by James Stewart and Luke Smith

Iron Ore remains a commodity that polarises the market. While supply continues to be the main focus of the market, demand has been just as important to the strength of Iron Ore over the past 12-18 months. There have been some extreme circumstances that have got the market in the situation where Iron Ore has broken through and maintained levels above $200/t.

On demand, Chinese economic activity and steel demand was impacted materially in early 2020, given the implications of COVID-19, however this recovered extremely quickly from 2Q20 and into 2H20 on the back of supportive stimulatory government policies. Similarly, the Rest of the World was significantly impacted in 2020, and while it took longer to recover, it is now accelerating in terms of steel demand as economies recover and strengthen.

On supply, issues commenced with the dam failures in Brazil (both Samarco and Brumadinho), then tightened further on the back of COVID-19 related issues (labour in particular) further impacting supply. The Pilbara has also had its issues, which shouldn’t be ignored, which from our perspective relate to the diversified majors underinvesting in sustaining capex through the downturn. These mixed causes have conspired with the pandemic to tighten overall supply, ultimately pushing Iron Ore prices higher.

A number of these factors, both in terms of supply and demand, will ease over coming years, so we expect Iron Ore prices to taper from current levels. While the diversified major resources companies (whose earnings are dominated by Iron Ore) may still outperform, given ongoing earnings upgrades, strength in balance sheets and free cash flow, limited M&A activity and strength in returns, we have a relative preference towards other commodities within the complex. Our preferred exposures within the Global Resources Fund remain Base Metals (Copper and Nickel), Battery Materials and Oil & Gas.

The following piece of research outlines some of the background to our view on the commodity market, the potential earnings upside forecast for the Australian diversified miners and the major pure-play Iron Ore miners, and the significant upside potential to ASX 200 earnings growth as a result.

Demand: What has been driving the rapid growth in Chinese steel production this year?

The strength in Chinese steel demand growth year to date has been a continuation from the strength seen through 2H2020. China slowed quickly and aggressively in 1Q CY2020, given the implications of Covid-19, but likewise, the reopening was quick and robust, hence production rates have been high during 2H2020, and continued into 2021.

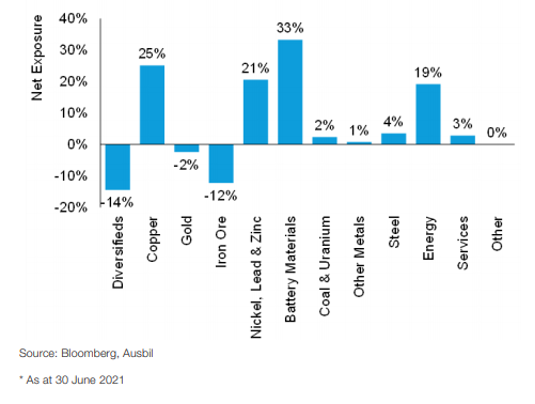

Chart 1: Chinese annualised steel production (Mtpa

Source: World Steel Data, JP Morgan

The 2021 line (red) shows a continuation in robust steel production from the strong end experienced in 2020 (black line). What is different between the two periods is China’s willingness to work through the generally weaker Chinese New Year period, which clearly supports the strong demand backdrop.

Construction accounts for roughly 60% of Chinese steel demand, arguably up to more than 80% when machinery is included in the overall calculation. Through the economic recovery since COVID-19 there has been synchronous growth in the three major FAI components, manufacturing, real estate, and infrastructure. Through 2019, prior to COVID-19 implications on economic growth, the backdrop for manufacturing was weak during the US-China trade war given the uncertainty regarding exports. All three major construction-related components of the Chinese economy benefited from loose monetary and stimulatory fiscal policy, which resulted in an acceleration of infrastructure, real estate and manufacturing related activity. The result has been booming steel demand for construction, and ultimately significant iron ore demand as a result.

Demand: What are you modelling in terms of China steel demand run rate?

Our current estimates see Chinese apparent steel consumption growth of roughly 2-3% year- on-year (yoy) in 2021 (noting that Chart 1 also includes elevated levels of steel exports inflating the steel production growth). While steel demand has been strong year to date, we are already seeing changes in policy focused towards both infrastructure and property that are likely to see demand ease from the second half. This feeds into our expectation that Chinese steel demand will ease into 2022 by 3-4% yoy, albeit remaining very strong when compared to 2019 pre- COVID absolute levels, but down yoy all the same (assisting in taking some of the sting out of pricing as well).

