by Will Granger – Investment Analyst

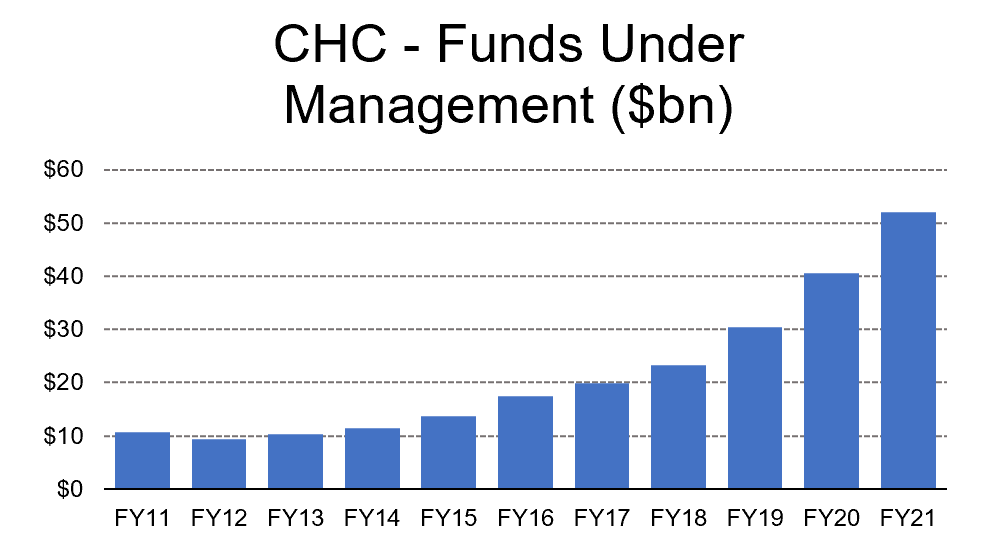

Airlie seeks to invest in high-quality businesses that are undervalued. One of the common scenarios in which we find ‘undervalued quality’ is when a great business sits within an otherwise average sector, as industry peers tend to be priced off similar multiples. When thinking of high-quality (or interesting!) businesses, most investors’ minds don’t rush to the Real Estate Investment Trust (or ‘REITs’) sector. And for good reason, as this sector, while ‘defensive’, generates an average return on equity (ROE) only in line with the broader market, at around 12%. Yet one of the ASX’s top performers over the past decade has been Charter Hall (CHC), which has delivered a total shareholder return of 19% per annum since listing in 2005. This performance has largely been driven by Charter Hall’s transition from a more traditional REIT into one of Australia’s largest property funds management businesses. The company’s funds under management (FUM) have grown at a 17% compound annual growth rate (CAGR) over the decade, and now sit at over $52bn. Importantly, this transition has reached an inflection point which should continue to drive very strong outcomes for shareholders.

