Industry is yet another area of the market that is evolving at an ever-increasing pace driven by artificial intelligence (AI), advanced robotics and the Internet of Things (IoT). We have believed for some time that the effects of this will be felt in many sectors that have not been subject to the levels of disruption seen in areas such as retail, advertising or entertainment. A recent study by McKinsey estimated that the economic value created within manufacturing could range between USD 1.7 trillion and USD 3.7 trillion by 2025. Accenture estimates even bigger benefits and estimates investment in industrial IoT could drive a USD 15 trillion global GDP value by 2030. This is a sizable opportunity and one that extends the reach of digital disruption deep into additional sectors of the market like industrials, healthcare and transportation. It further supports our contention that technology is no longer a vertical but an economic horizontal – in other words, a total necessity. It also opens new, exciting and differentiated investment opportunities in these sectors, in our view.

We strongly believe that such is the size and scope of the opportunity that over the next 10-15 years we will see a reversal of the trend towards manufacturing globalisation. Technology can provide the components needed to alter the traditional order of competitive advantage. Developing countries operating with low-skilled labour and low labour cost production are at risk as routine low-skill tasks are increasingly automated. New ways of manufacturing will be led by innovation, new ecosystems, and require strong digital inputs. The ecosystems will involve multiple modules in a broadened and better-managed holistic process.

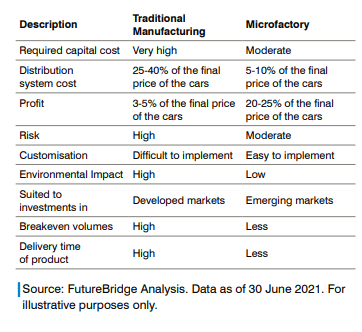

Figure 1: Drivers of microfactories

Silicon Valley-based company Enlightened estimates clients can reduce their lighting bills by circa 60-70% and air conditioning by approximately 20-30% using IoT sensor-based systems. AI-based systems are estimated by PTC, a US computer software and services company, to save as much as 50% of scrap cost losses, a 12% reduction in operating costs and a 60% increase in operator productivity. These numbers are significant in the context of traditional competitive benchmarks. However, one area where we expect to see a shift is in the capital intensity of manufacturing, the development of microfactories capable of doing what had required multi-billion-dollar investments. As an example, executives at E.go in Germany, an electric vehicle company, talk about the company’s business as the internet of manufacturing first and foremost – this drives the firm’s competitive advantage allowing it to run a 30,000 unit factory for an investment of about USD 100 million. This is truly innovative and has the potential to turn traditional manufacturing upside down.

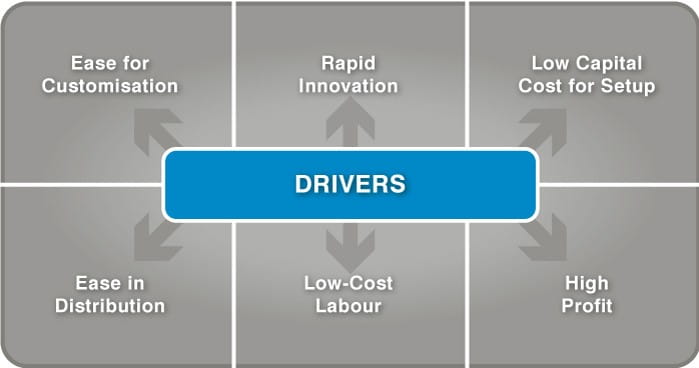

Figure 2: Traditional approach versus microfactory approach