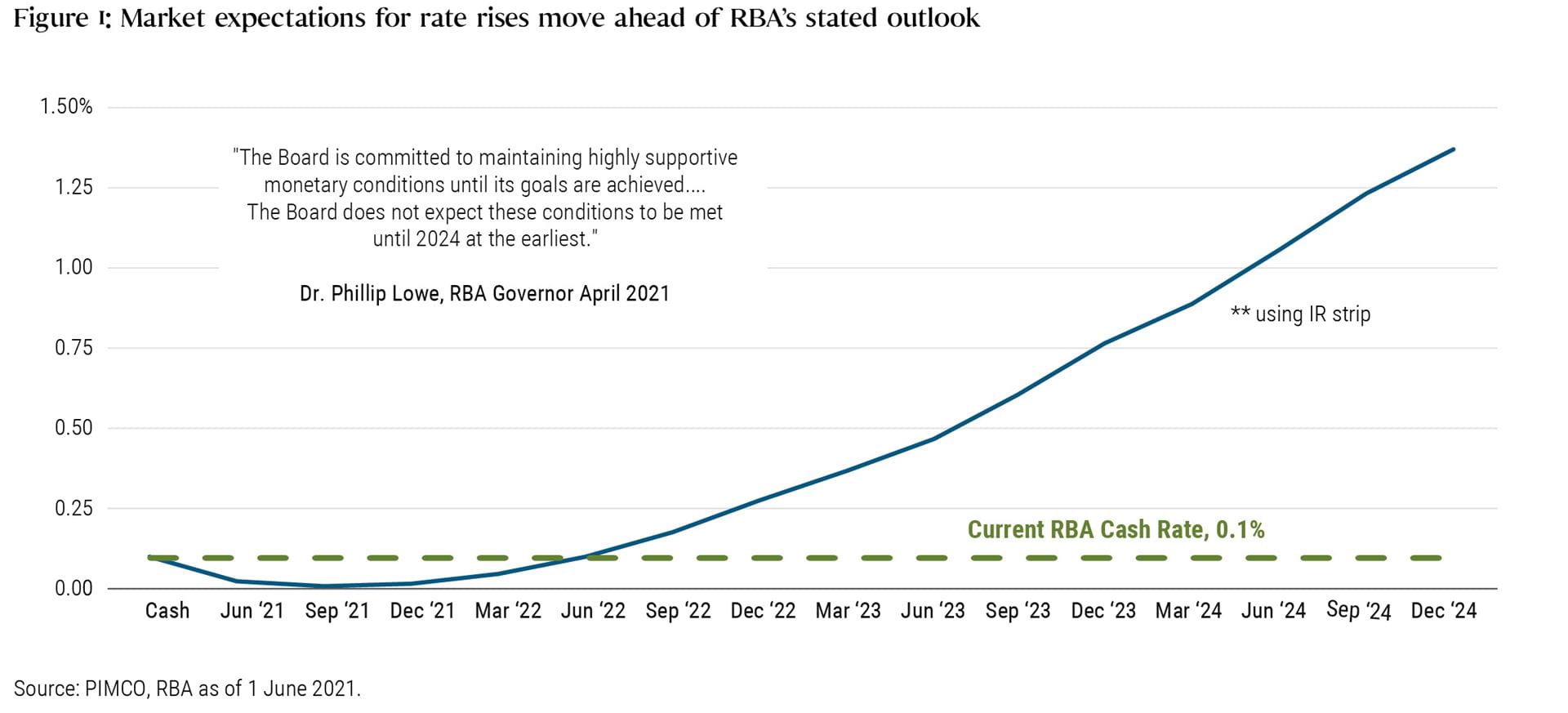

The Reserve Bank of Australia (RBA) has indicated that it will not increase the official cash rate until actual inflation is sustainably within its 2%–3% target range, which it has stated is unlikely to be until 2024 at the earliest. With all of the discussion around rising rates, it can be easy to forget that bond markets are forward-looking and price in expectations for future rate movements ahead of time. In fact, they have already priced in the first rate hike for late 2022, with the official cash rate priced to reach close to 1.5% by the end of 2024 (see Figure 1). This repricing of bond markets that has already occurred leads to our base case expectation that yields will remain relatively range-bound moving forward.