Source: Company filings, Airlie Funds Management

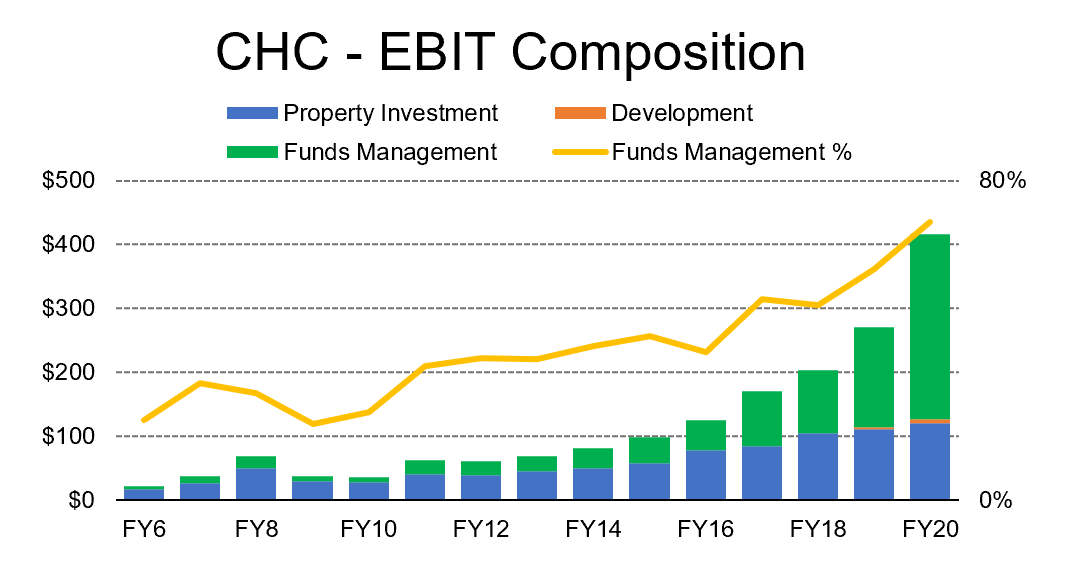

Charter Hall report two operating segments with very disparate economics. On one side, you have the funds management business, which acquires property assets on behalf of the company’s various funds and generates management, performance and other fee income. Charter Hall’s other segment is its direct property investment segment, which owns stakes in the various Charter Hall funds. In reality, these two businesses are intertwined; Charter Hall is often required to co-invest in its various funds for alignment purposes. This co-investment has historically been the limiting factor for the returns profile of the company.

There’s a lot to like about Charter Hall’s funds management business:

- The funds own a selection of high-quality assets with some of Australia’s most sought-after tenants (Government account for 12.5% of rental income, Woolworths 6.4%, Wesfarmers 5.9%, and Coles 5.2%).

- Wholesale capital is relatively ‘sticky’ with ~7yrs between redemption windows. This means investors can’t simply pull their money out at once, enhancing the stability of earnings.

- High contribution from recurring, annuity-style funds management fees and property services revenue (77% of CY20 funds management revenue).

- Scale begets scale – Charter Hall are one of only a handful of managers that can compete for assets >$1bn in value.

- A high proportion of transactions for Charter Hall are completed off-market, meaning less competition for those assets.

Furthermore, we believe there has been a step change in the quality of the business that should continue to materialise in outstanding financial results for shareholders. There are two key driving forces behind this change: 1) increasing scale in the funds management business, and 2) lower capital requirements.

Increasing Scale

Charter Hall’s funds management business has grown significantly in scale over the past 5 years, adding $35bn in FUM, a CAGR of 25%. Increased scale has resulted in strong margin expansion for the segment; Charter Hall’s funds management EBITDA margins (excluding performance and transaction fees) have expanded from 13% in 1H16 to 57% in 1H21. Segment earnings have grown at a 33% CAGR over that same 5-year period. Importantly, the funds management business now represents over 60% of group EBIT as at 1H21. Given that the funds management business is growing faster than the direct property segment, this higher contribution should help to accelerate group earnings growth.

Source: Company filings, Airlie Funds Management

Lower Capital Requirements

The other important step change for Charter Hall is the lowering capital intensity of the business. As Charter Hall’s funds management business has grown in scale, and its relationship with equity partners improved, those equity partners have required a lower co-investment stake. Charter Hall’s weighted average equity stake serves as a useful, albeit limited, proxy for the company’s lowering co-investment requirements. Charter Hall’s weighted average ownership share of its various funds has typically averaged around 12.5%. However, since 1H19 this average equity stake has steadily decreased, and now sits just above 8%.