Demand: What other factors are important when assessing the demand backdrop?

The rest of the world (RoW) demand picture for steel should also not be ignored. Right now, we have a situation where Chinese steel consumption has recovered to higher levels, whereas global steel production is still in the process of recovering and ultimately accelerating (despite an extremely strong backdrop). During 2020, the clear demand driver for Iron Ore was a China recovery. In 2021, demand is more about the rest of the world starting to normalise. Chinese steel production rose ~60mt in 2020 versus 2019, but the rest of the world fell by ~110mt. In 2021, we have Chinese growth rates moderating (small production yoy only), but a recovery in the rest of the world, to almost normal production rates (+20mt China production yoy, but +77mm RoW).

Supply: What are your expectations for Vale iron ore production in Brazil?

Vale, who are one of the four major Iron Ore producers globally (with RIO, FMG and BHP), cut production guidance for 2021 to 315-335Mt in December 2020. By way of comparison, the overall global market for Iron Ore is 1.5Bt pa. This downgrade compares to their original guidance of 375Mt, and has therefore removed a significant amount of expected supply from the marketplace. Vale continues to have issues with its tailings dams (recently a 15mtpa facility was taken offline as a result). The company are also having issues restarting suspended capacity, and there was a fire in January at their Madeira Port which is limiting shipments. We are cautious on Vale production increases in subsequent years. Vale are targeting a 400Mtpa run-rate by year-end 2022, however this likely only implies reaching that run-rate in the final quarter. The wet season and continued issues with restarts are likely to impact output leading into those run-rates, and as a result we currently estimate they will produce 355Mt in 2022 overall.

Price: What is your iron ore price forecast? How does this compare to historical assumptions?

Given the market backdrop we have described, we currently forecast Iron Ore prices (62% Fines) to taper from current levels towards $170/t in 2H21, $140/t in CY22 and $110/t in CY23.

While we believe that we have been ahead of the curve in terms of our positive view on Iron Ore (in particular following numerous China, Brazil and Pilbara trips, both in person and virtually), we have certainly been surprised by the absolute level of strength in the commodity over the last 6-9 months. Our expectations for demand strength and supply weakness continue and have been exceeded during this period, with COVID only exacerbating market tightness, through Chinese construction related stimulus and COVID-related supply issues in Brazil.

As a result, we have been in a continual upgrade phase to our own commodity and earnings expectations. That said, for the last three years (at least) we have been well above consensus expectations, supporting our view of significant ongoing earnings upgrades through this period, which ultimately was the key driving factor for share prices across the diversified majors and pure- play iron ore miners, in our view.

Are you using conservative forecasts?

For many of the reasons already discussed, we do not believe these are conservative forecasts. Instead, these forecasts reflect our estimates based on granular supply and demand analysis for the commodity. Some extreme circumstances have seen the market in Iron Ore break through and maintain levels above $200/t. As we highlight regarding the supply issues we have seen in Brazil, this supply contraction commenced with the tailings dam failures (both Samarco and Brumadinho), then tightened further on the back of COVID-19 related issues impacting supply further. The Pilbara has also had its issues, which should not be ignored, which from our perspective, simplistically relate to the diversified majors underinvesting in sustaining capex through the downturn.

Secondarily, in terms of demand, last year was an exceptional year. Post-COVID, China reverted to traditional mechanisms to support its economy. This saw renewed stimulus focused on construction- related industries (notably infrastructure and manufacturing, but increased liquidity also supporting property markets), which in turn supports demand for steel-related commodities.

A number of these factors, both in terms of supply and demand, will ease over coming years, so we are comfortable with our forecasts at this stage. On the supply side, it is worth noting that we are seeing some early signs of a supply response from non-traditional producers, and also from a number smaller producers. The numbers are small, but a small increase in supply is evident.

What is your long-term Iron Ore price and has it increased?