Since the start of August 2020, the yield on Australian government bonds has risen by around 1% to between 1.5% and 1.7%, leading to the largest margin in terms of an estimated return (or carry) over cash and term deposits in some time (see Figure 2). Investors can pick up more than 200 basis points (bps) in excess return expectations over cash when investing in core bond funds right now. The recent rise in longer-term bond yields along with steeper yield curves not only increases the margin over cash, but also means that bonds are better able to provide portfolio diversification.

2. Diversification of equity market risk

Despite their recent rise, bond yields remain structurally lower than long-term historical averages. This has caused investors to question whether bonds will still provide low or negative correlation to equities. While bonds have exhibited a fairly low or negative correlation to equities over the past 20 years, it is important to understand that over longer periods of time, bonds have not always displayed a negative correlation.

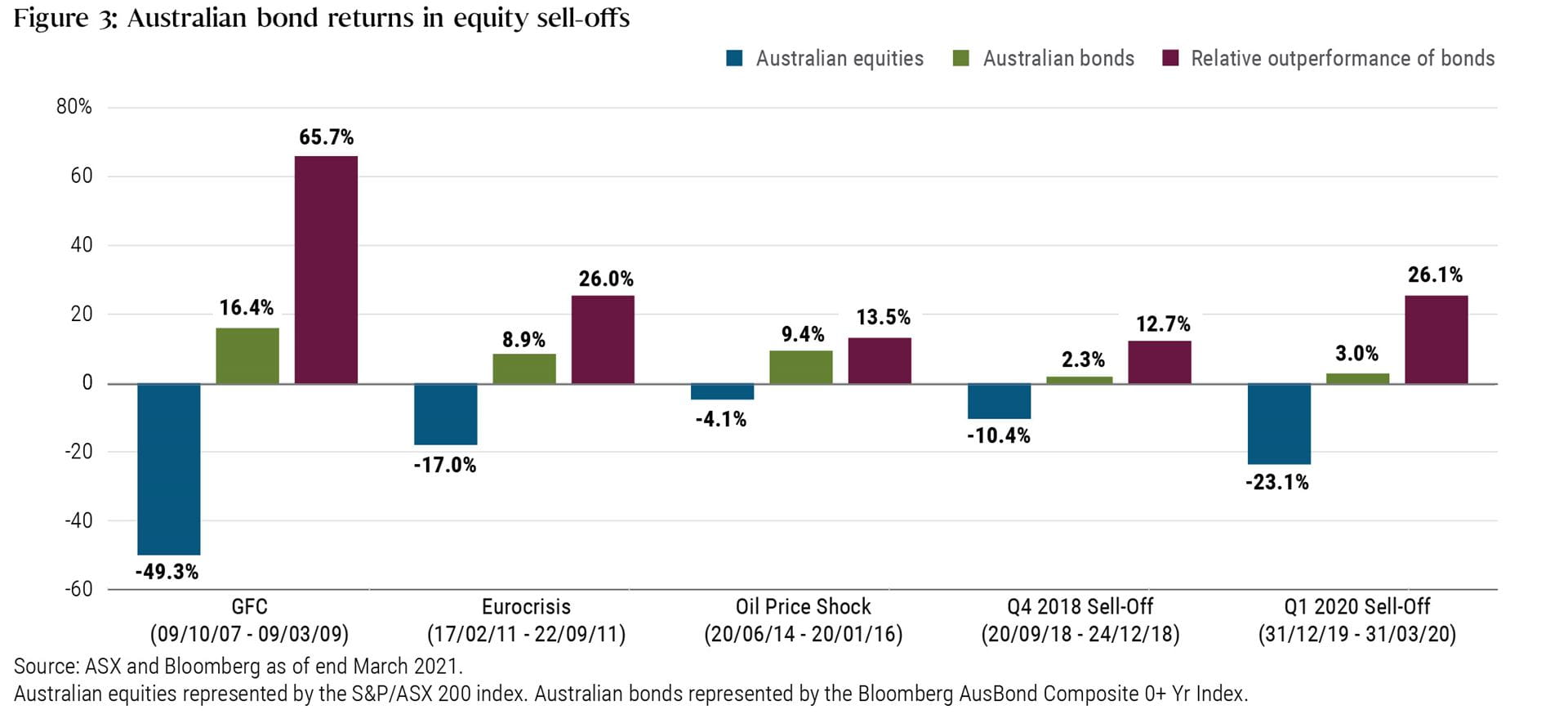

What has been shown to really matter, however, is ‘conditional correlation’ – that is, the correlation given certain market or economic conditions. For example, bonds have provided equity diversification and positive returns in nine of the 10 U.S. recessions since 1952, regardless of whether the average correlation to equities at the time was positive or negative. Importantly, government bonds have historically demonstrated a negative equity beta conditional on equity drawdowns, which implies that bond returns should increase as the size of equity drawdowns increases.

Although it’s important to acknowledge that bond yields are lower today, we still believe this diversification potential is valuable. Australian bonds have historically been one of the best diversifiers in risk-off environments, even at lower yield levels (see Figure 3). Given risk asset valuations have continued to move higher and price in a very strong global recovery, it may be prudent to have some insurance in the event that the recovery is not as strong as expected. Particularly when this insurance also pays you an estimated return above cash and term deposits.

3. Diversification by risk factor not by manager is key to constructing well-diversified portfolios

Asset classes are simply carriers of risk factors. Investors are generally familiar with risk factors when it comes to equities – common risk factors include value, growth, quality, size, momentum, to name just a few. However, when it comes to fixed interest, they are less familiar with the underlying risk factors driving their portfolios.