Source: Company filings, Airlie Funds Management

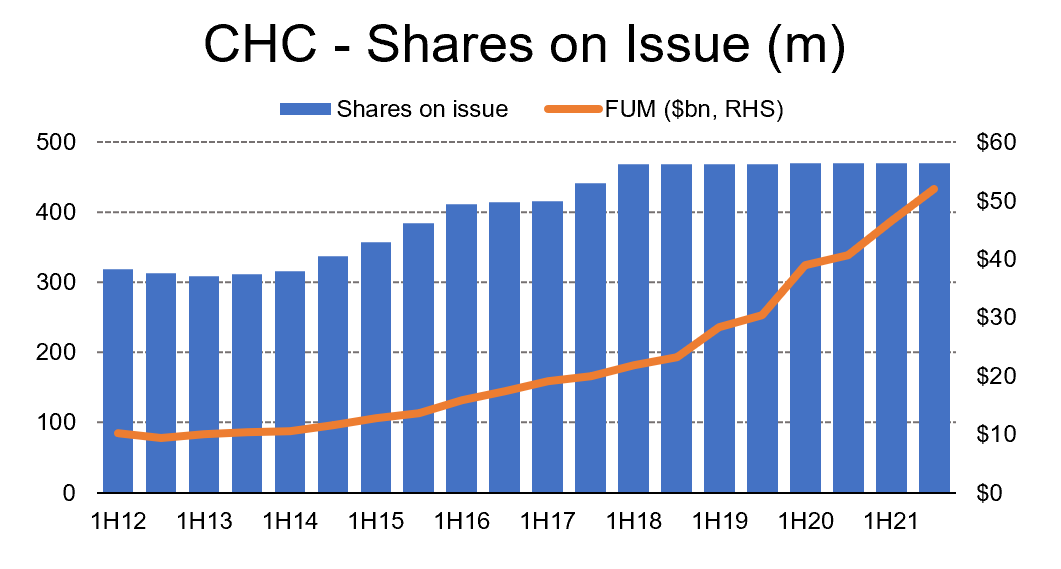

Simplistically, this means that for each additional $ of FUM added to the business the capital investment required for that $ of FUM has fallen by ~30% in just three years. As a result, Charter Hall’s incremental return on equity has increased dramatically; we estimate Charter Hall’s incremental return on equity, normalised for any large one-off performance fees, to be >25%. Importantly, this has been achieved without an increase in gearing. Lower capital requirements mean Charter Hall can continue to grow without the need for dilutive equity raises. For example, despite very strong FUM growth (which drives capital requirements), Charter Hall’s shares on issues haven’t grown since 1H18.

Source: Company filings, Airlie Funds Management.

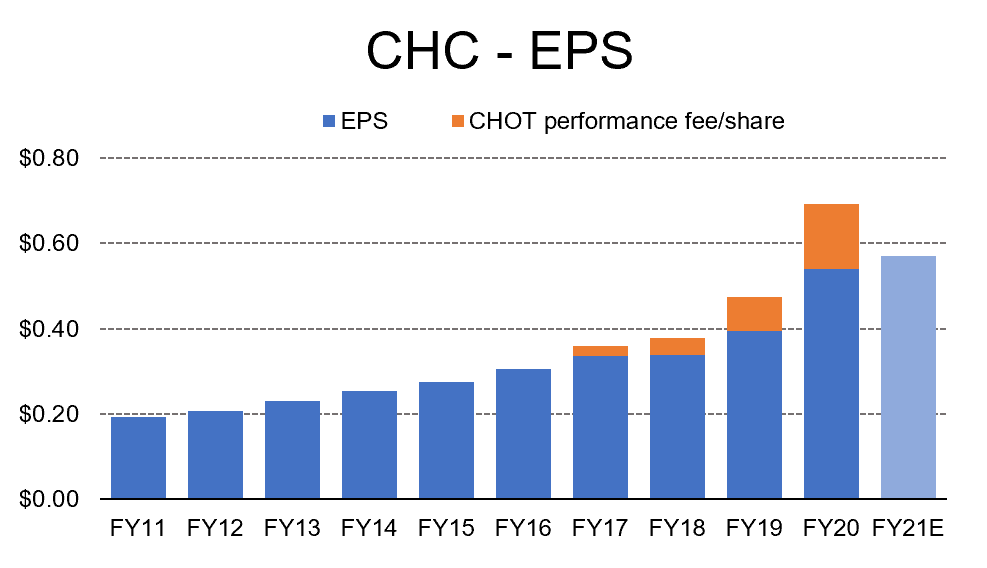

The combination of these two factors, being faster earnings growth and lower capital requirements, should continue to drive very strong EPS outcomes for shareholders.

Source: Company filings, Airlie Funds Management.

