by Tony Pattison

It’s no surprise to anyone that it’s getting harder and harder to generate income from your portfolio. With term deposit rates near zero and the Australian cash rate at 0.25%, investors may need to look to other asset classes to increase portfolio yields.

Thankfully, Australian equities are still offering a healthy yield on attractive companies. And in fact, now could be as good an entry point as any for investors seeking an increase in yield, for just an incremental increase in risk.

The dilemma we face…

Since 2010, term deposit rates in Australia have been on a downhill trajectory, as can be seen in the following chart.

Source: Martin Currie Australia. Term deposit: Average ‘special’ rate (all terms).

Unfortunately, for investors trying to live off their savings, this creates quite a dilemma in meeting the costs of living and keeping up with inflation.

Australian shares (as measured by the S&P/ASX 200) delivered income of 5.3% p.a. over the 5 years to 31 March 20211.

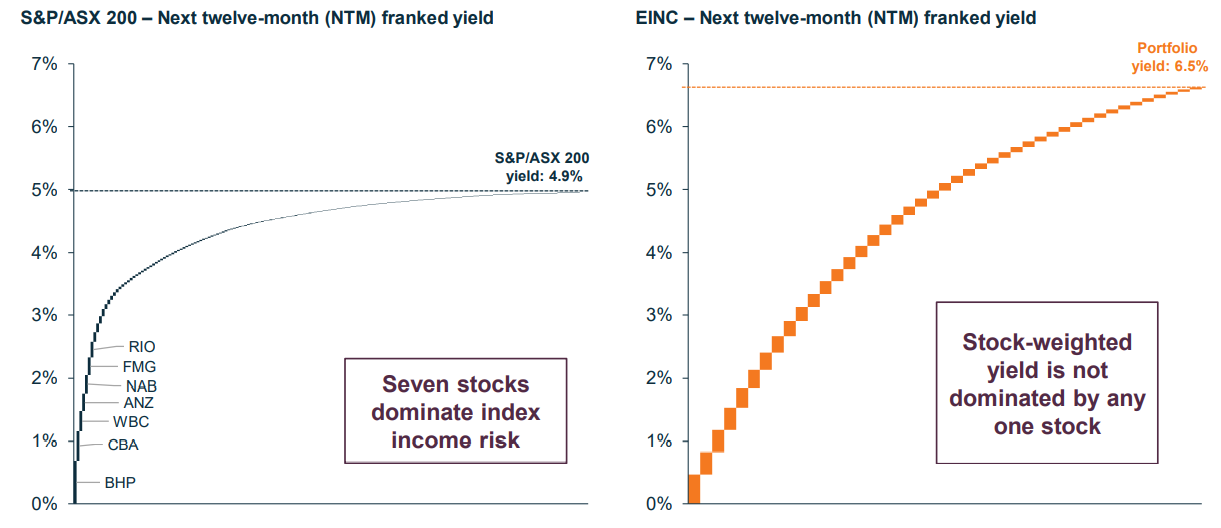

Over this same period, the Legg Mason Martin Currie Equity Income Fund (the unlisted fund which is managed by the same investment manager as, and employs the same strategy as, the BetaShares Legg Mason Equity Income Fund (managed fund) (EINC)2) has delivered income of 6.8% p.a. 3, and has done so with more diversification than the S&P/ASX 200. Due to stock and sector cap limits, the equity income strategy employed by Martin Currie Australia ensures that yield is not dominated by one or a few stocks, unlike the S&P/ASX 200, which has tended to rely heavily on the top seven stocks to generate the bulk of its income.

As you can see from the chart below, it is forecast that the top seven stocks on the S&P/ASX 200 will generate more than half the market’s income in the 12 months to 31 March 2022. In contrast, the forecast yield from EINC is more evenly spread across the portfolio, hence is more diversified and less exposed to a cut in any one particular stock’s dividends.

Source: Martin Currie Australia, FactSet; as at 31 March 2021. Data calculated for the BetaShares Legg Mason Equity Income Fund (managed fund) (ASX: EINC). Past performance is not an indicator of future performance. This strategy is not constrained by a benchmark, however for comparison purposes the representative account is shown against the S&P/ASX 200 Accumulation Index. Next 12 Months (NTM) income yield is calculated using the weighted average of broker concensus forecasts of each portfolio holding – because of this, the returns quoted are estimated figures and are therefore not guaranteed. Assumes zero percent tax rate and full franking benefits realised in tax return. The information provided should not be considered a recommendation to purchase or sell any particular security. It should not be assumed that any of the security transactions discussed here were, or will prove to be, profitable.