While investors often focus on diversifying their portfolio by manager, they tend to spend less time ensuring that the risk factors adopted by managers are truly diversified in an overall portfolio context. This is a fundamental flaw since the correlation between risk factors tends to be more stable than the relationship between managers and asset classes.

With inflation expectations rising, investors may think they are doing the right thing by concentrating portfolios on floating-rate credit exposures and reducing interest rate duration within portfolios. Although on the surface these types of portfolios may look diversified, they are often heavily reliant on credit risk factors (for example, investment grade credit spreads), which are more correlated to equities compared with the interest rate duration factor, which is predominantly negatively correlated. This narrower approach to risk factors can lead to portfolios that are less resilient across a range of scenarios and environments.

It can also be easy to overlook the benefits of employing a more diversified, multi-sector approach to credit allocations. By diversifying across a wider range of risk factors than simply investment grade credit spreads – such as high yield, emerging markets, or securitised debt in different geographies – investors historically have been able to achieve better risk-adjusted returns. It also offers a larger opportunity set from a return perspective and can be a valuable complement to core holdings.

Given the recent repricing in term risk, it’s an opportune time for investors to refocus their attention on building resilient portfolios that combine a whole range of risk factors to protect portfolios against a variety of scenarios (both expected and unexpected). Focusing on greater risk factor diversification should lead to better risk-adjusted returns and more predictable outcomes in market downturns.

Bottom line: Bonds remain a key part of a diversified portfolio

One of the key reasons why many investors hold bonds in a portfolio is for their diversification and defensive benefits, to serve as a hedge against equity market sell-offs, and we expect bonds to continue to play that role. Another key benefit is income – with cash and term deposit rates remaining anchored and bond yields having risen significantly, the relative advantage of bonds has only increased. With investments in cash or term deposits, on the other hand, investors are locking in negative real returns in the current environment.

In our view, investors should save the barbells for the gym and instead focus on enhancing their risk-adjusted portfolio returns via allocations to equity-diversifying asset classes like core bonds, as well as tapping into the vast multi-sector credit universe. Those who remain wedded to cash due to fears about bonds may be doing themselves, and their investment portfolios, a disservice.

Robert Mead is Head of Australia and Co-head of Asia-Pacific Portfolio Management

Hugh Holden is an Account Manager, Global Wealth Management