We currently use US$70/t real as our benchmark for the longer term underlying price for Iron Ore. This increased in recent years from roughly US$60/t previously. This step-change reflected stronger longer term demand projections (from China in particular) which in turn require the incentive price for Chinese domestic Iron Ore mine supply to be higher. Chinese GDP growth, population growth and per capita steel consumption were the key factors driving up our expectations for higher than expected demand growth. We expect Chinese domestic Iron Ore supply will remain the marginal source of supply.

The key question for us is how large (and how quickly) the Simandou project in Guinea will be brought online over the medium term, in order to displace this marginal domestic Chinese supply. China has set plans in motion for more independence in terms of Iron Ore, which involves the development of additional African supplies. While we expect the Simandou project to come online faster and larger than market expectations (similar to what we have seen with China’s investment in Bauxite in Guinea, and supporting China’s aim to diversify away from Australian supply), ultimately Chinese domestic iron ore supply is likely to remain the marginal tonne.

What is the EPS upside/downside for iron ore miners?

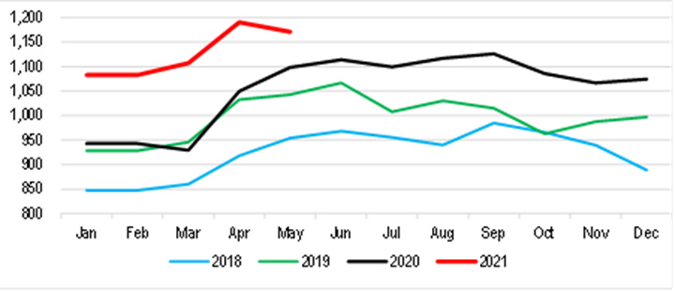

The following chart compares our forecasts for Iron Ore leaders BHP, Rio Tinto and Fortescue Metals relative to Bloomberg consensus. Simply, Ausbil is well ahead of consensus on our forecasts for the reasons outlined above. Clearly, higher Iron Ore forecasts are the starting point for our materially higher than consensus forecasts, but we also sit above consensus for other key commodities, such as Copper, Metallurgical Coal and Oil. The market consistently has commodity forecasts materially in backwardation (in a downward direction over time, as opposed to contango), therefore driving declining outlooks for earnings overall. This is a quirk in how the market projects earnings, but it is not always the case, particularly when there are clear and definable drivers of multi-year compound earnings growth, as is the case today with some of the best mining exposures. Ausbil’s outlook for the here majors relative to consensus is shown in Chart 2.

Chart 2: Ausbil’s outlook for majors relative to consensus

Source: Bloomberg, Ausbil

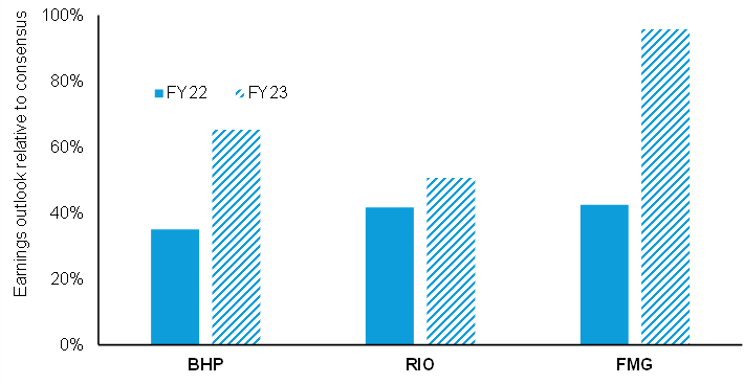

In terms of sensitivity to the Iron Ore price, Chart 3 illustrates profit sensitivity relative to consensus for different Iron Ore price outcomes across FY22 and FY23. This analysis reinforces two critical points. Firstly, in our view, there is a significant upside to earnings if Iron Ore prices are maintained at current levels. Secondly, the aggressive backwardation the street continues to forecast regarding the commodity complex in general could be significantly misleading in terms of the actual earning potential across these Iron Ore leaders.

Chart 3: Earnings (NPAT) sensitivities across different Iron Ore price levels relative to consensus

Source: Bloomberg, Ausbil

Earnings: What are the implications on overall market earnings expectations?