Risks

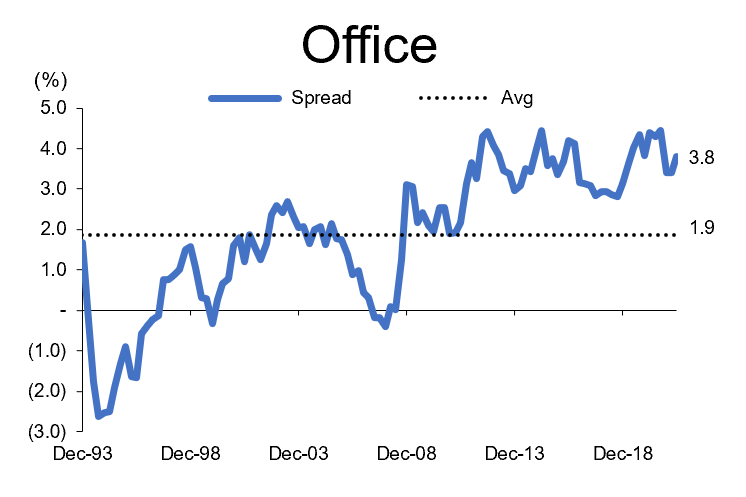

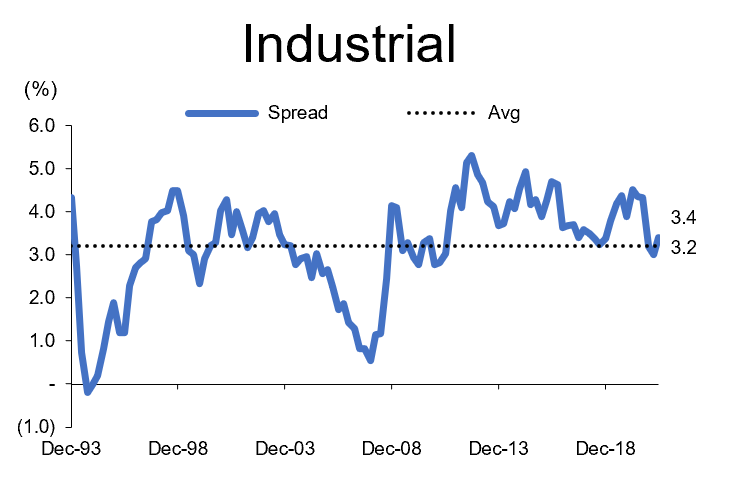

The two key topics of the day for REITs have been the threat of rising interest rates and the risk of a structural decline in office demand due to increasing work from home. Whilst these two factors do certainly pose a risk to Charter Hall’s outlook, there are a few countervailing factors that give us comfort.

For one, the cap rate spread on 10-year bonds is at close to all-time highs across all property sectors. This should provide somewhat of a valuation cushion and suggests that an increase in inflation or deterioration in rents is already priced into valuations. This is particularly true of Office, where the cap rate spread sits significantly above the long-term average.

Source: Macquarie Securities, Airlie Funds Management.

Source: Macquarie Securities, Airlie Funds Management.

Another point worth noting is that Charter Hall’s FUM growth has been very strong in recent periods. The company has grown FUM (excluding the impact of positive revaluations) at 24% per annum over the past two years, including ~19% growth in FY21. Office FUM sits at 46% of total FUM, meaning that every 10% decline in office valuations would create a 4.6% headwind for FUM growth. Given the current momentum in FUM growth for Charter Hall, even a relatively bearish scenario for office valuations should be surmountable.

It’s also important to note that Charter Hall has been run by David Harrison since 2004. Harrison has overseen the company’s FUM grow from $0.5bn to $52bn and is an integral part of the deal-making process. While strong management is always a positive for a business, this does create some ‘key man’ risk if Harrison were to leave Charter Hall.

Valuation

We estimate Charter Hall is trading on a P/E multiple of 24x FY22 underlying earnings, which is in line with the ASX200’s P/E multiple excluding resources and banks. This is despite the business generating roughly double the average market ROE. Given the company’s strong earnings momentum, high quality of earnings, and above-market returns profile, we see this business as a great example of undervalued quality, and it is one of our core positions in the Airlie Australian Share Fund.

.PNG)