As shown above, despite our sharemarket nearing all-time highs, the manager of EINC, Martin Currie Australia, forecasts the franked yield on EINC to be 6.6% for the 12 months to 31 March 20224.

Is the timing right for Australian equities for income?

This year’s Australian equity reporting season in February was the strongest in ten years, and the upcoming August reporting season is shaping up to be even stronger. Interestingly, with the upcoming reporting season, the market seems to be underestimating income growth.

There are several factors working in favour of the Australian equity market:

- As a result of fiscal stimulus from the federal government, consumer and business confidence is high.

- Wages and savings are up.

- House prices are up.

- Unemployment remains low.

Plus, many companies are holding high levels of cash, have low gearing and high franking balances. In fact, as at 31 March 2021, the total gearing level of EINC’s equity portfolio was at a low 25%. Interest rates are also at record lows and companies now have the ability to fund expansions and buying opportunities relatively cheaply.

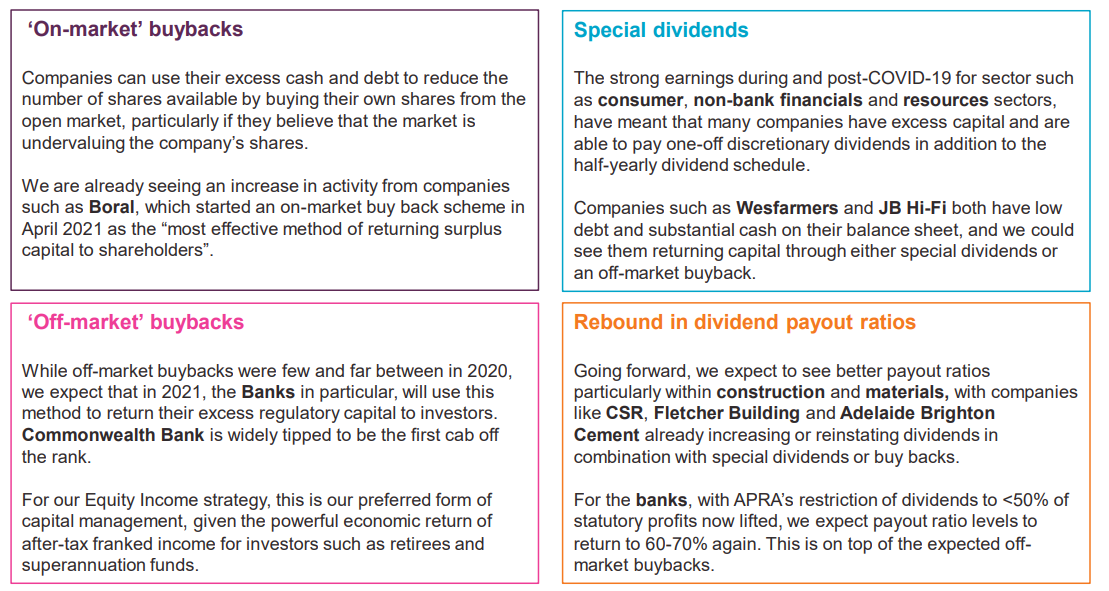

Importantly, Martin Currie Australia have identified four capital management activities that could contribute to income growth for investors, as outlined in the table below.

Source: Martin Currie Australia. This information should not be considered a recommendation to purchase or sell any particular security, or EINC. It should not be assumed that any of the security transactions were, or will prove to be, profitable. Examples are provided for illustrative purposes only. Actual portfolio may differ.

Investors seeking income from an equity portfolio can consider the BetaShares Legg Mason Equity Income Fund (managed fund) (EINC).

1. Source: Martin Currie Australia, FactSet. You cannot invest directly in an index. Past performance is not indicative of future performance.

2. The unlisted fund is used in this instance as EINC has an inception date of 13 February 2018.

3. Source: Martin Currie Australia, FactSet . Past performance is not indicative of future performance.

4. The yield forecast for the next 12 months is calculated using the weighted average of broker consensus forecasts of each portfolio holding and research conducted by Legg Mason Asset Management Australia Limited and is gross of fees. Neither the yield forecasts nor past performance is a guarantee of future results. Future results are impossible to predict. Forward-looking statements which are, by their very nature, subject to various risks and uncertainties, and are based on certain assumptions which may not be correct. You should therefore not place undue reliance on such statements.