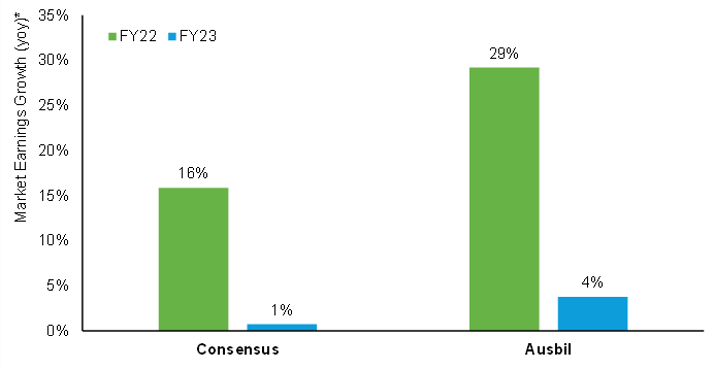

In terms of the implications of these scenarios on expected overall market earnings growth, Chart 4 illustrates the difference between Ausbil and consensus. Currently consensus forecasts earnings growth of +16% and +1% yoy for FY22 and FY23 respectively. All scenarios we have outlined for Iron Ore prices are also significant in terms of incremental growth expectations for the market, as shown in Table 1. Ausbil’s forecasts for Iron Ore would result in +29% yoy earnings growth in FY22 and then +4% earnings growth in FY23 (off the rebased FY22 market expectations). Both the chart and table for these scenarios clearly highlights the potential additional earnings growth on offer if the current pricing environment continues for an extended period.

Chart 4: Market earnings growth expectations and Ausbil forecasts

Note that comparison to Ausbil earnings is only adjusted for Iron Ore forecasts for BHP/RIO/FMG. Source: Bloomberg, Ausbil

Table 1: Market Earnings Growth (yoy)*

Consensus Ausbil $125/t $150/t $175/t $200/t $225/t

FY22 16% 29% 20% 28% 36% 44% 52%

FY23 1% 4% 12% 12% 12% 13% 13%

Note that comparison to Ausbil earnings is only adjusted for Iron Ore forecasts for BHP/RIO/FMG. Source: Bloomberg, Ausbil

Positioning for the Ausbil Global Resources Fund

Given the case for Iron Ore exposures, our expectations are for Iron Ore prices to soften from their current elevated levels based on two premises. Firstly, Chinese demand is likely to soften from the current high levels as credit is tightened and construction-related activity softens (specifically infrastructure and property construction). Secondly, supply eventually recovers, with marginal supply and Brazilian tonnes expected to continue to respond to the enticement of current high prices. While Vale’s growth guidance should be taken with a pinch of salt, supply is still expected to continue to increase into the year-end.

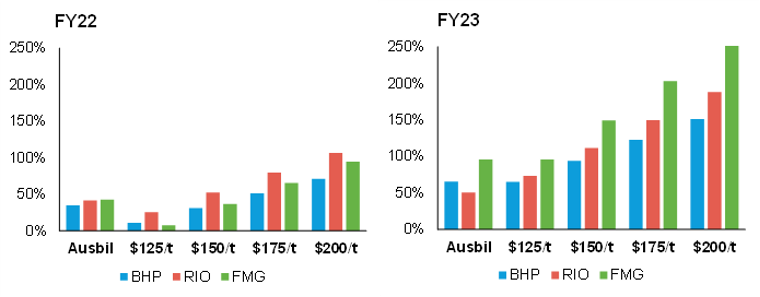

As a result, current positioning within the Ausbil Global Resources Fund, based on relative value, and a softening outlook for Iron Ore, results in a current net-short position on the commodity (both directly and through put options). This has generated funding for allocation across our relative preferred commodities (base metals primarily in copper and nickel, battery materials, and oil & gas) – as illustrated in Chart 5 – which we expect to strengthen from current levels.

That said, this is a relative call amongst commodities, as we have made the case for fundamental underlying earnings upside for the Iron Ore producers that is ahead of consensus. And again, we highlight that earnings are the key driver for share prices in our view. The benefit of our absolute return focus is that we can make the most of tactical opportunities such as elevated price levels, and add protection to exposures to generate preferable risk-adjusted returns across all markets.

Chart 5: Net exposure by commodity